- South Korea

- /

- Chemicals

- /

- KOSE:A001340

Does Paik Kwang Industrial (KRX:001340) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Paik Kwang Industrial Co., Ltd. (KRX:001340) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Paik Kwang Industrial

How Much Debt Does Paik Kwang Industrial Carry?

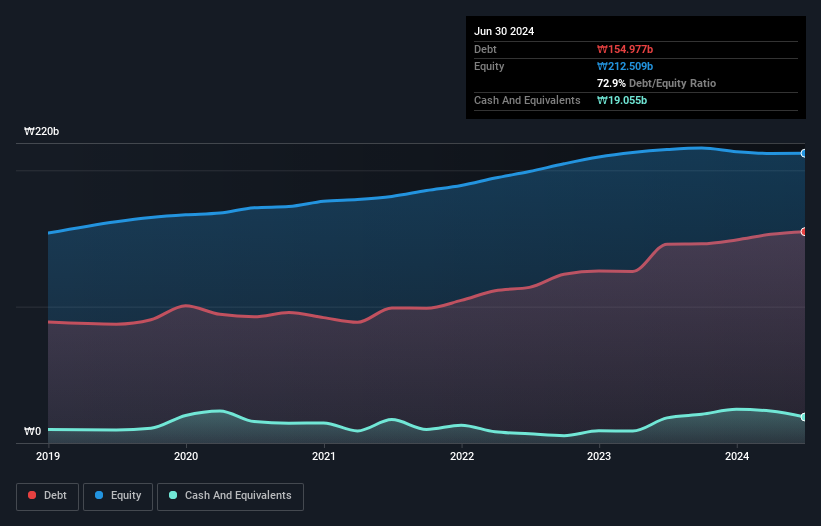

The image below, which you can click on for greater detail, shows that at June 2024 Paik Kwang Industrial had debt of ₩155.0b, up from ₩145.8b in one year. On the flip side, it has ₩19.1b in cash leading to net debt of about ₩135.9b.

How Strong Is Paik Kwang Industrial's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Paik Kwang Industrial had liabilities of ₩144.3b due within 12 months and liabilities of ₩78.3b due beyond that. On the other hand, it had cash of ₩19.1b and ₩27.7b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩176.0b.

While this might seem like a lot, it is not so bad since Paik Kwang Industrial has a market capitalization of ₩388.1b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Paik Kwang Industrial's debt to EBITDA ratio (4.6) suggests that it uses some debt, its interest cover is very weak, at 1.6, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Even worse, Paik Kwang Industrial saw its EBIT tank 66% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Paik Kwang Industrial will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Paik Kwang Industrial saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Paik Kwang Industrial's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least its level of total liabilities is not so bad. After considering the datapoints discussed, we think Paik Kwang Industrial has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 5 warning signs with Paik Kwang Industrial (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001340

Paikkwang IndustrialLtd

Produces and sells inorganic chemical products in South Korea and internationally.

Proven track record very low.

Market Insights

Community Narratives