Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Taekyung Ind. Co., Ltd. (KRX:015890) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Taekyung Ind

How Much Debt Does Taekyung Ind Carry?

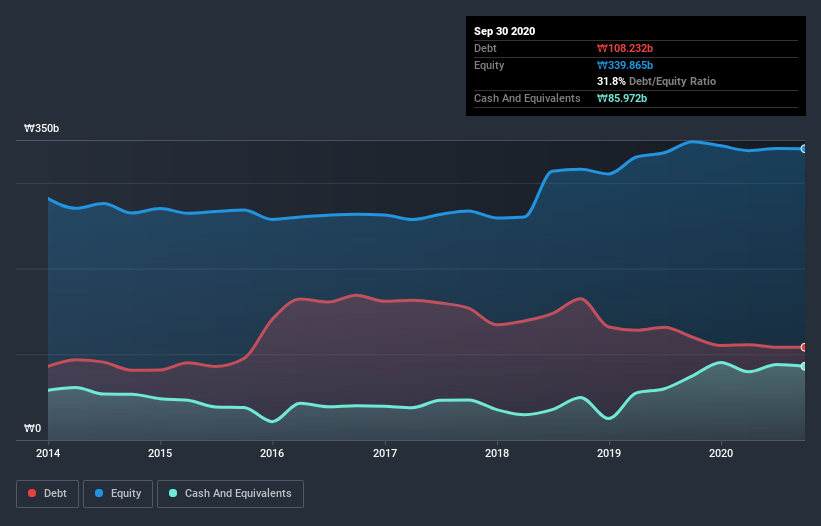

You can click the graphic below for the historical numbers, but it shows that Taekyung Ind had ₩108.2b of debt in September 2020, down from ₩119.9b, one year before. However, it also had ₩86.0b in cash, and so its net debt is ₩22.3b.

A Look At Taekyung Ind's Liabilities

According to the last reported balance sheet, Taekyung Ind had liabilities of ₩134.7b due within 12 months, and liabilities of ₩73.8b due beyond 12 months. Offsetting these obligations, it had cash of ₩86.0b as well as receivables valued at ₩63.5b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩59.0b.

While this might seem like a lot, it is not so bad since Taekyung Ind has a market capitalization of ₩164.1b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Taekyung Ind's low debt to EBITDA ratio of 0.80 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.6 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Shareholders should be aware that Taekyung Ind's EBIT was down 54% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Taekyung Ind will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Taekyung Ind actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Based on what we've seen Taekyung Ind is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. Looking at all this data makes us feel a little cautious about Taekyung Ind's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Taekyung Ind you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Taekyung Ind or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taekyung Industry.Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A015890

Taekyung Industry.Co

Manufactures and sells ferroalloy and calcium carbonate materials in South Korea and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026