- South Korea

- /

- Personal Products

- /

- KOSDAQ:A048410

Hyundai Bioscience (KOSDAQ:048410 shareholders incur further losses as stock declines 10% this week, taking three-year losses to 57%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Hyundai Bioscience Co., Ltd. (KOSDAQ:048410) have had an unfortunate run in the last three years. Unfortunately, they have held through a 59% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 44% lower in that time. Furthermore, it's down 28% in about a quarter. That's not much fun for holders.

If the past week is anything to go by, investor sentiment for Hyundai Bioscience isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Hyundai Bioscience

Hyundai Bioscience wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Hyundai Bioscience grew revenue at 21% per year. That's well above most other pre-profit companies. In contrast, the share price is down 17% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

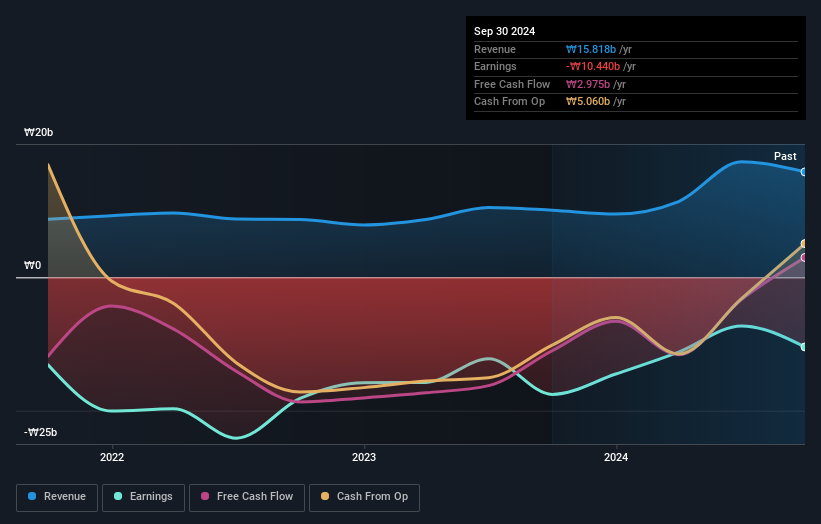

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hyundai Bioscience's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Hyundai Bioscience hasn't been paying dividends, but its TSR of -57% exceeds its share price return of -59%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We regret to report that Hyundai Bioscience shareholders are down 41% for the year. Unfortunately, that's worse than the broader market decline of 3.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 1.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Hyundai Bioscience is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A048410

Adequate balance sheet minimal.

Market Insights

Community Narratives