- South Korea

- /

- Chemicals

- /

- KOSE:A004430

Here's Why Songwon Industrial (KRX:004430) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Songwon Industrial Co., Ltd. (KRX:004430) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Songwon Industrial

How Much Debt Does Songwon Industrial Carry?

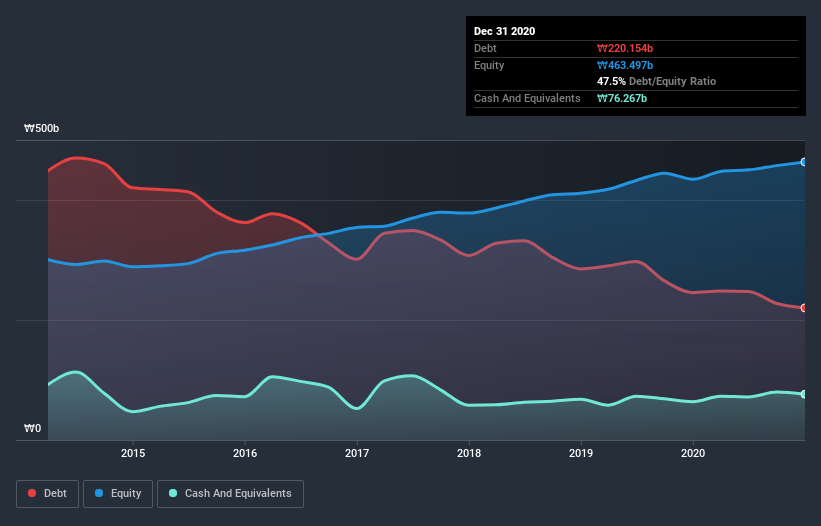

The image below, which you can click on for greater detail, shows that Songwon Industrial had debt of ₩220.2b at the end of December 2020, a reduction from ₩245.6b over a year. However, it does have ₩76.3b in cash offsetting this, leading to net debt of about ₩143.9b.

How Strong Is Songwon Industrial's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Songwon Industrial had liabilities of ₩293.1b due within 12 months and liabilities of ₩134.5b due beyond that. Offsetting these obligations, it had cash of ₩76.3b as well as receivables valued at ₩138.4b due within 12 months. So it has liabilities totalling ₩213.0b more than its cash and near-term receivables, combined.

Songwon Industrial has a market capitalization of ₩469.2b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Songwon Industrial has a low net debt to EBITDA ratio of only 1.4. And its EBIT easily covers its interest expense, being 10.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also good is that Songwon Industrial grew its EBIT at 15% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Songwon Industrial's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Songwon Industrial produced sturdy free cash flow equating to 71% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Songwon Industrial's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its level of total liabilities. When we consider the range of factors above, it looks like Songwon Industrial is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Songwon Industrial (including 1 which can't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Songwon Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A004430

Songwon Industrial

Manufactures and sells polymer stabilizers, tin intermediates, PVC stabilizers, and specialty chemicals in South Korea, Rest of Asia, Europe, North and South America, Australia, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives