- South Korea

- /

- Personal Products

- /

- KOSE:A214420

Tonymoly Co., Ltd's (KRX:214420) P/S Is Still On The Mark Following 29% Share Price Bounce

Despite an already strong run, Tonymoly Co., Ltd (KRX:214420) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 68%.

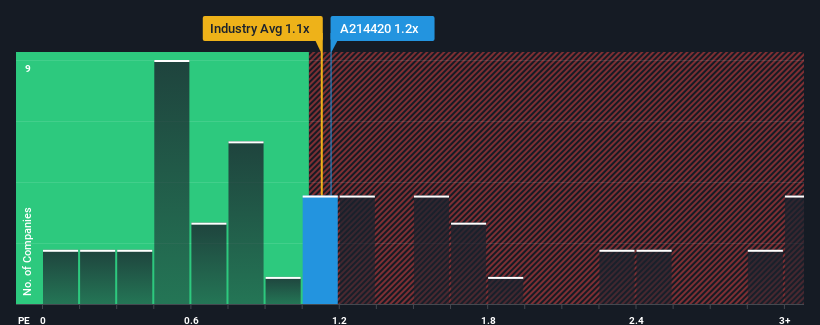

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Tonymoly's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in Korea is also close to 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Tonymoly

What Does Tonymoly's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Tonymoly has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Tonymoly's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Tonymoly's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an excellent 33% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 19% over the next year. With the industry predicted to deliver 18% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Tonymoly's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Tonymoly's P/S?

Its shares have lifted substantially and now Tonymoly's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Tonymoly's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You always need to take note of risks, for example - Tonymoly has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tonymoly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A214420

Tonymoly

Engages in the manufacturing, selling, and franchising cosmetics in South Korea and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives