- Sweden

- /

- Commercial Services

- /

- OM:NORVA

3 Stocks Estimated To Be Undervalued In January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets are experiencing mixed signals with U.S. consumer confidence declining and European stocks seeing modest gains during the holiday-shortened week. Amid these fluctuations, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value in a market characterized by both growth and uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.08 | 49.9% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.59 | MYR1.18 | 49.8% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Lea Bank (OB:LEA) | NOK10.40 | NOK20.78 | 49.9% |

Let's review some notable picks from our screened stocks.

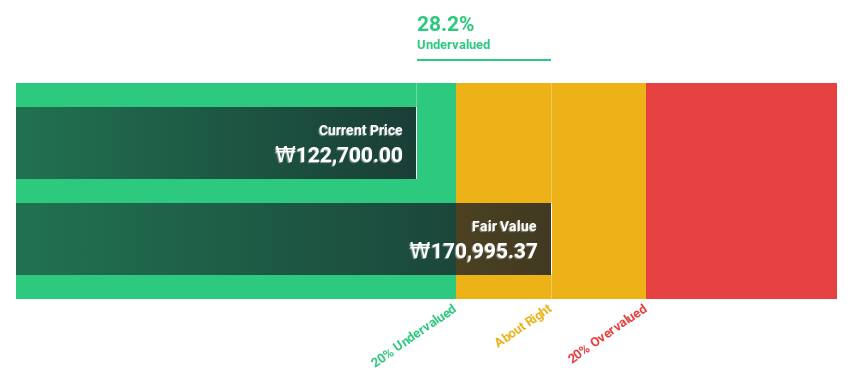

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd offers semiconductor test solutions both in South Korea and internationally, with a market cap of approximately ₩445.44 billion.

Operations: TSE Co., Ltd's revenue is primarily derived from providing semiconductor test solutions in both domestic and international markets.

Estimated Discount To Fair Value: 49.3%

Trading at ₩43,500, TSE is significantly undervalued based on discounted cash flow analysis, with a fair value estimate of ₩85,866.04. While its return on equity is forecast to be low at 12.9% in three years, earnings are expected to grow substantially by 38.2% annually, outpacing the Korean market's growth rate of 28.7%. Despite slower revenue growth at 12.6%, it surpasses the broader market's pace of 9%.

- Upon reviewing our latest growth report, TSE's projected financial performance appears quite optimistic.

- Get an in-depth perspective on TSE's balance sheet by reading our health report here.

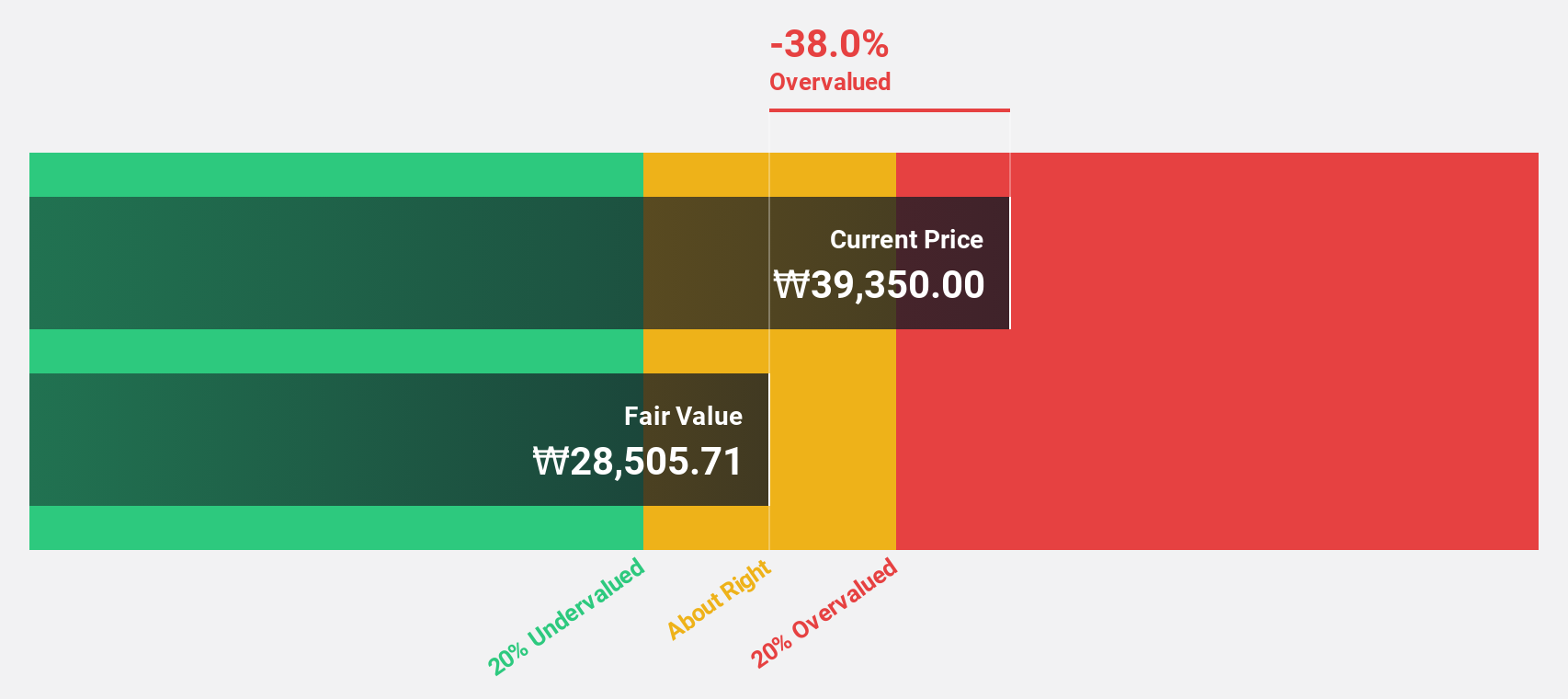

C&C International (KOSDAQ:A352480)

Overview: C&C International Co., Ltd is involved in the research, development, manufacture, and sale of cosmetics in Korea with a market cap of ₩446.37 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to ₩289.76 million.

Estimated Discount To Fair Value: 42.7%

C&C International, trading at ₩45,000, is significantly undervalued with a fair value estimate of ₩78,470.47. Despite recent share price volatility, its earnings grew by 62.4% last year and are projected to increase by 25% annually. Revenue is expected to grow at 24.6% per year, outpacing the Korean market's growth rate of 9%. The company's return on equity is forecasted to reach a robust 21.5%, indicating strong future profitability potential.

- The analysis detailed in our C&C International growth report hints at robust future financial performance.

- Navigate through the intricacies of C&C International with our comprehensive financial health report here.

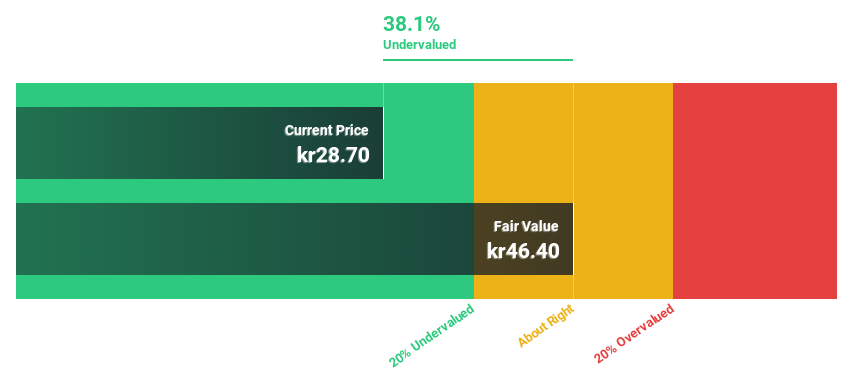

Norva24 Group (OM:NORVA)

Overview: Norva24 Group AB (Publ) operates in Northern Europe, offering underground infrastructure maintenance services, with a market cap of SEK4.94 billion.

Operations: The company generates revenue from its underground infrastructure maintenance services, with a focus on waste management, amounting to NOK3.50 billion.

Estimated Discount To Fair Value: 40.4%

Norva24 Group, trading at SEK27.15, is undervalued with a fair value estimate of SEK45.57. The company's earnings are projected to grow significantly at 21.2% annually, surpassing the Swedish market's growth rate of 14.6%. Despite recent declines in net income and earnings per share for Q3 2024 compared to the previous year, revenue increased from NOK 792.2 million to NOK 934.8 million, highlighting robust sales growth amidst market challenges.

- According our earnings growth report, there's an indication that Norva24 Group might be ready to expand.

- Dive into the specifics of Norva24 Group here with our thorough financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 903 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norva24 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORVA

Norva24 Group

Provides underground infrastructure maintenance services in Northern Europe.

Excellent balance sheet and good value.

Market Insights

Community Narratives