In a week marked by broad-based gains in major U.S. stock indexes and a drop in initial jobless claims, investor sentiment remains cautiously optimistic amid geopolitical tensions and economic uncertainties. As markets navigate these dynamics, high-yield dividend stocks can offer attractive income opportunities for investors seeking stability and potential returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.77% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd is involved in the production and sale of specialized industrial paper in South Korea, with a market cap of ₩308.96 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates its revenue through the production and sale of specialized industrial paper in South Korea.

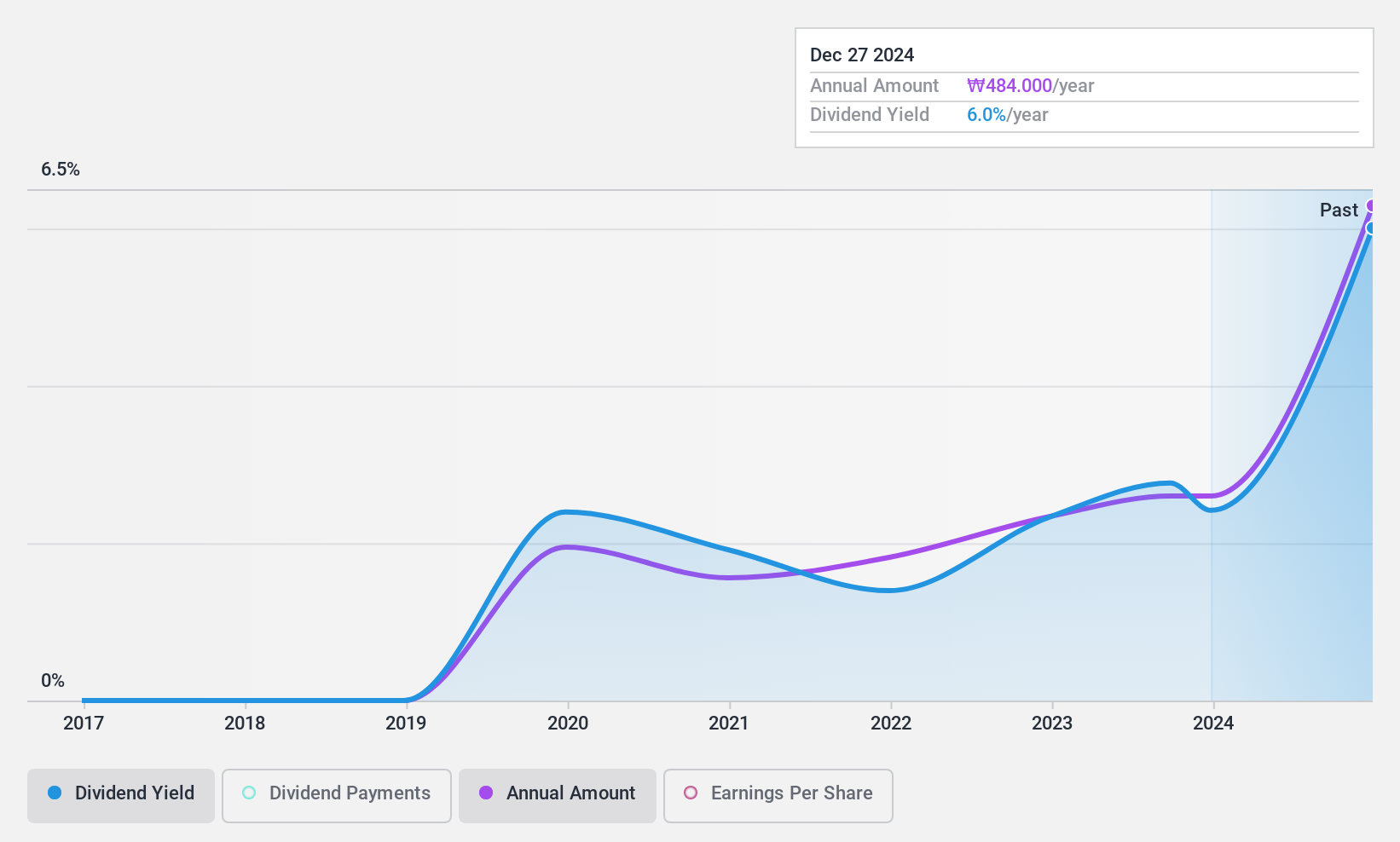

Dividend Yield: 6.1%

Asia Paper Manufacturing's dividend yield is among the top 25% in the Korean market, supported by a low payout ratio of 43.3%, indicating dividends are well-covered by earnings. However, its dividend history is unstable with volatility over the past five years. Recent earnings showed a decline in net income to KRW 6.20 billion for Q3 2024 from KRW 20.61 billion last year, impacting profit margins and potentially affecting future dividend stability.

- Take a closer look at Asia Paper Manufacturing's potential here in our dividend report.

- According our valuation report, there's an indication that Asia Paper Manufacturing's share price might be on the cheaper side.

