- South Korea

- /

- Chemicals

- /

- KOSE:A010640

Earnings Not Telling The Story For Chinyang Poly Urethane Co.,Ltd (KRX:010640) After Shares Rise 36%

Chinyang Poly Urethane Co.,Ltd (KRX:010640) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 91%.

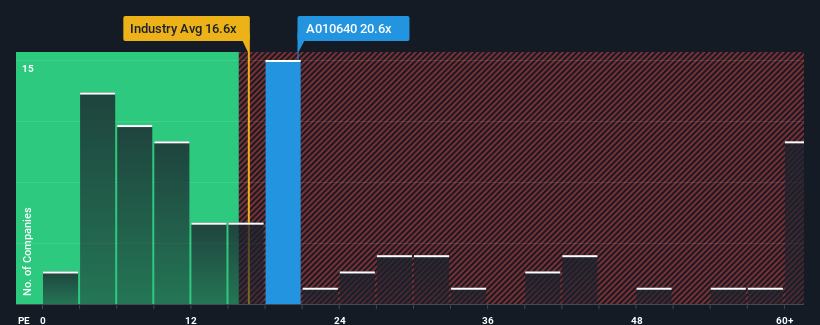

After such a large jump in price, Chinyang Poly UrethaneLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.6x, since almost half of all companies in Korea have P/E ratios under 13x and even P/E's lower than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

The recent earnings growth at Chinyang Poly UrethaneLtd would have to be considered satisfactory if not spectacular. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Chinyang Poly UrethaneLtd

Is There Enough Growth For Chinyang Poly UrethaneLtd?

The only time you'd be truly comfortable seeing a P/E as high as Chinyang Poly UrethaneLtd's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 4.9% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 127% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 32% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Chinyang Poly UrethaneLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

The large bounce in Chinyang Poly UrethaneLtd's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chinyang Poly UrethaneLtd currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Chinyang Poly UrethaneLtd is showing 3 warning signs in our investment analysis, and 1 of those is significant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010640

Chinyang Poly UrethaneLtd

Produces and supplies polyurethane foam products in South Korea.

Slight risk with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026