- South Korea

- /

- Chemicals

- /

- KOSE:A092230

What Kind Of Investors Own Most Of KPX Holdings Co.,Ltd. (KRX:092230)?

The big shareholder groups in KPX Holdings Co.,Ltd. (KRX:092230) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

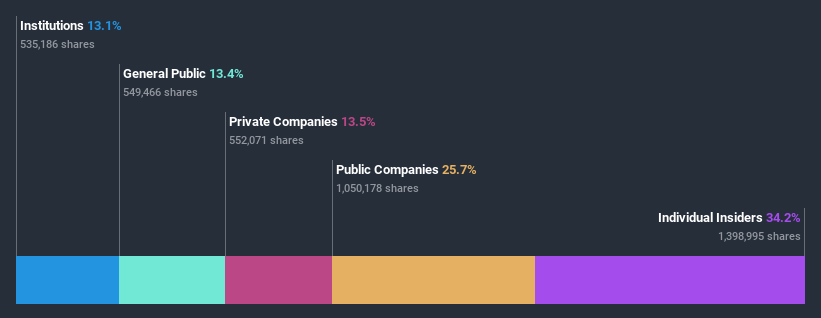

KPX HoldingsLtd is a smaller company with a market capitalization of ₩233b, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about KPX HoldingsLtd.

See our latest analysis for KPX HoldingsLtd

What Does The Institutional Ownership Tell Us About KPX HoldingsLtd?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

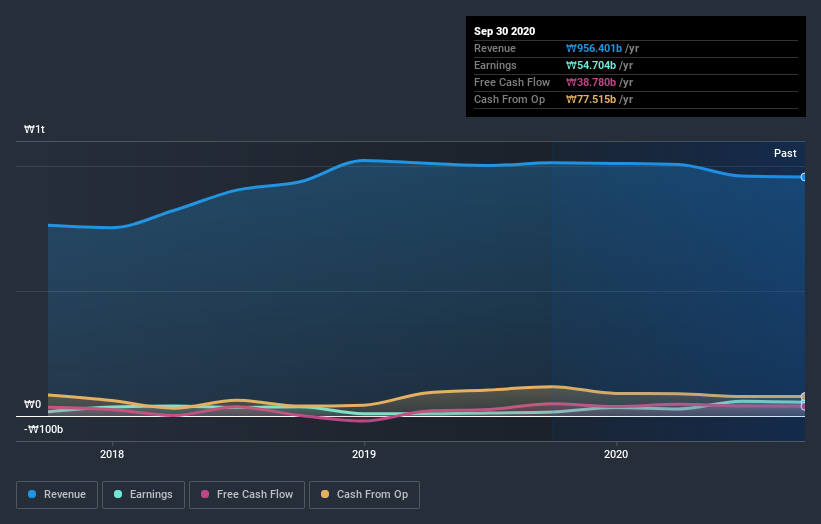

As you can see, institutional investors have a fair amount of stake in KPX HoldingsLtd. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of KPX HoldingsLtd, (below). Of course, keep in mind that there are other factors to consider, too.

KPX HoldingsLtd is not owned by hedge funds. Toyota Tsusho Corporation is currently the company's largest shareholder with 26% of shares outstanding. With 23% and 12% of the shares outstanding respectively, Gyu-Mo Yang and CK Enterprise Corporation are the second and third largest shareholders. Gyu-Mo Yang, who is the second-largest shareholder, also happens to hold the title of Co-Chief Executive Officer.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 61% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of KPX HoldingsLtd

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of KPX Holdings Co.,Ltd.. Insiders own ₩80b worth of shares in the ₩233b company. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public holds a 13% stake in KPX HoldingsLtd. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 14%, of the company's shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

It appears to us that public companies own 26% of KPX HoldingsLtd. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks for example - KPX HoldingsLtd has 2 warning signs we think you should be aware of.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade KPX HoldingsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPX Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A092230

KPX Holdings

Through its subsidiaries, manufactures and sells chemical products.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)