- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A025750

Investors in HansolHomeDeco.Co (KRX:025750) from three years ago are still down 34%, even after 14% gain this past week

It is doubtless a positive to see that the HansolHomeDeco.Co., Ltd. (KRX:025750) share price has gained some 53% in the last three months. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 34% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for HansolHomeDeco.Co

Given that HansolHomeDeco.Co didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, HansolHomeDeco.Co saw its revenue grow by 8.0% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 10% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

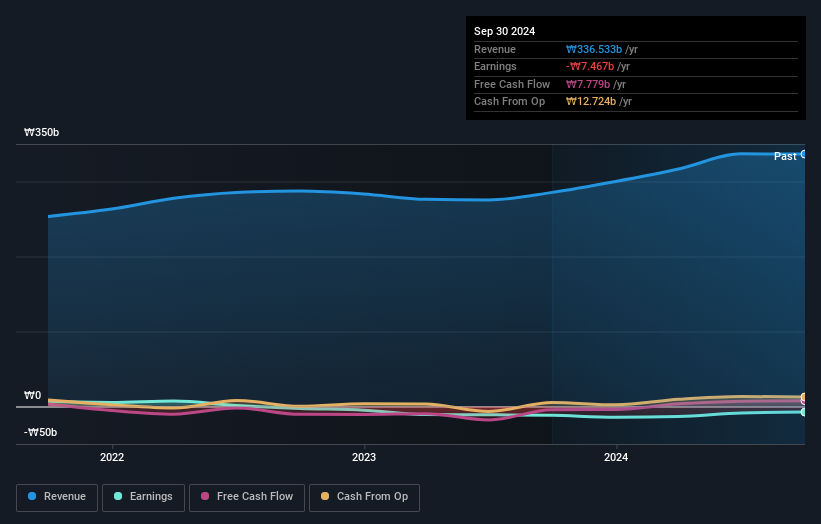

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on HansolHomeDeco.Co's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that HansolHomeDeco.Co shareholders have received a total shareholder return of 25% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that HansolHomeDeco.Co is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HansolHomeDeco.Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A025750

HansolHomeDeco.Co

Manufactures and distributes furniture components, interior materials, and other products in South Korea.

Good value slight.

Market Insights

Community Narratives