- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

KRX Growth Companies With High Insider Ownership And Earnings Surge Up To 144%

Reviewed by Simply Wall St

The South Korean market has shown positive momentum, rising 1.1% over the past week and achieving a 3.7% increase over the last year, with earnings expected to grow by 29% annually. In this context, companies with high insider ownership and significant earnings growth are particularly compelling for investors looking for potential opportunities.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We're going to check out a few of the best picks from our screener tool.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. specializes in providing medical aesthetics devices globally, with a market capitalization of approximately ₩3.37 billion.

Operations: The company operates primarily in the global medical aesthetics devices sector.

Insider Ownership: 10.1%

Earnings Growth Forecast: 22.2% p.a.

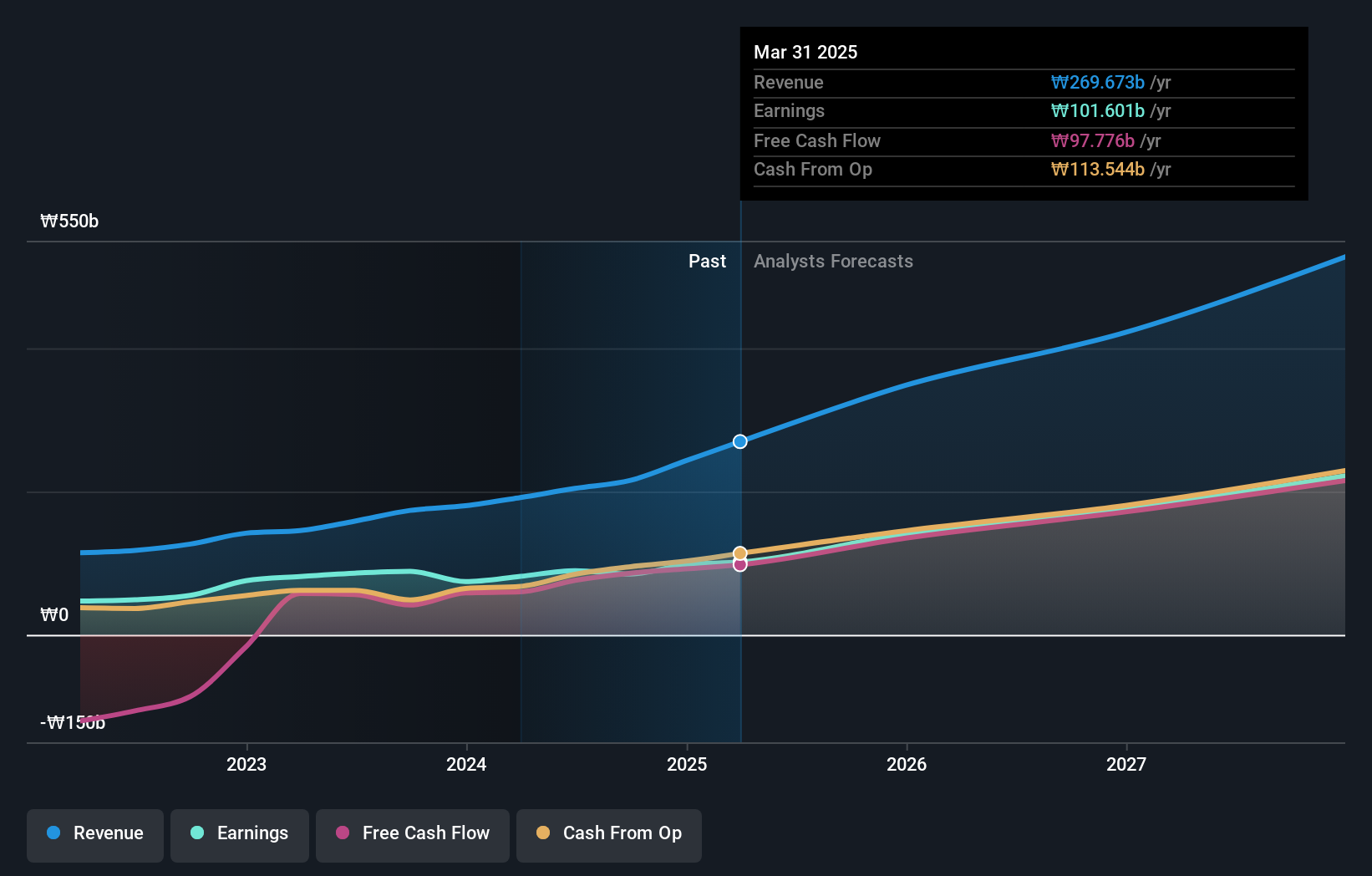

CLASSYS Inc. has demonstrated a highly volatile share price in recent months, yet its financial outlook remains robust with earnings growth of 25.9% annually over the past five years and projected revenue growth of 21.3% per year, outpacing the South Korean market average. Despite no insider trading activity reported in the last three months, CLASSYS's strong presence at multiple investor conferences underscores its active engagement with the investment community and commitment to transparency.

- Take a closer look at CLASSYS' potential here in our earnings growth report.

- The valuation report we've compiled suggests that CLASSYS' current price could be inflated.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. is a South Korean company engaged in the manufacturing and selling of electrolytes and additives for secondary batteries and electric double-layer capacitors (EDLC), with a market capitalization of approximately ₩5.75 billion.

Operations: The company generates its revenue primarily from the production and sale of electrolytes and additives used in secondary batteries and EDLCs.

Insider Ownership: 20.8%

Earnings Growth Forecast: 144.8% p.a.

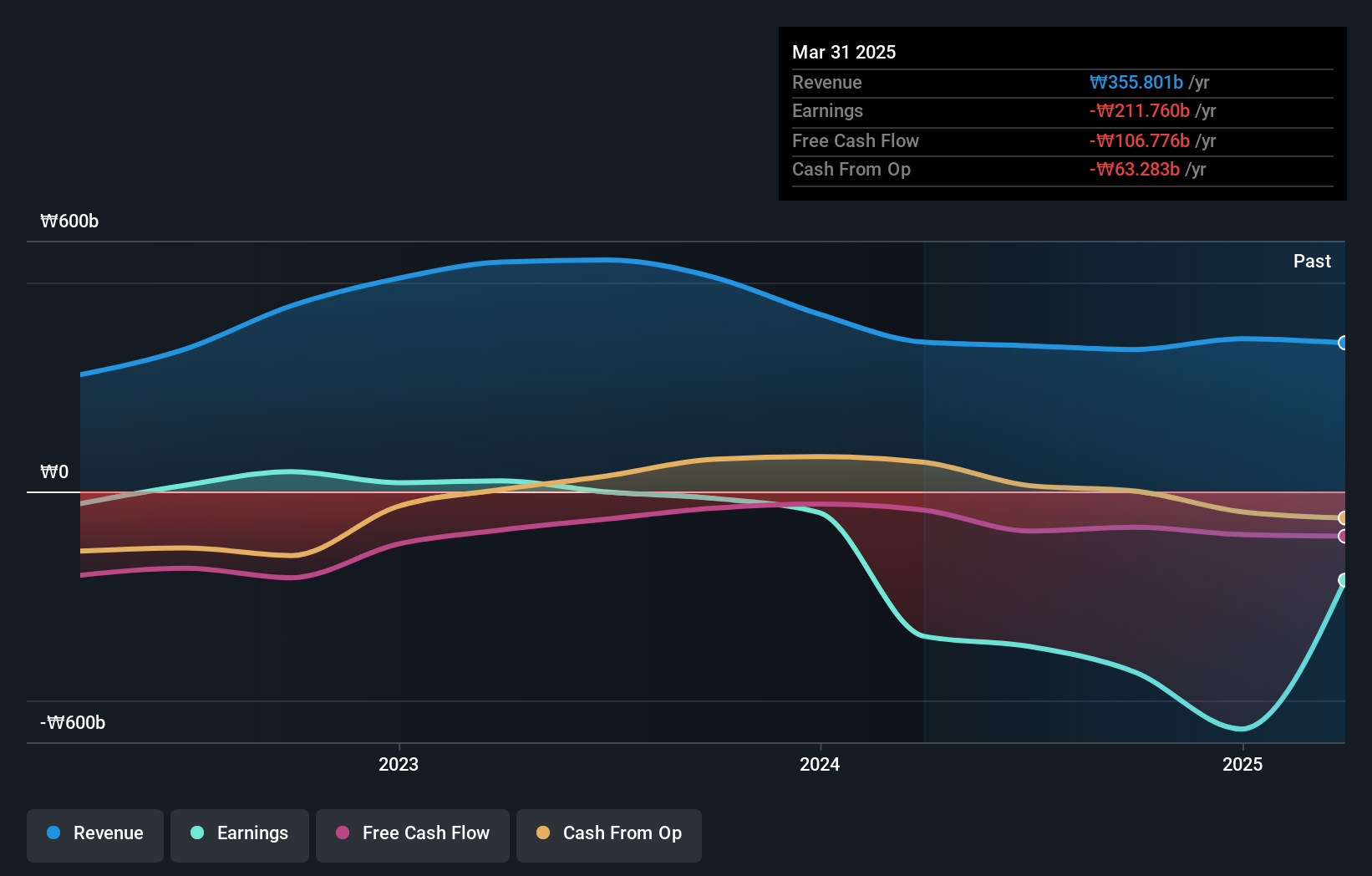

Enchem is poised for significant growth, with earnings expected to increase by 144.8% annually. This growth rate is well above the average market forecast, complementing its projected revenue surge of 56.5% per year—also outpacing the South Korean market's expansion. Despite a highly volatile share price recently, Enchem has not experienced any insider selling in the past three months and is on track to become profitable within three years, aligning with its strong growth trajectory.

- Get an in-depth perspective on Enchem's performance by reading our analyst estimates report here.

- Our valuation report here indicates Enchem may be overvalued.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The company generates revenue through the sale of cosmetic products tailored for both genders.

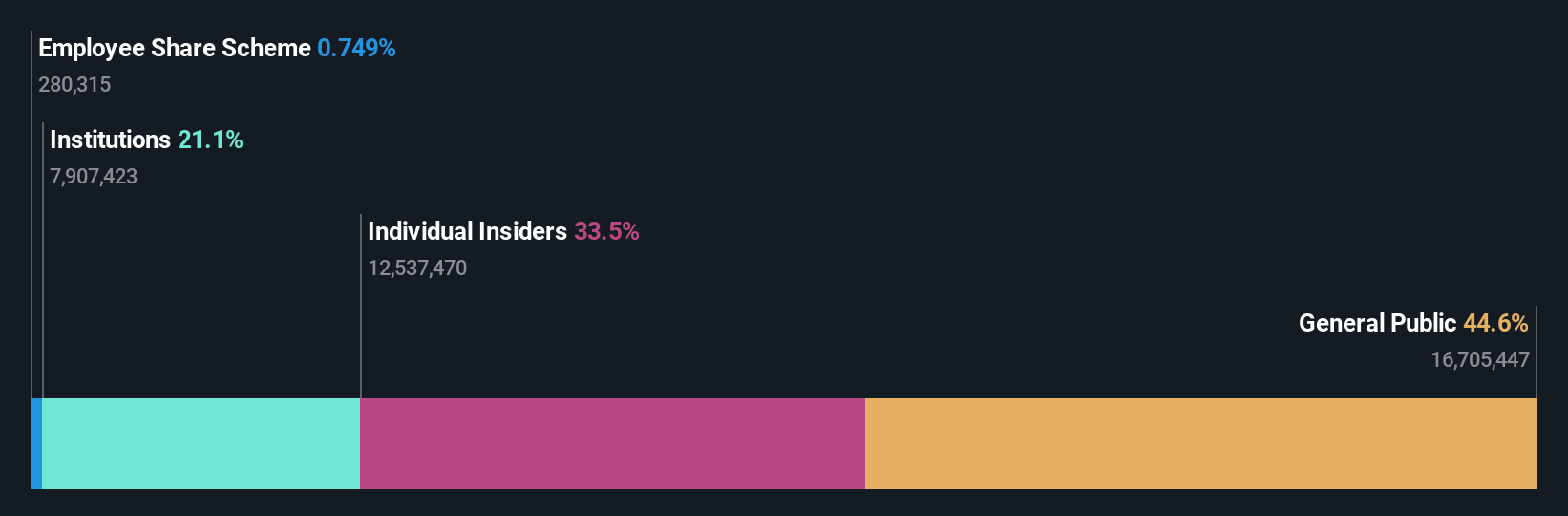

Insider Ownership: 34.2%

Earnings Growth Forecast: 26.2% p.a.

APR Co., Ltd. stands out with its projected annual revenue growth of 23.1%, surpassing the South Korean market average significantly. Earnings are also expected to rise by 26.21% annually, although slightly below the broader market's pace. The company's Return on Equity is anticipated to be robust at 34.8% in three years, reflecting high-quality earnings and a strong financial position, trading at a 15.3% discount to its estimated fair value despite recent share price volatility and no insider selling reported over the past quarter.

- Unlock comprehensive insights into our analysis of APR stock in this growth report.

- Our valuation report unveils the possibility APR's shares may be trading at a premium.

Make It Happen

- Reveal the 82 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Exceptional growth potential with solid track record.

Market Insights

Community Narratives