- South Korea

- /

- Chemicals

- /

- KOSDAQ:A900250

What China Crystal New Material Holdings Co.,Ltd.'s (KOSDAQ:900250) 25% Share Price Gain Is Not Telling You

China Crystal New Material Holdings Co.,Ltd. (KOSDAQ:900250) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 54% share price drop in the last twelve months.

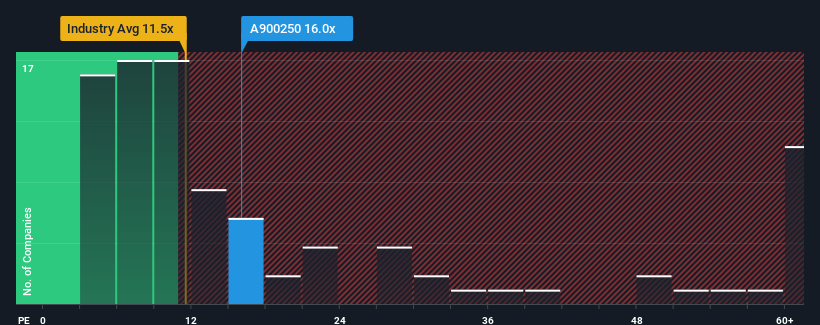

After such a large jump in price, China Crystal New Material HoldingsLtd's price-to-earnings (or "P/E") ratio of 16x might make it look like a sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that China Crystal New Material HoldingsLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for China Crystal New Material HoldingsLtd

Is There Enough Growth For China Crystal New Material HoldingsLtd?

In order to justify its P/E ratio, China Crystal New Material HoldingsLtd would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 40%. The last three years don't look nice either as the company has shrunk EPS by 74% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 33% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that China Crystal New Material HoldingsLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

China Crystal New Material HoldingsLtd's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China Crystal New Material HoldingsLtd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with China Crystal New Material HoldingsLtd (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on China Crystal New Material HoldingsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A900250

China Crystal New Material HoldingsLtd

China Crystal New Material Holdings Co.,Ltd.

Flawless balance sheet and fair value.

Market Insights

Community Narratives