- South Korea

- /

- Chemicals

- /

- KOSDAQ:A278280

Chunbo Co., Ltd.'s (KOSDAQ:278280) 34% Jump Shows Its Popularity With Investors

Chunbo Co., Ltd. (KOSDAQ:278280) shares have continued their recent momentum with a 34% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 6.8% isn't as impressive.

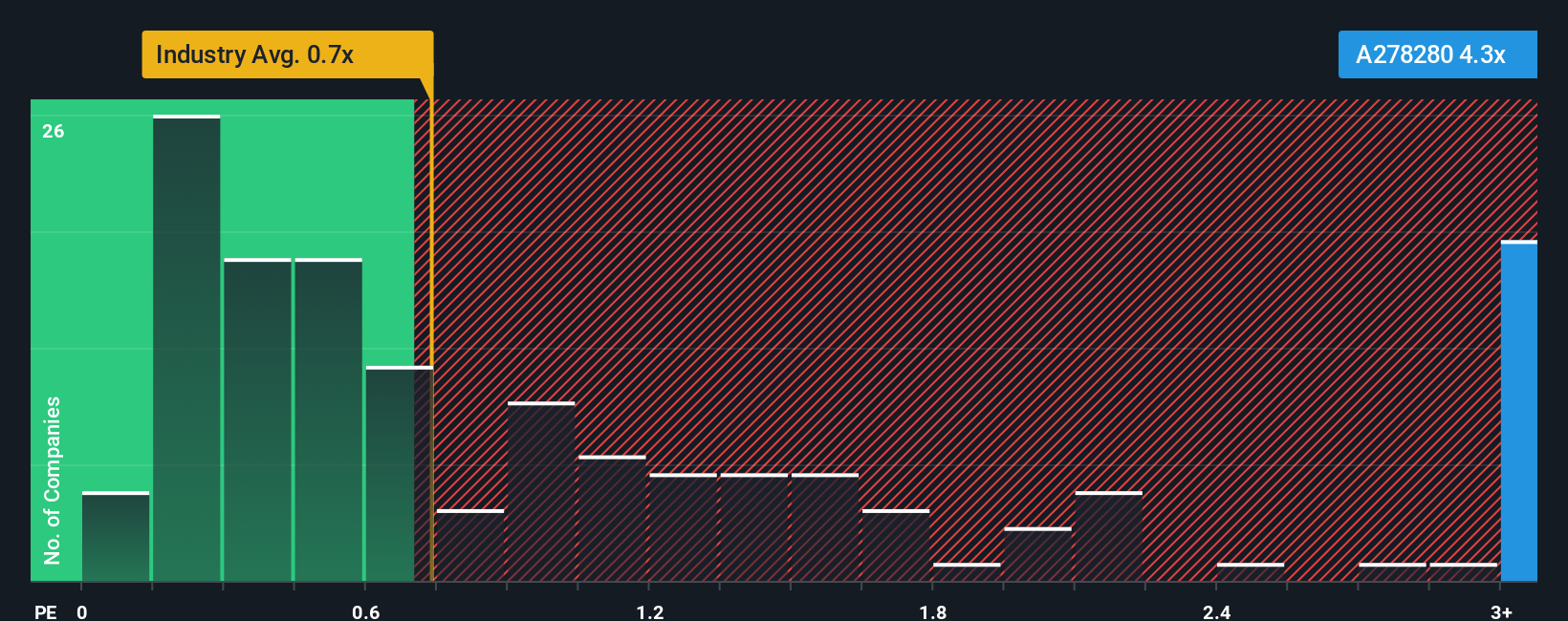

Following the firm bounce in price, you could be forgiven for thinking Chunbo is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.3x, considering almost half the companies in Korea's Chemicals industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Chunbo

How Has Chunbo Performed Recently?

Chunbo hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Chunbo's future stacks up against the industry? In that case, our free report is a great place to start.How Is Chunbo's Revenue Growth Trending?

In order to justify its P/S ratio, Chunbo would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 45% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Chunbo's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Chunbo's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Chunbo maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Chunbo (2 are significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A278280

Chunbo

Operates in the fine chemical materials industry in South Korea and internationally.

Low risk with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026