- South Korea

- /

- Insurance

- /

- KOSE:A032830

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate geopolitical tensions and economic shifts, major indices like the Dow Jones Industrial Average and S&P 500 have reached record highs, reflecting a resilient investor sentiment. Amid these dynamics, dividend stocks stand out as a compelling option for investors seeking stable income streams and potential growth in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

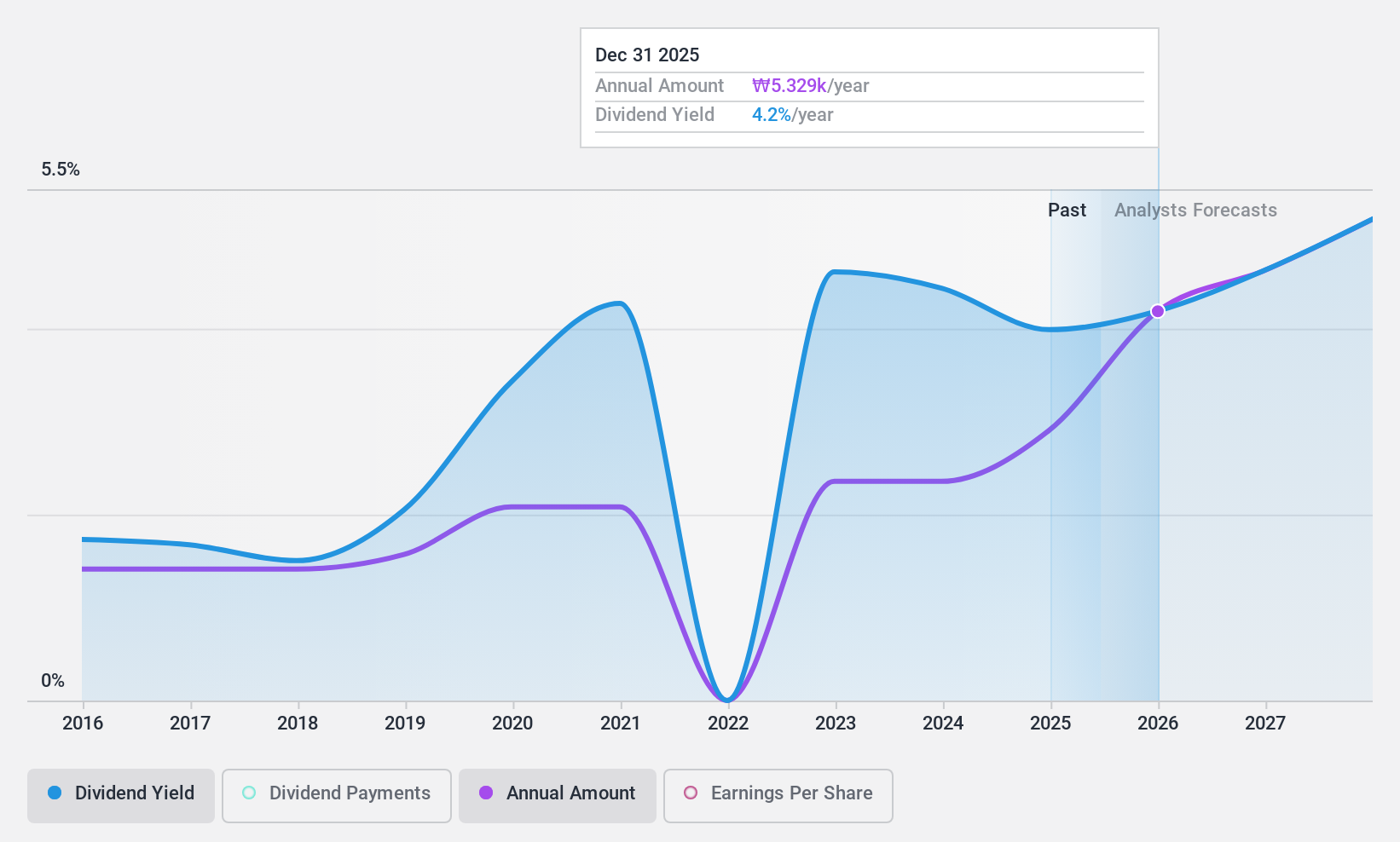

Samsung Life Insurance (KOSE:A032830)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Life Insurance Co., Ltd. operates in the life insurance sector both in Korea and internationally, with a market cap of ₩19.14 trillion.

