- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

Lunit And Two Other Stocks Believed To Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European stocks seeing modest gains, investors are keenly assessing opportunities amidst fluctuating indices. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on discrepancies between market price and intrinsic value, offering potential for future growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| Round One (TSE:4680) | ¥1310.00 | ¥2617.57 | 50% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.86 | 49.8% |

| S Foods (TSE:2292) | ¥2745.00 | ¥5472.35 | 49.8% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7615.98 | 49.6% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.53 | CN¥9.01 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.90 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.53 | CN¥126.46 | 49.8% |

Let's explore several standout options from the results in the screener.

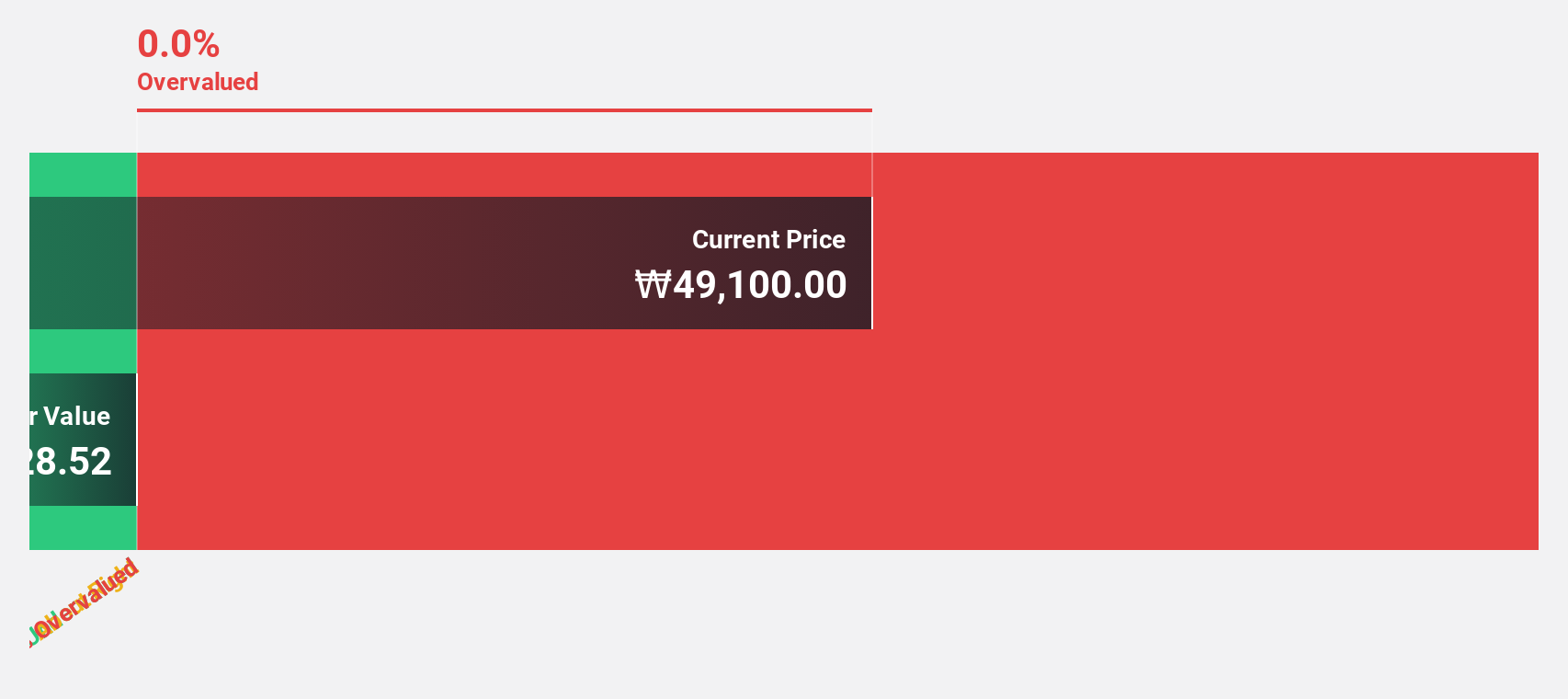

Lunit (KOSDAQ:A328130)

Overview: Lunit Inc. is a South Korean company that offers AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩1.77 trillion.

Operations: The company's revenue is primarily derived from its healthcare software segment, which generated ₩39.54 billion.

Estimated Discount To Fair Value: 27.1%

Lunit's stock appears significantly undervalued, trading over 20% below its estimated fair value of ₩87,499.34. Despite a volatile share price recently, the company is poised for high revenue growth at 49.9% annually, surpassing market averages. Lunit's recent advancements in AI technology and strategic partnerships enhance its competitive edge in oncology diagnostics and global market expansion. However, its low future return on equity forecast may be a concern for some investors.

- Our growth report here indicates Lunit may be poised for an improving outlook.

- Click here to discover the nuances of Lunit with our detailed financial health report.

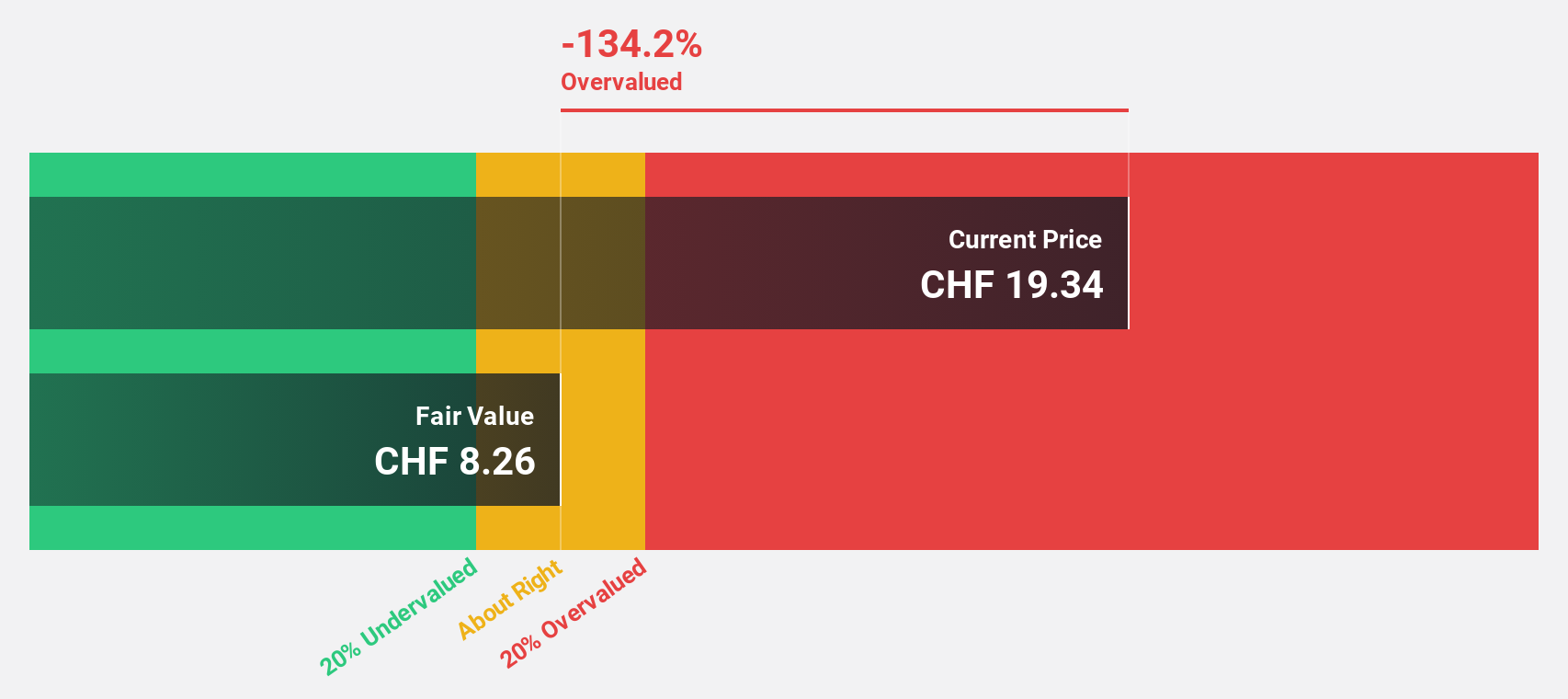

Stadler Rail (SWX:SRAIL)

Overview: Stadler Rail AG is a company that manufactures and sells trains across Switzerland, Germany, Austria, various parts of Europe, the Americas, and CIS countries with a market cap of CHF2 billion.

Operations: Stadler Rail AG generates revenue primarily from Rolling Stock (CHF3.10 billion), followed by Service & Components (CHF789.41 million), and Signalling (CHF135.68 million).

Estimated Discount To Fair Value: 46.7%

Stadler Rail is trading at CHF20, significantly below its estimated fair value of CHF37.55, indicating it may be undervalued based on cash flows. Earnings are projected to grow substantially at 22.9% annually, outpacing the Swiss market's average growth rate. However, the dividend yield of 4.5% isn't well covered by free cash flows, and future return on equity is forecast to remain modest at 18.7%, which could be a concern for some investors.

