- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A002310

Despite the downward trend in earnings at Asia Paper Manufacturing (KRX:002310) the stock surges 20%, bringing five-year gains to 60%

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Asia Paper Manufacturing. Co., Ltd (KRX:002310) share price is up 37% in the last 5 years, clearly besting the market return of around 31% (ignoring dividends).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Our free stock report includes 3 warning signs investors should be aware of before investing in Asia Paper Manufacturing. Read for free now.In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Asia Paper Manufacturing's earnings per share are down 15% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 5.7% per year is probably viewed as evidence that Asia Paper Manufacturing is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

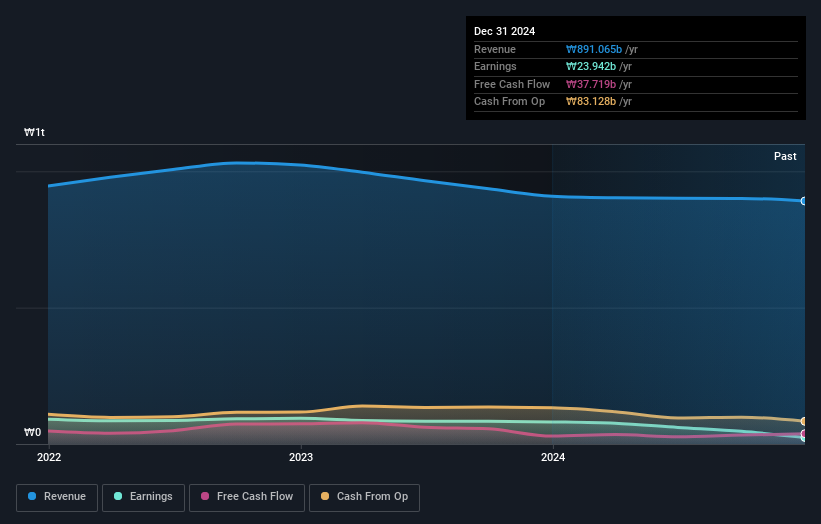

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Asia Paper Manufacturing's TSR for the last 5 years was 60%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Asia Paper Manufacturing shares lost 1.9% throughout the year, that wasn't as bad as the market loss of 4.6%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 10% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Asia Paper Manufacturing better, we need to consider many other factors. For instance, we've identified 3 warning signs for Asia Paper Manufacturing (1 doesn't sit too well with us) that you should be aware of.

Of course Asia Paper Manufacturing may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002310

Asia Paper Manufacturing

Engages in the production and sale of specialized industrial paper in South Korea.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives