- South Korea

- /

- Chemicals

- /

- KOSDAQ:A278280

The three-year loss for Chunbo (KOSDAQ:278280) shareholders likely driven by its shrinking earnings

Chunbo Co., Ltd. (KOSDAQ:278280) shareholders will doubtless be very grateful to see the share price up 52% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. The share price has sunk like a leaky ship, down 72% in that time. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

While the last three years has been tough for Chunbo shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Chunbo became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Arguably the revenue decline of 35% per year has people thinking Chunbo is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

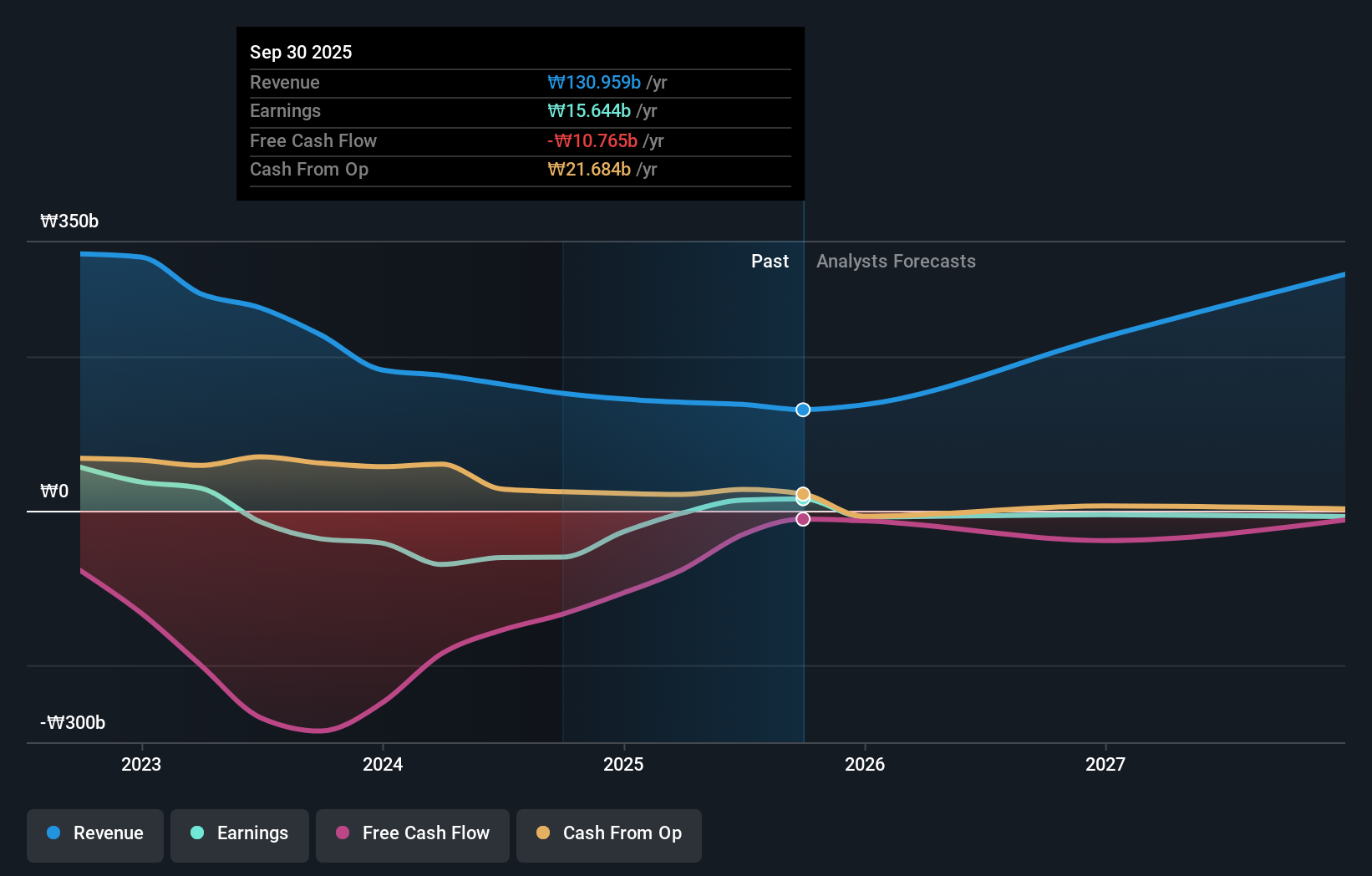

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Chunbo has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Chunbo will earn in the future (free profit forecasts).

A Different Perspective

Chunbo shareholders are up 70% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Chunbo better, we need to consider many other factors. Even so, be aware that Chunbo is showing 3 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A278280

Chunbo

Operates in the fine chemical materials industry in South Korea and internationally.

Low risk with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026