Operations: Samsung Life Insurance Co., Ltd. generates its revenue from three main segments: Domestic - Insurance with ₩26.51 trillion, Domestic - Card and Installment Lease contributing ₩4.02 trillion, and Overseas operations bringing in ₩145.04 billion.

Dividend Yield: 3.4%

Samsung Life Insurance offers a reliable dividend yield of 3.39%, supported by a low payout ratio of 26.7% and a cash payout ratio of 9.5%, indicating strong earnings and cash flow coverage. Despite its yield being lower than the top tier in the KR market, dividends have been stable and growing over the past decade. Trading at nearly half its estimated fair value, recent earnings growth further supports its dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Samsung Life Insurance.

- The valuation report we've compiled suggests that Samsung Life Insurance's current price could be quite moderate.

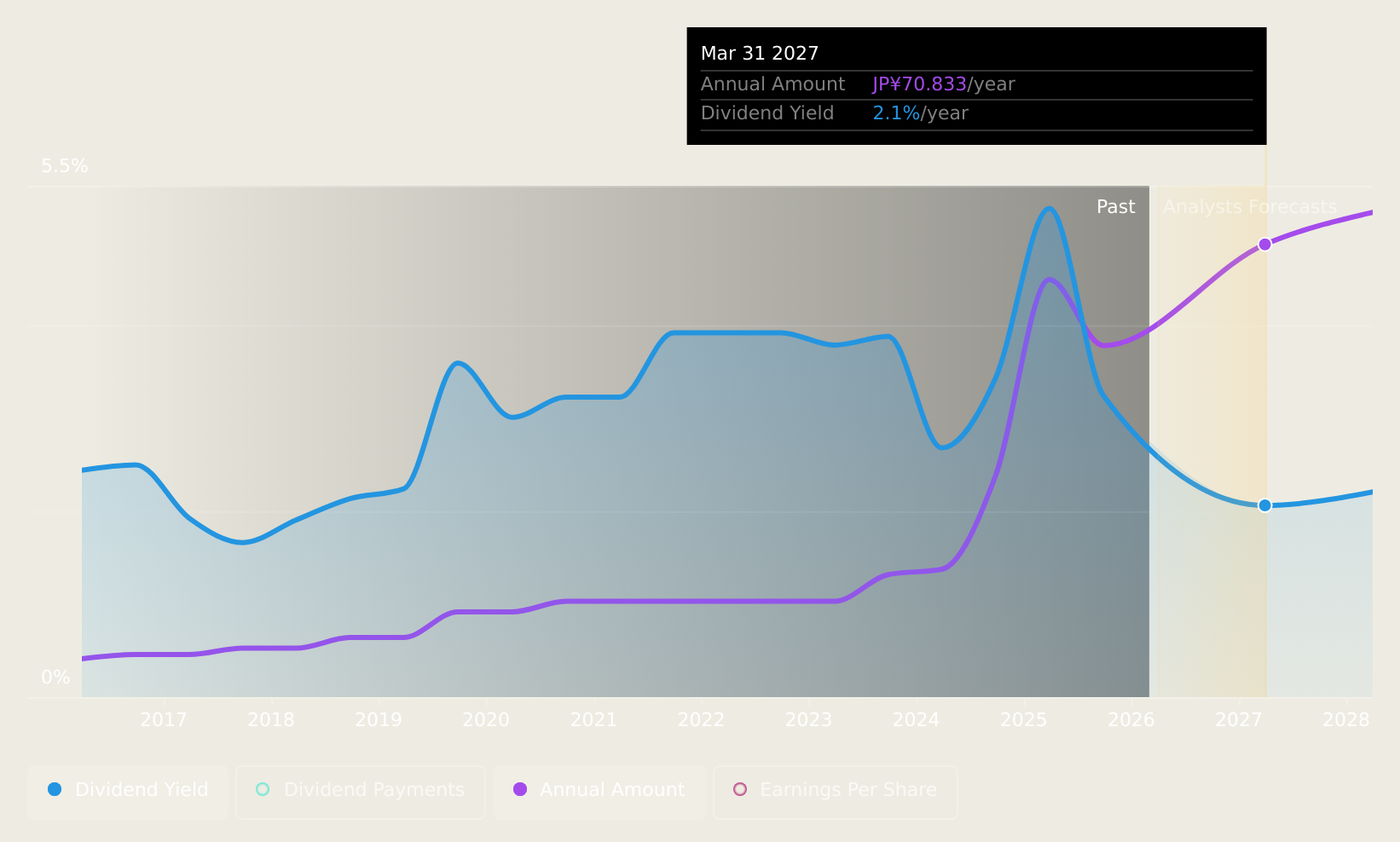

Dai-Dan (TSE:1980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities in Japan with a market cap of ¥154.39 billion.

Operations: Dai-Dan Co., Ltd.'s revenue is primarily derived from its operations in electrical, air conditioning, plumbing and sanitary, and firefighting facilities works within Japan.

Dividend Yield: 3.8%

Dai-Dan's dividend yield of 3.78% is slightly below the top tier in Japan, with a payout ratio of 35.3%, indicating coverage by earnings but not free cash flow. Dividends have been stable and reliable over the past decade, recently increased to JPY 71 per share for fiscal year ending March 2025 from JPY 48 last year. The stock trades at a discount to its estimated fair value, supported by strong recent earnings growth.

- Take a closer look at Dai-Dan's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Dai-Dan shares in the market.

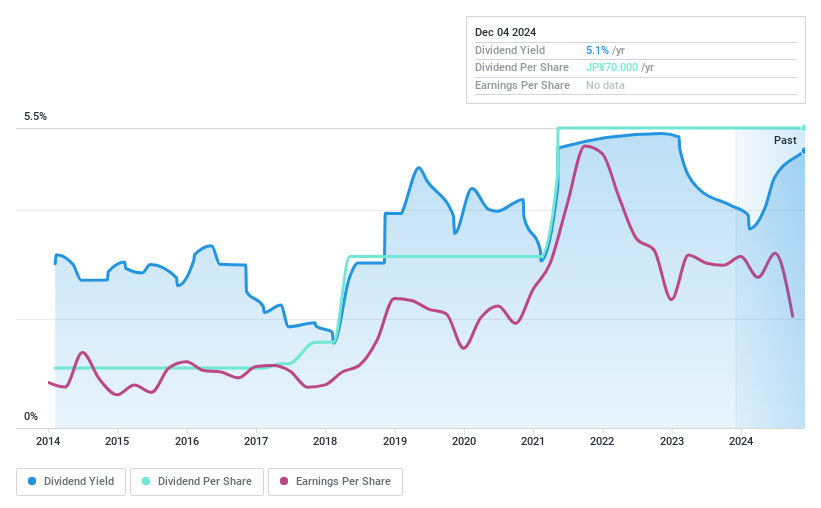

Innotech (TSE:9880)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Innotech Corporation, with a market cap of ¥18.64 billion, operates in the import and sale of electronic design automation software, electric components, and semiconductor products both in Japan and internationally.

Operations: Innotech Corporation generates revenue through its Test Solution Business (¥16.02 billion), System and Service Business (¥13.59 billion), and Semiconductor Design-Related Business (¥13.14 billion).

Dividend Yield: 5%

Innotech's dividend yield of 4.98% ranks in the top 25% of Japan's market, but its sustainability is questionable due to a high cash payout ratio of 99.6%, indicating dividends are not well covered by free cash flows. Despite stable and reliable dividends over the past decade, recent profit margins have declined from 4.1% to 2.6%. A share repurchase program worth ¥500 million aims to enhance capital efficiency and shareholder returns through May 2025.

- Click here to discover the nuances of Innotech with our detailed analytical dividend report.

- Our expertly prepared valuation report Innotech implies its share price may be too high.

Summing It All Up

- Delve into our full catalog of 1953 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A032830

Samsung Life Insurance

Engages in the life insurance business in South Korea and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives