- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A258830

These 4 Measures Indicate That Sejong Medical (KOSDAQ:258830) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Sejong Medical Co., Ltd. (KOSDAQ:258830) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Sejong Medical

What Is Sejong Medical's Debt?

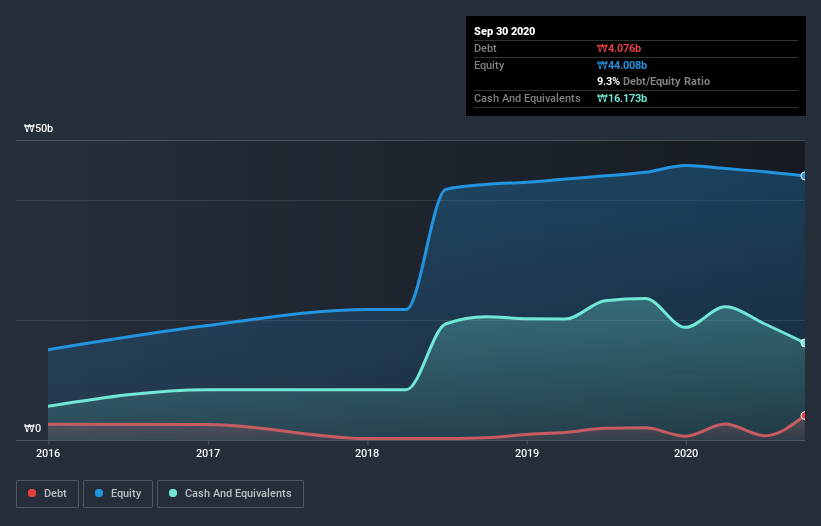

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Sejong Medical had ₩4.06b of debt, an increase on ₩2.02b, over one year. But it also has ₩16.2b in cash to offset that, meaning it has ₩12.1b net cash.

How Strong Is Sejong Medical's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Sejong Medical had liabilities of ₩7.76b due within 12 months and liabilities of ₩3.83b due beyond that. Offsetting this, it had ₩16.2b in cash and ₩1.85b in receivables that were due within 12 months. So it actually has ₩6.43b more liquid assets than total liabilities.

This short term liquidity is a sign that Sejong Medical could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Sejong Medical has more cash than debt is arguably a good indication that it can manage its debt safely.

In fact Sejong Medical's saving grace is its low debt levels, because its EBIT has tanked 51% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sejong Medical's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Sejong Medical has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Sejong Medical burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Sejong Medical has net cash of ₩12.1b, as well as more liquid assets than liabilities. So we are not troubled with Sejong Medical's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Sejong Medical has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Sejong Medical or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A258830

Sejong Medical

Engages in the manufacture and sale of laparoscopic surgery systems and equipment in South Korea.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives