- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A228670

Ray (KOSDAQ:228670 investor three-year losses grow to 74% as the stock sheds ₩18b this past week

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Ray Co., Ltd. (KOSDAQ:228670), who have seen the share price tank a massive 74% over a three year period. That would be a disturbing experience. And over the last year the share price fell 69%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 29% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Ray

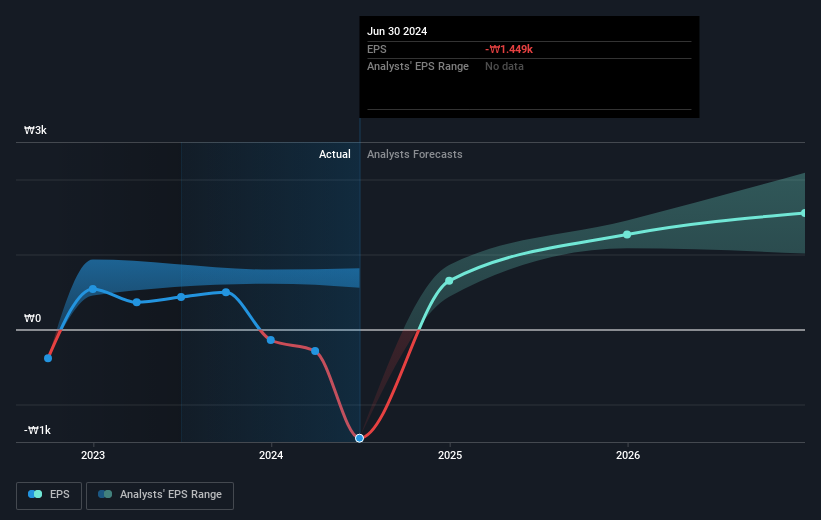

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Ray saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Ray's key metrics by checking this interactive graph of Ray's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Ray shareholders are down 69% for the year. Unfortunately, that's worse than the broader market decline of 2.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Ray better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Ray (at least 1 which is concerning) , and understanding them should be part of your investment process.

Of course Ray may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A228670

Ray

RAY Co., Ltd. provides x-ray diagnostic equipment in the dental industry.

Exceptional growth potential and undervalued.