- South Korea

- /

- Chemicals

- /

- KOSE:A011170

Shareholders in Lotte Chemical (KRX:011170) have lost 70%, as stock drops 4.9% this past week

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Lotte Chemical Corporation (KRX:011170) for half a decade as the share price tanked 74%. We also note that the stock has performed poorly over the last year, with the share price down 59%. Shareholders have had an even rougher run lately, with the share price down 45% in the last 90 days.

If the past week is anything to go by, investor sentiment for Lotte Chemical isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Lotte Chemical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

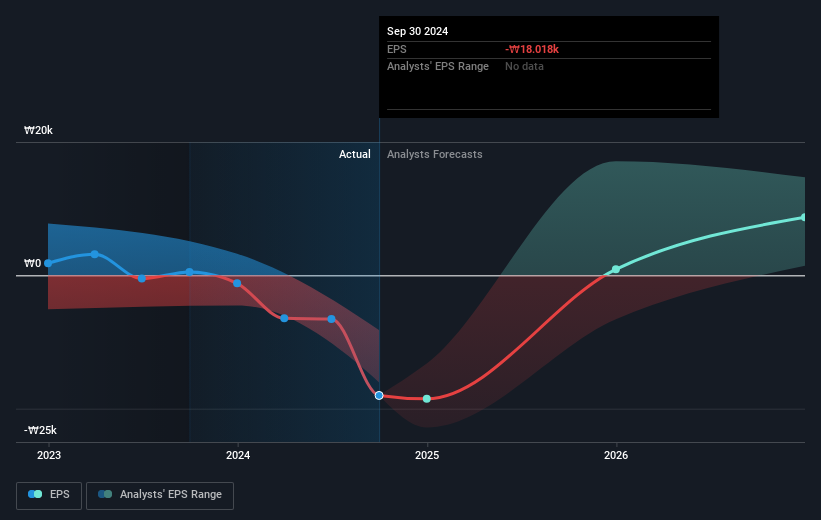

In the last half decade Lotte Chemical saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Lotte Chemical's TSR for the last 5 years was -70%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Lotte Chemical shareholders are down 59% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 3.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Lotte Chemical that you should be aware of.

Of course Lotte Chemical may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011170

Lotte Chemical

A chemical company, manufactures and distributes polymers, monomers, basic petrochemical products, and megatrend products.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives