- South Korea

- /

- Biotech

- /

- KOSDAQ:A290650

High Insider Ownership Growth Companies In Global December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and fluctuating consumer confidence, investors are keenly observing the performance of small-cap stocks and technology sectors, which have recently shown resilience. In this context, growth companies with high insider ownership present an intriguing opportunity, as such ownership can often signal strong alignment between management interests and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

We're going to check out a few of the best picks from our screener tool.

L&C BIOLTD (KOSDAQ:A290650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: L&C Bio Co., Ltd is a research and development company focused on tissue regeneration medicine, with a market capitalization of ₩1.49 trillion.

Operations: L&C Bio Co., Ltd generates its revenue primarily from its research and development activities in the field of tissue regeneration medicine.

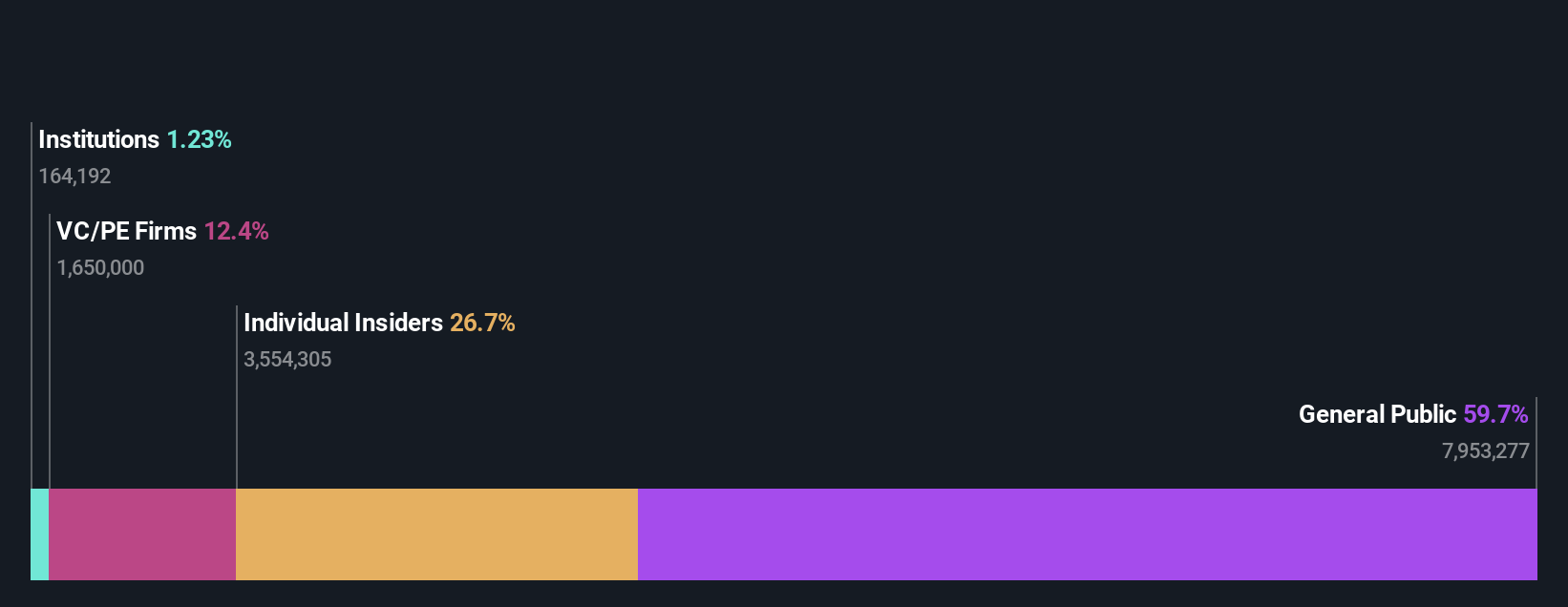

Insider Ownership: 26.1%

L&C BIO LTD is positioned for significant growth, with earnings expected to rise 44.7% annually, outpacing the KR market's 28.5%. The company offers good value with a price-to-earnings ratio of 20.5x, below the industry average of 27.6x. Despite recent share price volatility and low forecasted return on equity (10.2%), it became profitable this year and anticipates robust revenue growth at 54.7% per year, well above market expectations.

- Get an in-depth perspective on L&C BIOLTD's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report L&C BIOLTD implies its share price may be lower than expected.

Tomocube (KOSDAQ:A475960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tomocube, Inc. manufactures and sells optical devices and medical equipment, with a market cap of ₩711.38 billion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 26.7%

Tomocube's potential for growth is underscored by its forecasted earnings increase of 128.3% annually, with profitability expected within three years. Despite lacking meaningful revenue (₩7B) and experiencing high share price volatility recently, the company's return on equity is projected to reach 22.4%, surpassing benchmarks in three years. Recent inclusion in the S&P Global BMI Index highlights its growing recognition, although insider trading activity over the past three months remains unclear.

