- South Korea

- /

- Personal Products

- /

- KOSDAQ:A175250

Even after rising 10% this past week, Icure Pharmaceutical Incorporation (KOSDAQ:175250) shareholders are still down 84% over the past three years

This week we saw the Icure Pharmaceutical Incorporation (KOSDAQ:175250) share price climb by 10%. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 86% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Icure Pharmaceutical Incorporation

Icure Pharmaceutical Incorporation wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Icure Pharmaceutical Incorporation saw its revenue shrink by 6.8% per year. That is not a good result. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

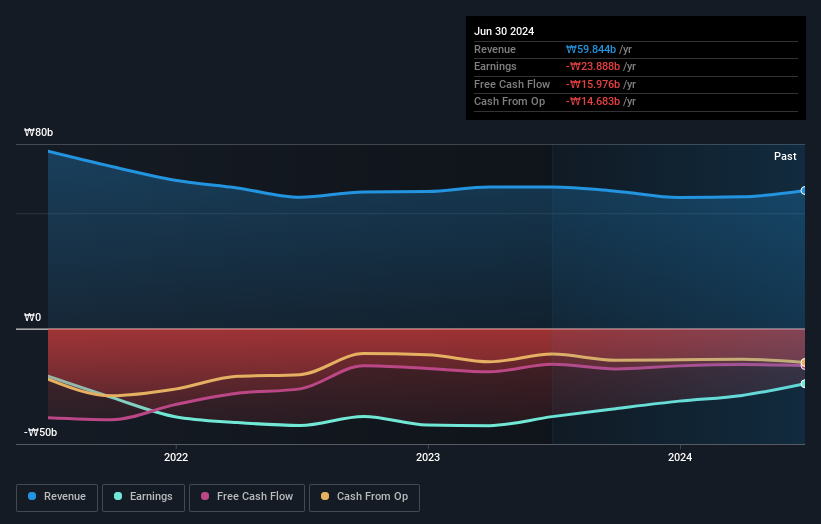

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Icure Pharmaceutical Incorporation's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Icure Pharmaceutical Incorporation's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Icure Pharmaceutical Incorporation hasn't been paying dividends, but its TSR of -84% exceeds its share price return of -86%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Icure Pharmaceutical Incorporation has rewarded shareholders with a total shareholder return of 8.7% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Icure Pharmaceutical Incorporation (2 shouldn't be ignored) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A175250

Icure Pharmaceutical Incorporation

A biopharmaceutical company, researches, develops, and sells pharmaceutical and cosmetic products in South Korea.

Mediocre balance sheet low.