- South Korea

- /

- Chemicals

- /

- KOSDAQ:A170920

LTCLtd (KOSDAQ:170920) adds ₩9.5b to market cap in the past 7 days, though investors from a year ago are still down 33%

It's nice to see the LTC Co.,Ltd (KOSDAQ:170920) share price up 11% in a week. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 34% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for LTCLtd

LTCLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

LTCLtd grew its revenue by 23% over the last year. That's definitely a respectable growth rate. Meanwhile, the share price is down 34% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

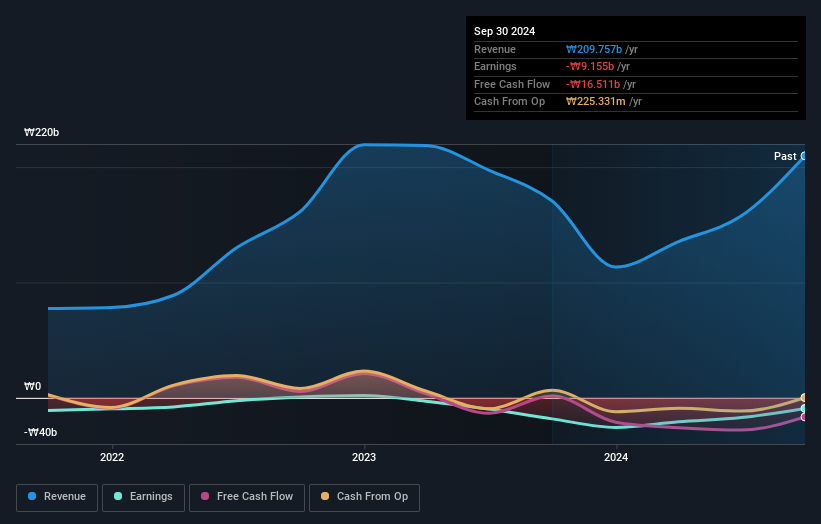

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at LTCLtd's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that LTCLtd shareholders are down 33% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 2.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand LTCLtd better, we need to consider many other factors. Take risks, for example - LTCLtd has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: LTCLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A170920

LTCLtd

Provides FPD and semiconductor chemical solutions in Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives