- South Korea

- /

- Personal Products

- /

- KOSE:A278470

KRX Stocks Insiders Are Investing In With Up To 22% Revenue Growth

Reviewed by Simply Wall St

South Korea's economy has shown resilience with a current account surplus of $9.13 billion in July, driven by strong export growth and increased net assets. In this environment, identifying growth companies with high insider ownership can be particularly compelling, as it often signals confidence from those closest to the business and aligns well with positive economic indicators.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Here we highlight a subset of our preferred stocks from the screener.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.42 billion.

Operations: The company's revenue segment primarily consists of Surgical & Medical Equipment, amounting to ₩204.37 million.

Insider Ownership: 10.1%

Revenue Growth Forecast: 19.3% p.a.

CLASSYS Inc. demonstrates potential as a growth company with high insider ownership in South Korea. Its earnings are expected to grow at 22.52% annually, although this is slower than the market average of 28.6%. Revenue is forecasted to increase by 19.3% per year, outpacing the KR market's 10.3%. The company has been actively presenting at major investor forums and recently reported strong Q2 performance, indicating robust engagement and transparency with investors.

- Unlock comprehensive insights into our analysis of CLASSYS stock in this growth report.

- Our valuation report here indicates CLASSYS may be overvalued.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., with a market cap of ₩1.93 trillion, operates as a biopharmaceutical company primarily in South Korea through its subsidiaries.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which amounted to ₩296.59 billion.

Insider Ownership: 38.9%

Revenue Growth Forecast: 22.1% p.a.

PharmaResearch shows promise with substantial insider ownership and a strong growth trajectory. Earnings are forecast to grow 22.2% annually, slightly below the KR market average of 28.6%, but revenue is expected to increase by 22.1% per year, outpacing the market's 10.3%. Despite recent volatility in share price, the stock trades at 55.4% below its estimated fair value and analysts predict a potential price rise of 30.7%.

- Take a closer look at PharmaResearch's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, PharmaResearch's share price might be too pessimistic.

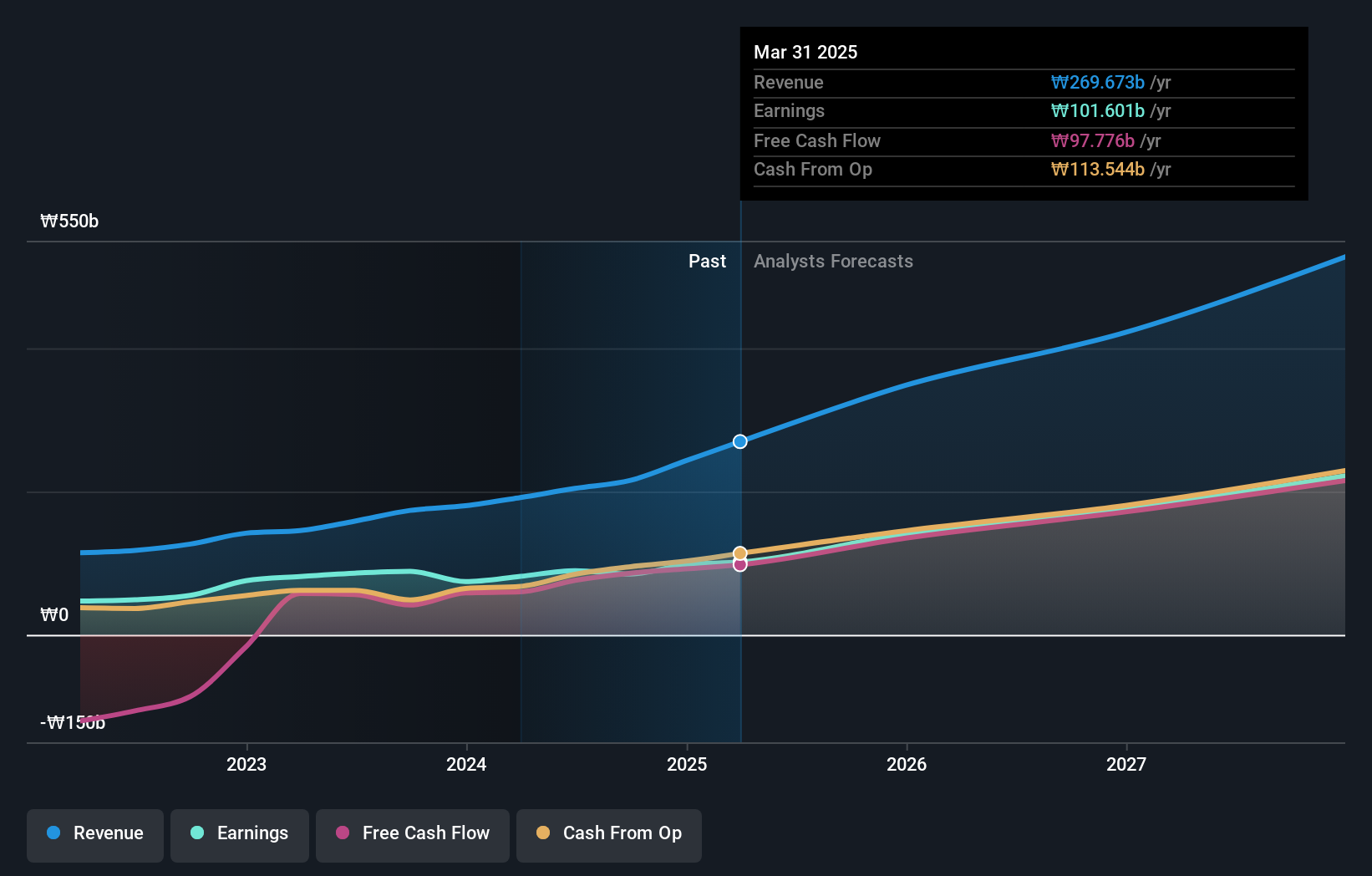

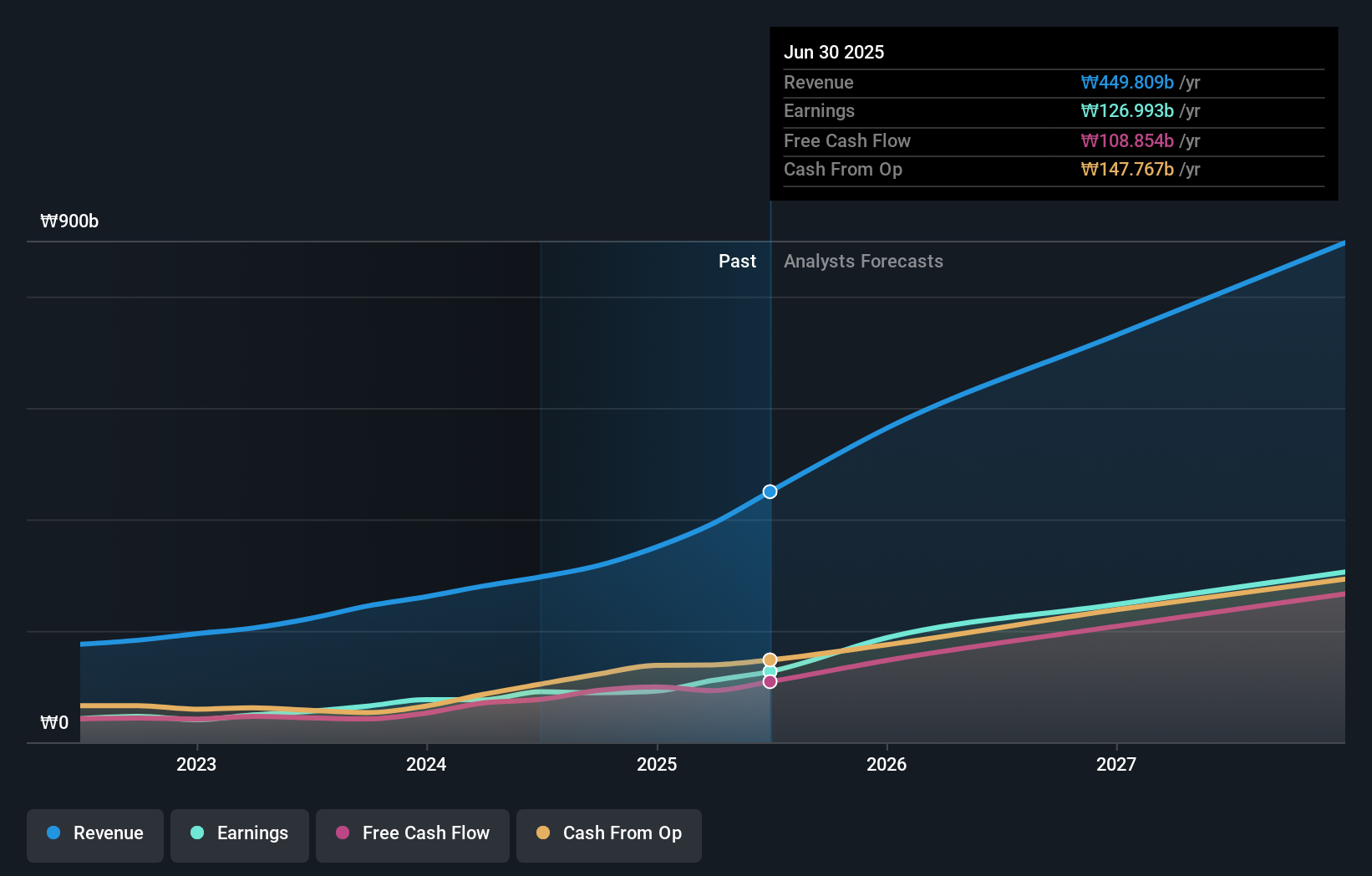

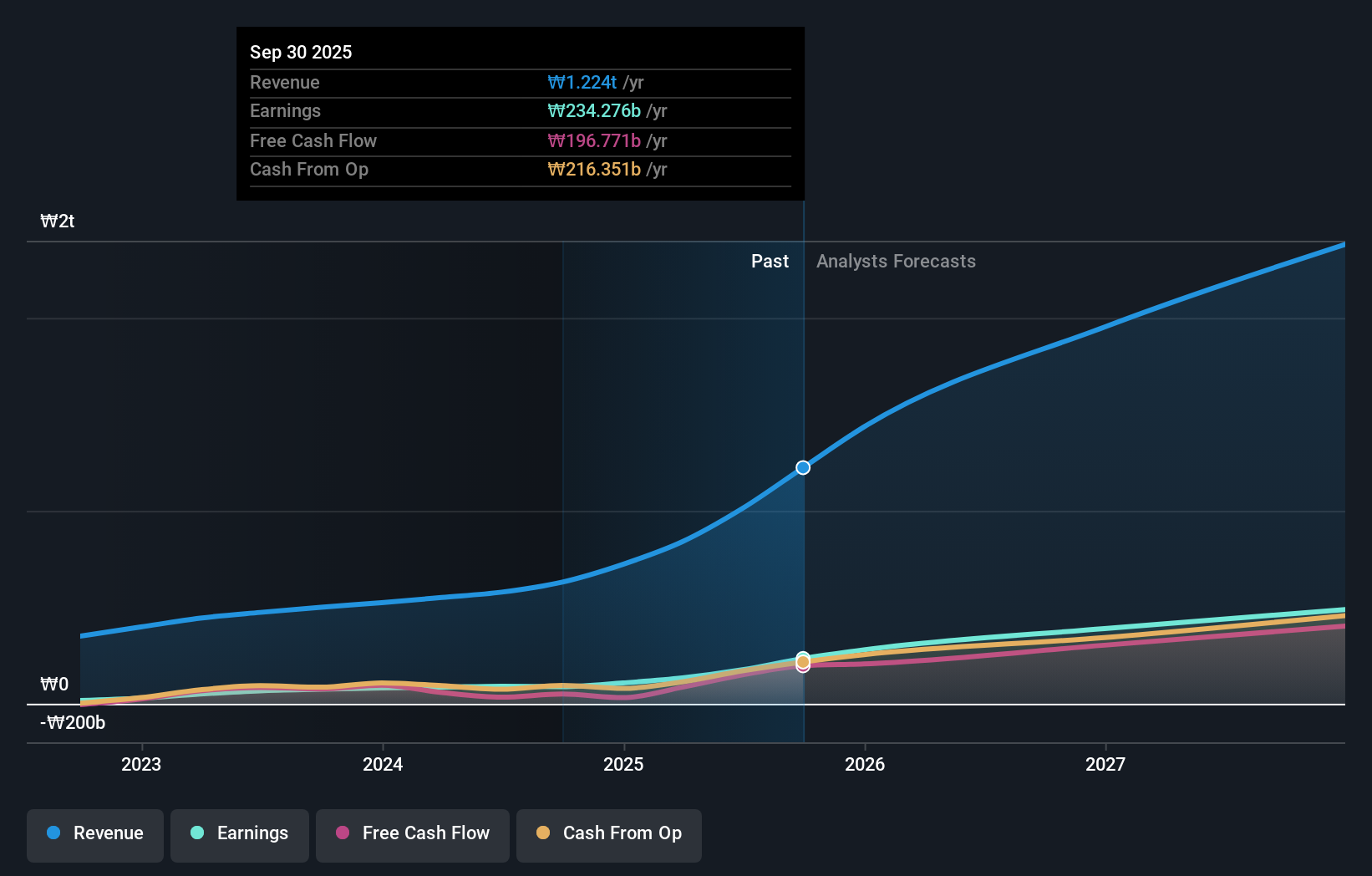

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd manufactures and sells cosmetic products for men and women, with a market cap of ₩2.15 trillion.

Operations: The company's revenue segments include ₩614.77 billion from cosmetics and ₩64.46 billion from apparel fashion.

Insider Ownership: 34.4%

Revenue Growth Forecast: 22.2% p.a.

APR Co., Ltd. demonstrates strong growth potential with high insider ownership. Earnings grew by 35.6% last year and are forecast to grow significantly at 25.6% annually over the next three years, although slightly below the KR market average of 28.6%. Revenue is expected to rise by 22.2% per year, outpacing the market's growth rate of 10.3%. Despite recent share price volatility, APR trades at a substantial discount of 45.3% below its estimated fair value and analysts predict a price increase of 44.4%. The company has also announced a buyback program worth ₩60 billion to stabilize stock prices and enhance shareholder value by December 2024.

- Delve into the full analysis future growth report here for a deeper understanding of APR.

- The analysis detailed in our APR valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 89 companies within our Fast Growing KRX Companies With High Insider Ownership screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet and good value.