- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

3 Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape marked by rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming their value counterparts. In this environment, identifying stocks that might be trading below their estimated value can present unique opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49094.79 | 49.8% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17610.00 | ₩34899.00 | 49.5% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.26 | 49.8% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Constellium (NYSE:CSTM) | US$9.24 | US$18.27 | 49.4% |

Let's review some notable picks from our screened stocks.

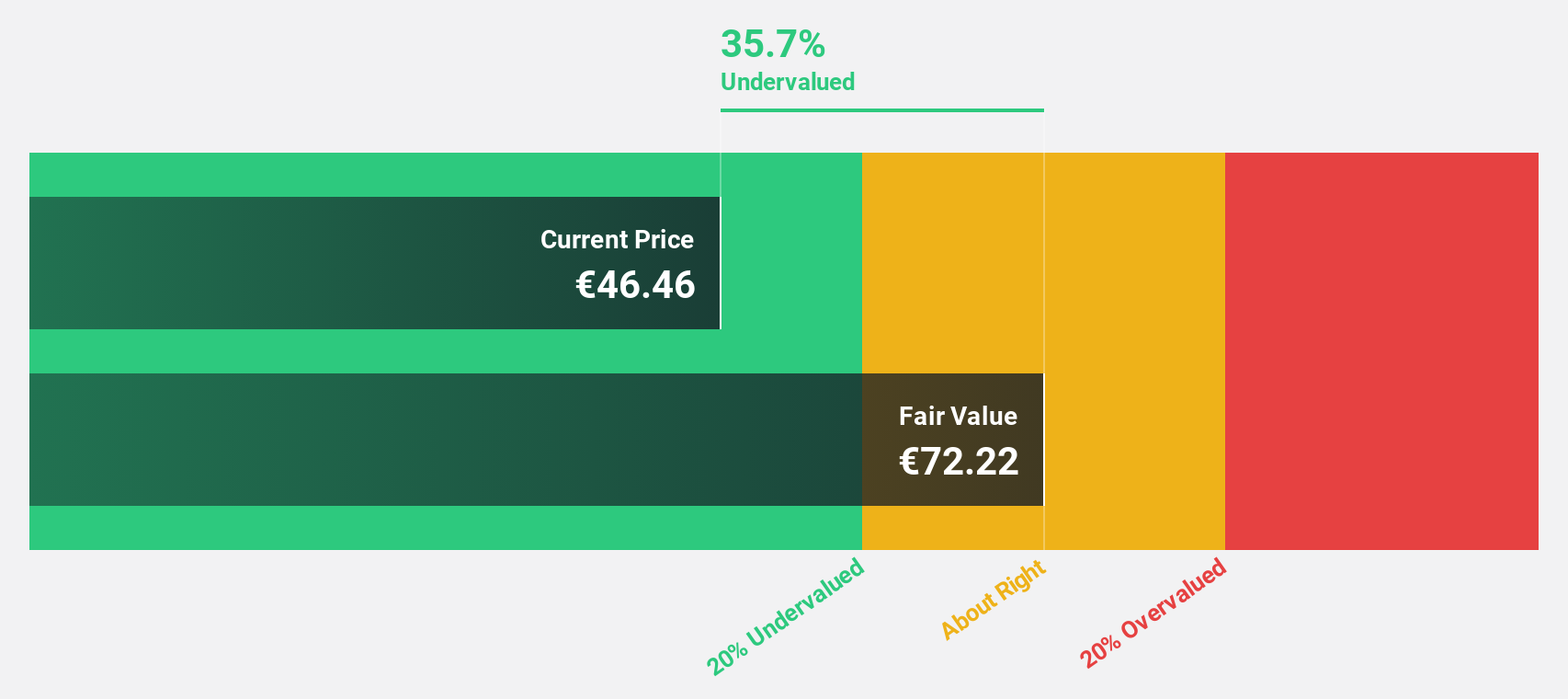

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of €5.73 billion.

Operations: The company's revenue segments include €1.89 billion from North-Western Europe and €684.90 million from Global Services Energy.

Estimated Discount To Fair Value: 39.4%

SPIE is trading at €33.94, significantly below its estimated fair value of €55.99, suggesting it may be undervalued based on cash flows. Earnings are expected to grow by 21% annually over the next three years, outpacing the French market's growth rate. However, SPIE carries a high level of debt and has an unstable dividend track record. Recent share repurchase programs aim to offset dilution from employee plans and incentives.