KPX Holdings (KOSE:A092230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Holdings Co., Ltd. operates through its subsidiaries to manufacture and sell chemical products, with a market cap of approximately ₩216.22 billion.

Operations: KPX Holdings Co., Ltd. generates revenue through its subsidiaries by producing and distributing chemical products.

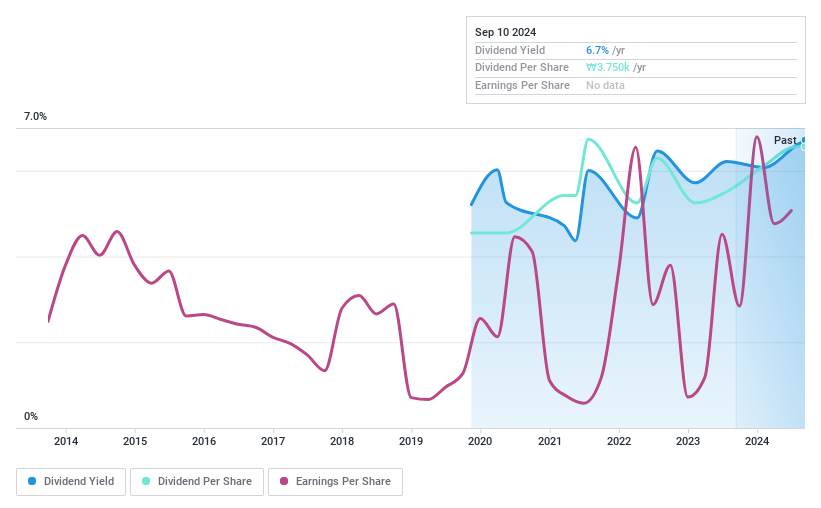

Dividend Yield: 6.8%

KPX Holdings offers a high dividend yield in the Korean market, with strong coverage by earnings and cash flows, indicated by a payout ratio of 23.7% and cash payout ratio of 19.3%. However, its dividend history is marked by volatility over the past five years. Recent earnings results show a shift from net income to a net loss for Q3 2024, which might impact future dividend stability despite revenue growth to KRW 4.96 billion.

- Click here and access our complete dividend analysis report to understand the dynamics of KPX Holdings.

- Our valuation report here indicates KPX Holdings may be undervalued.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market cap of NOK11.75 billion.

Operations: SpareBank 1 Nord-Norge's revenue segments include Retail Market (NOK2.41 billion), Segment Adjustment (NOK1.57 billion), Corporate Banking (Excluding SMB) (NOK1.53 billion), Sparebank 1 Finans Nord-Norge (NOK327 million), Eiendoms- Megler 1 Nord-Norge (NOK222 million), and Sparebank 1 Regnskaps- Huset Nord-Norge (NOK314 million).

