- South Korea

- /

- Metals and Mining

- /

- KOSE:A008970

Investors Appear Satisfied With Dong Yang Steel Pipe Co., Ltd.'s (KRX:008970) Prospects As Shares Rocket 31%

Despite an already strong run, Dong Yang Steel Pipe Co., Ltd. (KRX:008970) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 120% following the latest surge, making investors sit up and take notice.

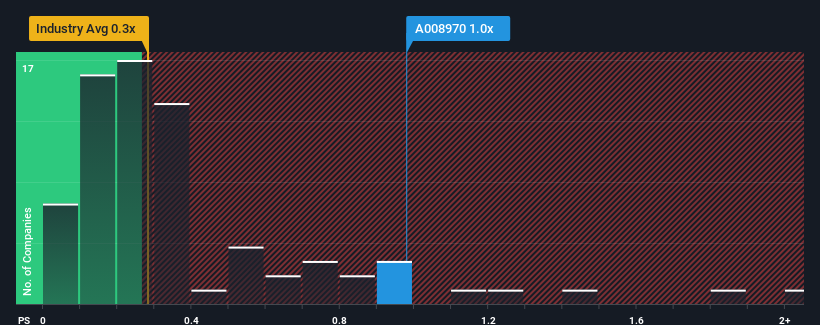

After such a large jump in price, when almost half of the companies in Korea's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Dong Yang Steel Pipe as a stock probably not worth researching with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in Dong Yang Steel Pipe. Read for free now.Check out our latest analysis for Dong Yang Steel Pipe

What Does Dong Yang Steel Pipe's Recent Performance Look Like?

For example, consider that Dong Yang Steel Pipe's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dong Yang Steel Pipe will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Dong Yang Steel Pipe?

The only time you'd be truly comfortable seeing a P/S as high as Dong Yang Steel Pipe's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 38% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 2.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Dong Yang Steel Pipe is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The large bounce in Dong Yang Steel Pipe's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Dong Yang Steel Pipe maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Dong Yang Steel Pipe you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kbi Dong Yang Steel PipeLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008970

Kbi Dong Yang Steel PipeLtd

Manufactures and sells steel pipes in South Korea, the United States, rest of Asia, Europe, the Middle East, and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives