- South Korea

- /

- Oil and Gas

- /

- KOSE:A267250

KRX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, but it has seen a 3.8% increase over the past year, with earnings forecasted to grow by 30% annually. In this context of steady growth and promising earnings potential, dividend stocks can offer a reliable income stream while participating in market gains.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.57% | ★★★★★★ |

| Hansae (KOSE:A105630) | 3.03% | ★★★★★☆ |

| Kangwon Land (KOSE:A035250) | 5.59% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.46% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.89% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.44% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.87% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.76% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.10% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.56% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top KRX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. operates in the non-life insurance sector across several countries including Korea, China, and the United States, with a market capitalization of approximately ₩14.72 trillion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenue primarily from its insurance business, amounting to approximately ₩18.88 billion.

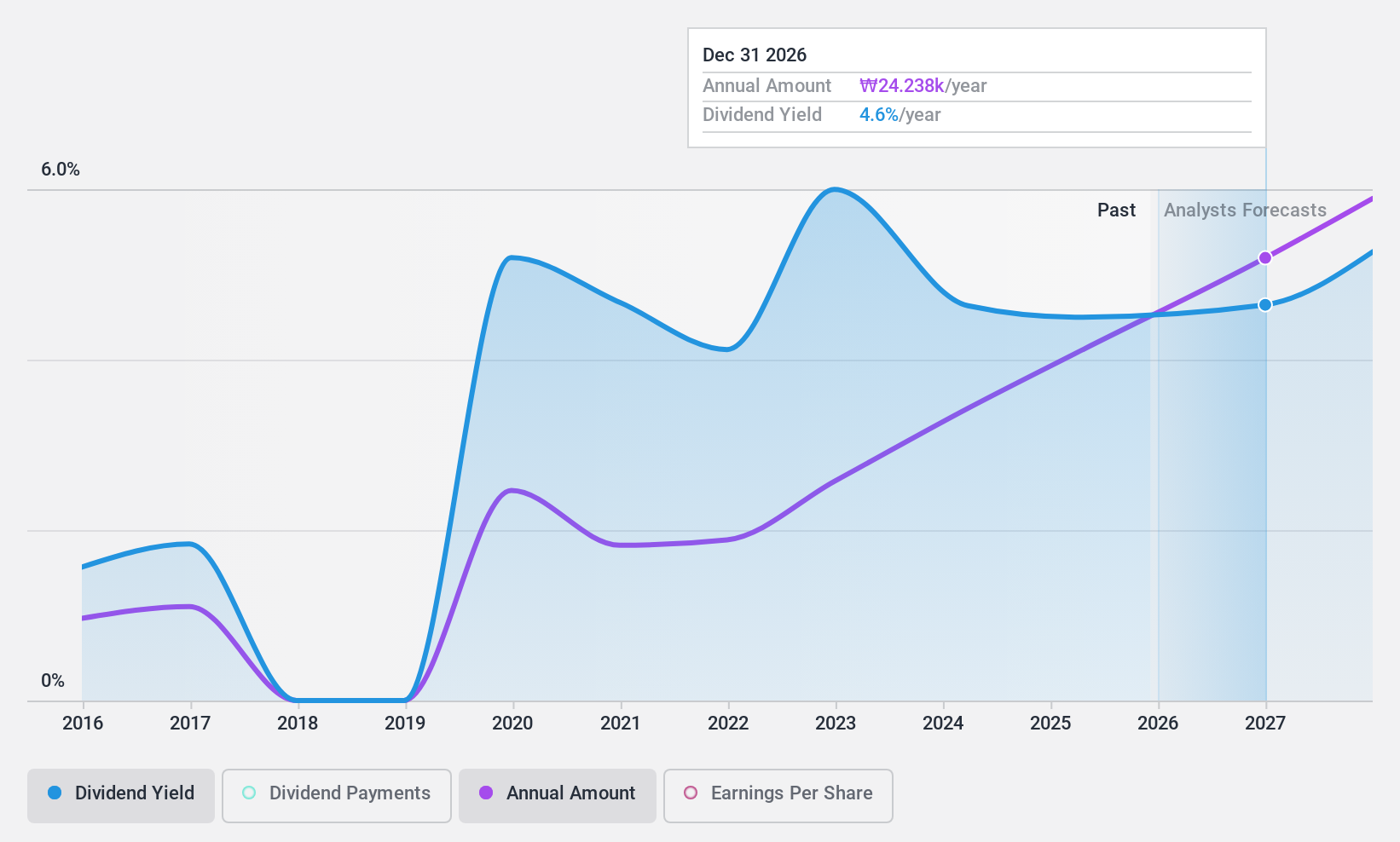

Dividend Yield: 4.6%

Samsung Fire & Marine Insurance's dividend yield ranks in the top 25% of South Korean market payers. Despite a volatile and unreliable dividend history over the past decade, recent earnings growth supports its dividends, with a payout ratio of 39.5% and cash payout ratio of 26.7%, indicating sustainability. The company reported net income of KRW 1.31 billion for H1 2024, up from KRW 1.21 billion year-over-year, reinforcing its potential as a dividend stock contender.

