- South Korea

- /

- Chemicals

- /

- KOSE:A011170

The Lotte Chemical (KRX:011170) Share Price Is Up 45% And Shareholders Are Holding On

One way to deal with stock volatility is to ensure you have a properly diverse portfolio. Of course, the aim of the game is to pick stocks that do better than an index fund. Lotte Chemical Corporation (KRX:011170) has done well over the last year, with the stock price up 45% beating the market return of 43% (not including dividends). Unfortunately the longer term returns are not so good, with the stock falling 32% in the last three years.

View our latest analysis for Lotte Chemical

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Lotte Chemical actually saw its earnings per share drop 82%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Unfortunately Lotte Chemical's fell 14% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

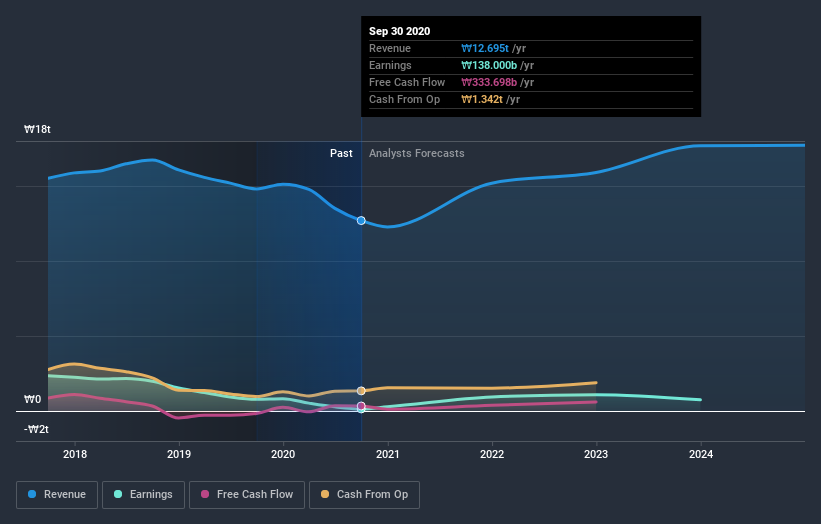

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Lotte Chemical is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Lotte Chemical shareholders have received returns of 47% over twelve months (even including dividends), which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 2% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Lotte Chemical better, we need to consider many other factors. For example, we've discovered 3 warning signs for Lotte Chemical that you should be aware of before investing here.

But note: Lotte Chemical may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Lotte Chemical, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A011170

Lotte Chemical

A chemical company, manufactures and distributes polymers, monomers, basic petrochemical products, and megatrend products.

Undervalued with moderate growth potential.