- South Korea

- /

- Insurance

- /

- KOSE:A000400

The Market Lifts Lotte Non - Life Insurance Co., Ltd. (KRX:000400) Shares 34% But It Can Do More

Despite an already strong run, Lotte Non - Life Insurance Co., Ltd. (KRX:000400) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 152% following the latest surge, making investors sit up and take notice.

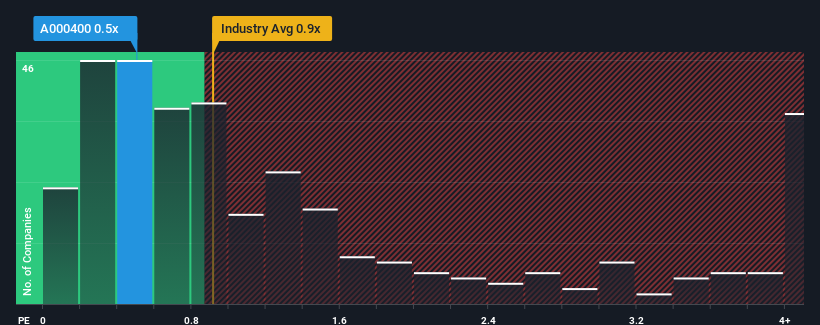

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Lotte Non - Life Insurance's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Korea is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Lotte Non - Life Insurance

How Has Lotte Non - Life Insurance Performed Recently?

The revenue growth achieved at Lotte Non - Life Insurance over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Lotte Non - Life Insurance will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lotte Non - Life Insurance will help you shine a light on its historical performance.How Is Lotte Non - Life Insurance's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Lotte Non - Life Insurance's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Still, lamentably revenue has fallen 21% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 56% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this information, it's perhaps curious but not a major surprise that Lotte Non - Life Insurance is trading at a fairly similar P/S in comparison. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Lotte Non - Life Insurance appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Lotte Non - Life Insurance revealed its narrower three-year contraction in revenue isn't contributing to its P/S as much as we would have predicted, given the industry is set to shrink even more. The fact that the company's P/S is on par with the industry despite the fact that it outperformed it could be an indication of some unobserved threats to future revenues. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Lotte Non - Life Insurance (1 is potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Lotte Non - Life Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000400

Lotte Non - Life Insurance

Provides non-life insurance products in South Korea.

Imperfect balance sheet very low.

Market Insights

Community Narratives