- Click here and access our complete dividend analysis report to understand the dynamics of Samsung Fire & Marine Insurance.

- Upon reviewing our latest valuation report, Samsung Fire & Marine Insurance's share price might be too pessimistic.

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hansae Co., Ltd. manufactures and sells finished clothing products in Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of ₩649.03 billion.

Operations: Hansae Co., Ltd. generates revenue from its clothing manufacturing segment, amounting to ₩1.73 billion.

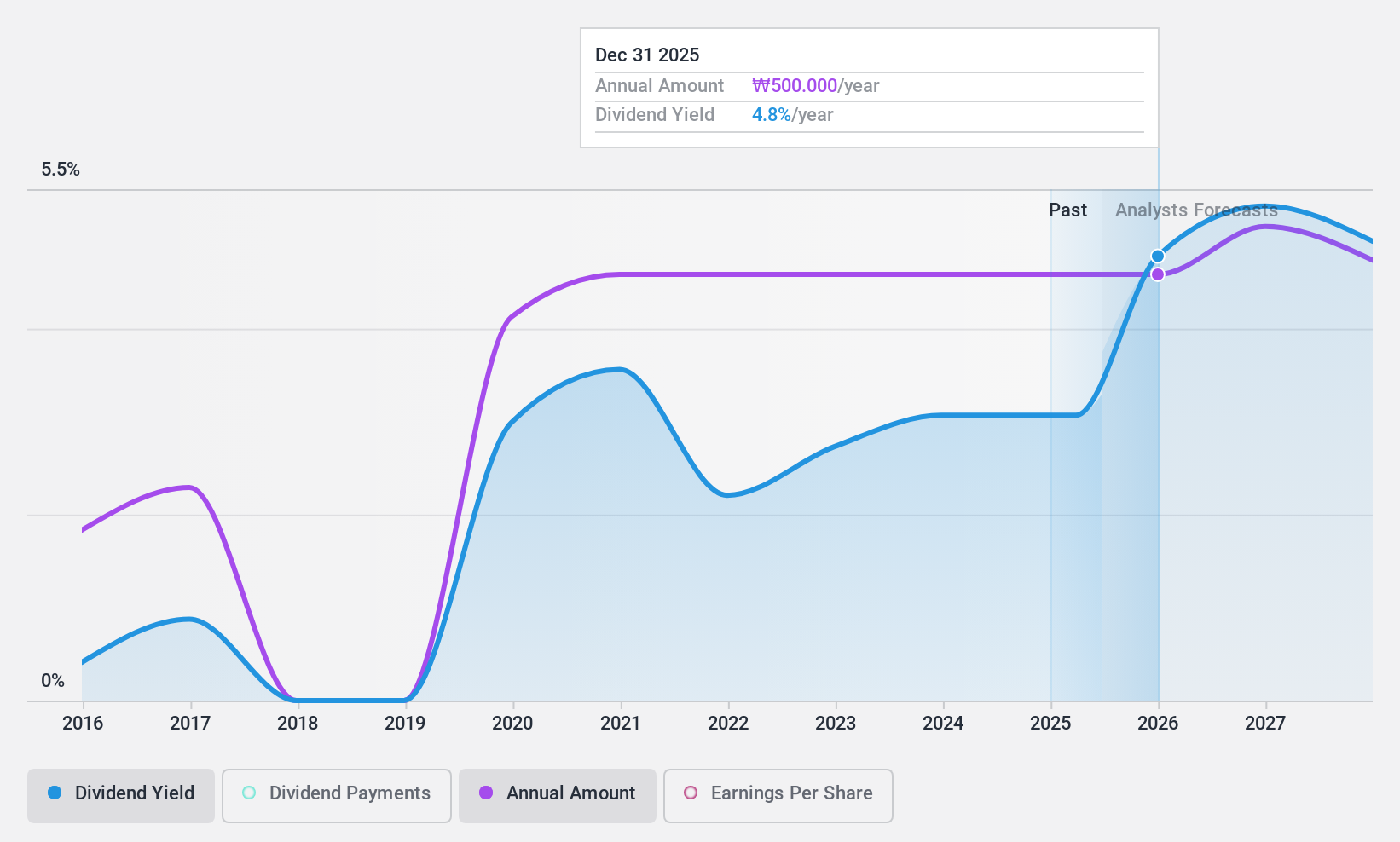

Dividend Yield: 3%

Hansae's dividend payments are well-supported, with a low payout ratio of 19.9% and cash payout ratio of 35%, ensuring sustainability. Despite a modest yield of 3.03%, dividends have been stable and growing over the past decade. Recent earnings showed KRW 40.14 billion for H1 2024, down from KRW 53.28 billion year-over-year, reflecting some financial challenges but maintaining reliable dividends amidst these fluctuations in net income.

- Dive into the specifics of Hansae here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Hansae is priced lower than what may be justified by its financials.

HD Hyundai (KOSE:A267250)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd., with a market cap of ₩5.62 trillion, operates in the oil refining sector both domestically in Korea and internationally through its subsidiaries.

Operations: HD Hyundai Co., Ltd.'s revenue is primarily derived from its Essential Oil segment at ₩43.99 billion, followed by Shipbuilding & Marine Engineering at ₩25.77 billion, Construction Equipment at ₩11.90 billion, Electrical/Electronic at ₩4.15 billion, and Ship Service at ₩1.99 billion.

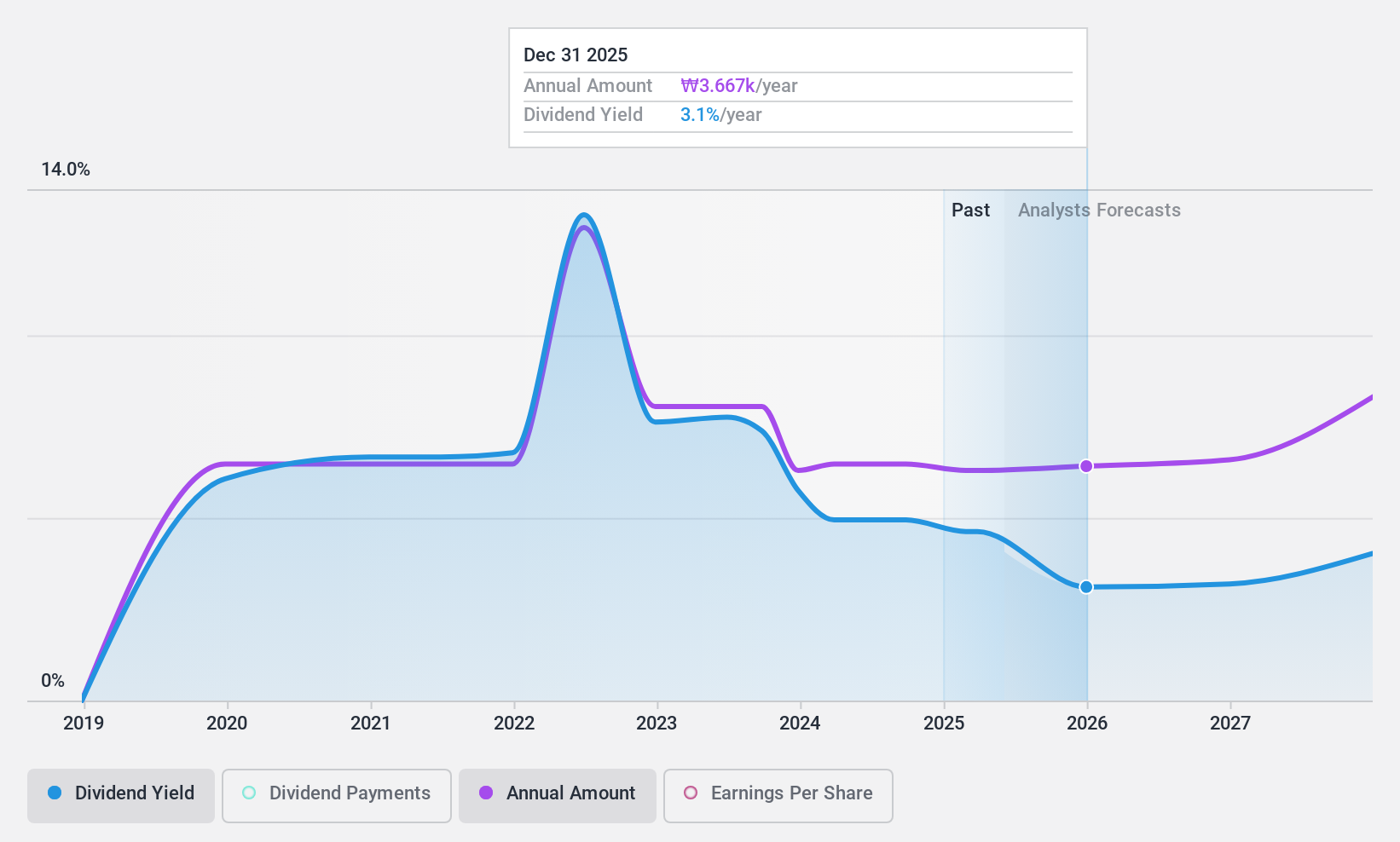

Dividend Yield: 4.7%

HD Hyundai's dividend yield of 4.65% ranks in the top 25% of South Korean payers, supported by a reasonable payout ratio of 61.8% and a low cash payout ratio of 7.7%. Despite earnings growth and forecasts for further increases, the company has an unstable five-year dividend history with volatile payments. Recent Q2 results showed significant earnings improvement with sales reaching KRW 17.88 trillion and net income at KRW 136.24 billion, enhancing financial robustness amidst dividend inconsistencies.

- Click here to discover the nuances of HD Hyundai with our detailed analytical dividend report.

- The analysis detailed in our HD Hyundai valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Explore the 77 names from our Top KRX Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A267250

HD Hyundai

Through its subsidiaries, engages in oil refining business in Korea and internationally.

Flawless balance sheet and good value.