- According our earnings growth report, there's an indication that Stadler Rail might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Stadler Rail.

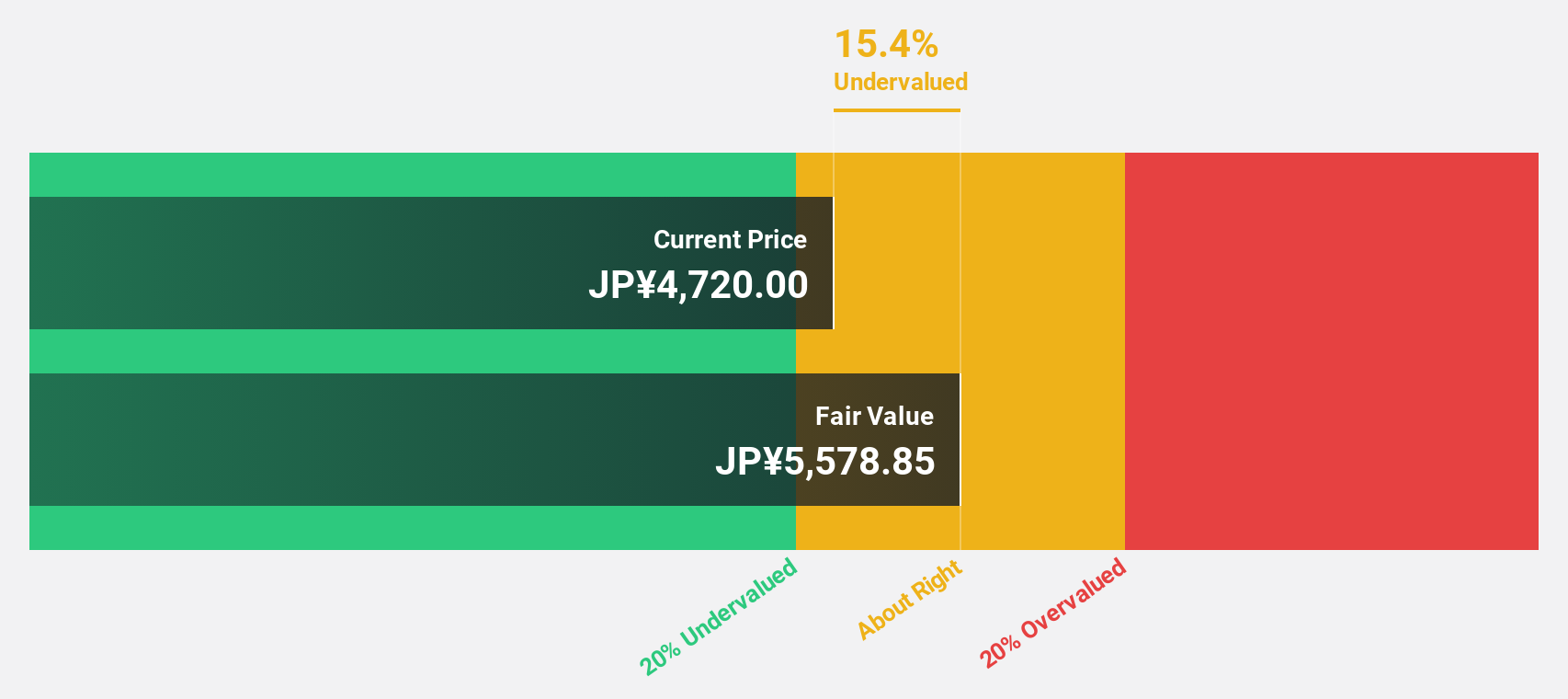

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants both in Japan and internationally, with a market cap of ¥336.66 billion.

Operations: The company's revenue segments include Marugame Seimen generating ¥121.61 billion, and the Overseas Business contributing ¥99.74 billion.

Estimated Discount To Fair Value: 30.8%

TORIDOLL Holdings is trading at ¥3897, significantly below its estimated fair value of ¥5628.67, suggesting it could be undervalued based on cash flows. Earnings are expected to grow substantially by 44.7% annually, outpacing the Japanese market's average growth rate. However, recent guidance revisions show lowered profit expectations due to underperformance in its overseas segment despite strong domestic results from Marugame Seimen, which may concern some investors regarding future profitability.

- The analysis detailed in our TORIDOLL Holdings growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of TORIDOLL Holdings.

Key Takeaways

- Embark on your investment journey to our 874 Undervalued Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

Undervalued with excellent balance sheet.