- Click here to discover the nuances of Tomocube with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Tomocube's share price might be too optimistic.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

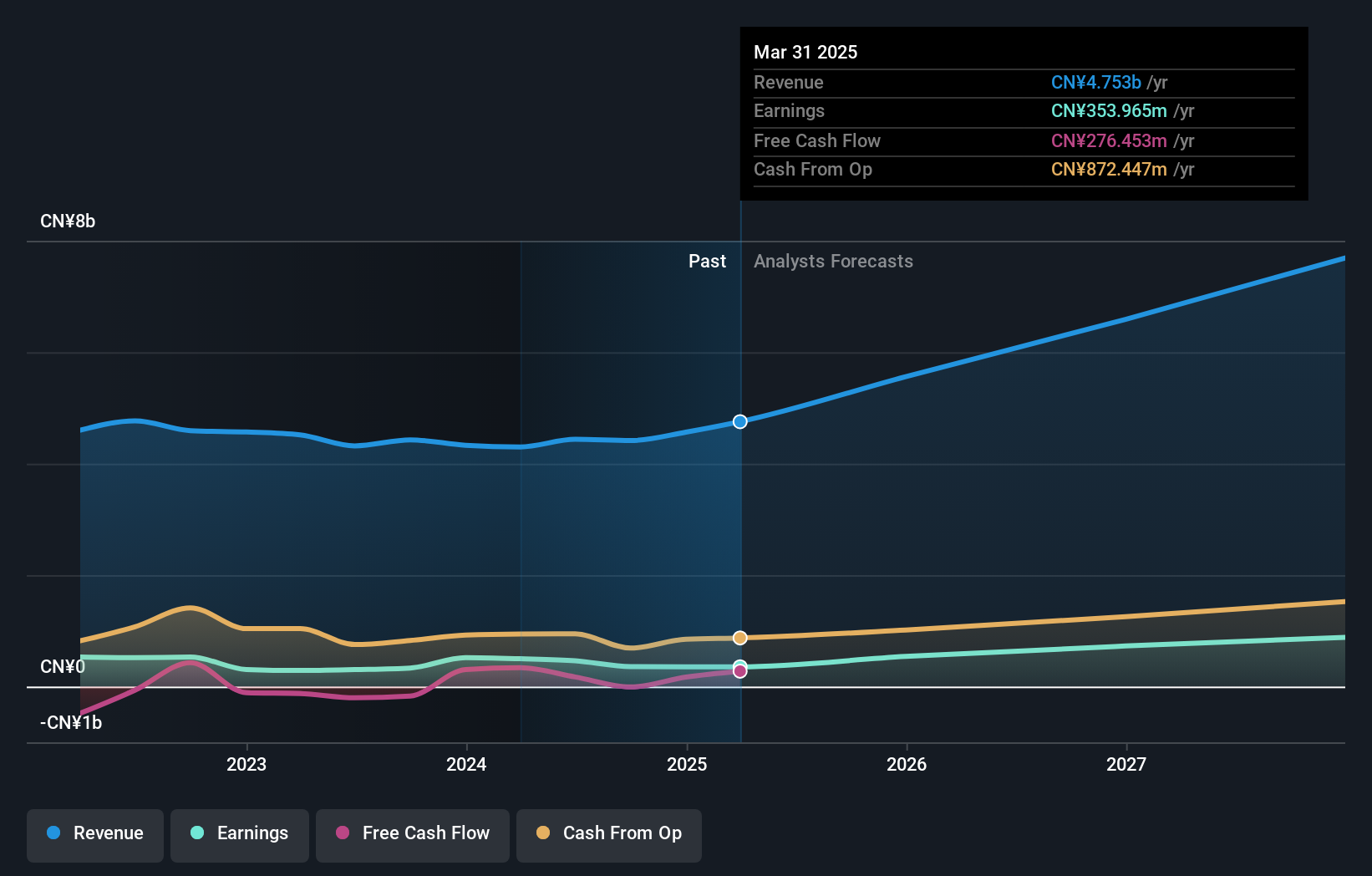

Overview: Aoshikang Technology Co., Ltd. is involved in the research, development, production, and sale of printed circuit boards with a market cap of CN¥11.87 billion.

Operations: The company's revenue primarily comes from its printed circuit boards segment, totaling CN¥5.29 billion.

Insider Ownership: 19.9%

Aoshikang Technology's earnings are forecast to grow significantly at 35.8% annually, outpacing the Chinese market. Despite a volatile share price and a dividend yield of 1.55% that isn't well covered by free cash flows, its P/E ratio of 34.2x suggests good value relative to peers. Recent earnings show modest growth with net income reaching CNY 282.45 million for the first nine months of 2025, while a share buyback program indicates confidence in future prospects without recent insider trading activity reported.

- Dive into the specifics of Aoshikang Technology here with our thorough growth forecast report.

- The analysis detailed in our Aoshikang Technology valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Reveal the 858 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Interested In Other Possibilities? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A290650

L&C BIOLTD

L&C Bio Co., Ltd operates as a research and development company in tissue regeneration medicine.

High growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026