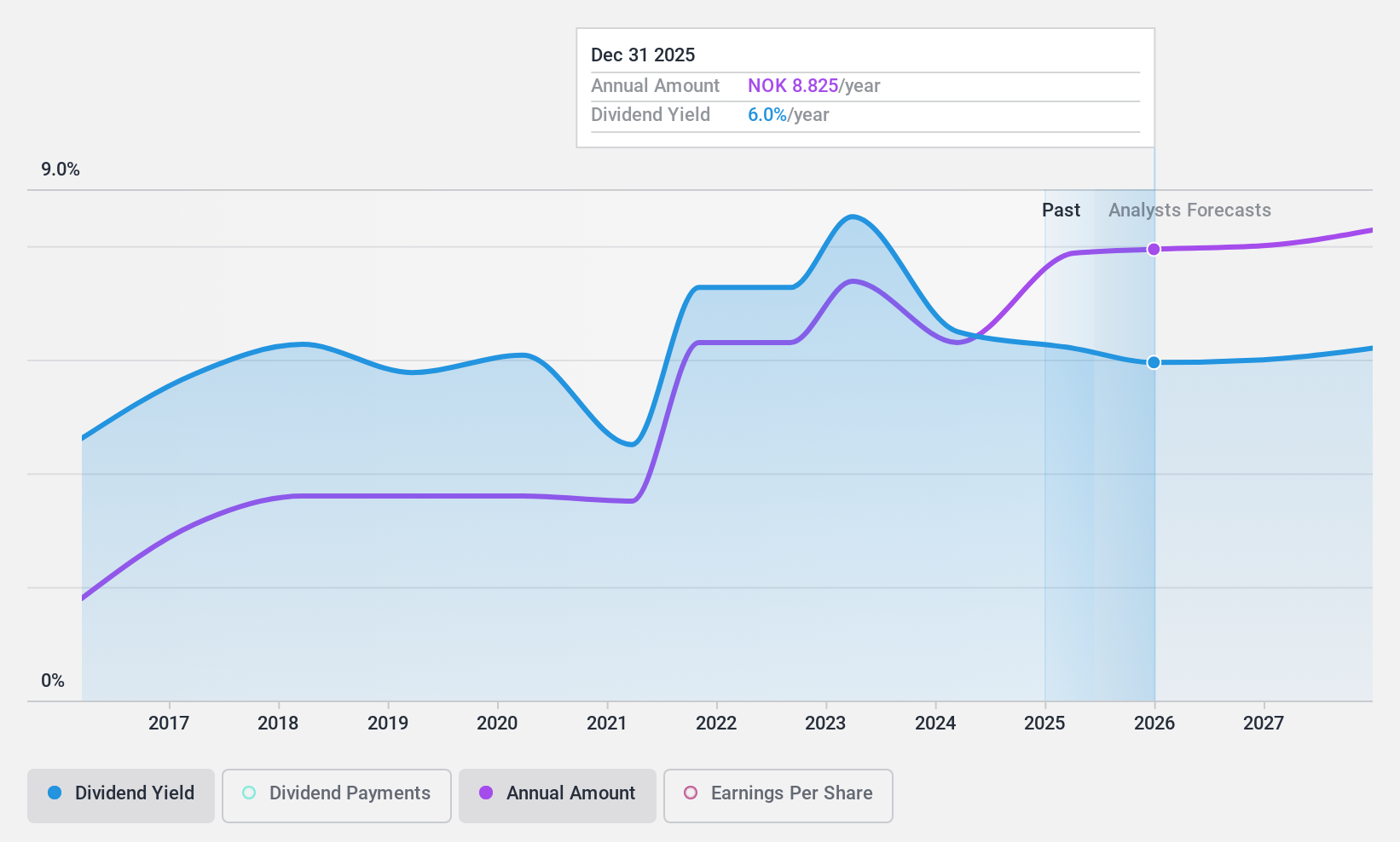

Dividend Yield: 5.9%

SpareBank 1 Nord-Norge's dividend is well-covered by earnings, with a payout ratio of 44%, and forecasted to remain sustainable at 66.6% in three years. The bank has a reliable dividend history over the past decade, though its yield of 5.94% is below top-tier Norwegian payers. Recent restructuring aims to enhance efficiency and business value, potentially supporting future dividends. Earnings growth was robust last year, but allowance for bad loans remains low at 60%.

- Dive into the specifics of SpareBank 1 Nord-Norge here with our thorough dividend report.

- Our valuation report unveils the possibility SpareBank 1 Nord-Norge's shares may be trading at a discount.

Where To Now?

- Explore the 1957 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NONG

Undervalued with solid track record and pays a dividend.