- Insights from our recent growth report point to a promising forecast for SPIE's business outlook.

- Click here to discover the nuances of SPIE with our detailed financial health report.

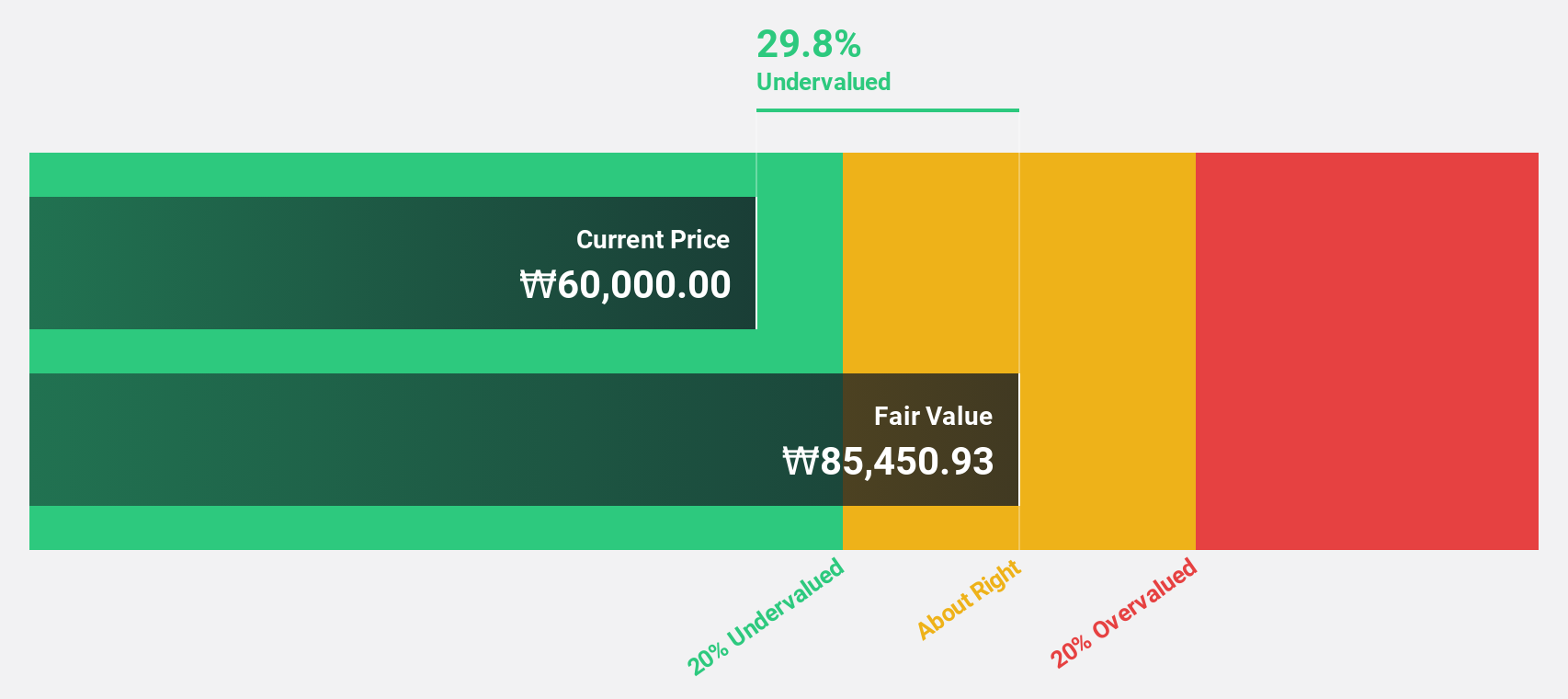

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market capitalization of ₩3.71 trillion.

Operations: The company's revenue segment primarily consists of Surgical & Medical Equipment, generating ₩215.54 billion.

Estimated Discount To Fair Value: 37.9%

CLASSYS is trading at ₩56,700, well below its estimated fair value of ₩91,245.34, indicating potential undervaluation based on cash flows. Earnings are projected to grow 27.4% annually over the next three years, surpassing the Korean market's growth rate. A recent share repurchase program worth KRW 25 billion aims to enhance shareholder value and stabilize stock price. These factors combined with strong revenue forecasts highlight CLASSYS as a compelling opportunity for investors focused on cash flow valuation.

- In light of our recent growth report, it seems possible that CLASSYS' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in CLASSYS' balance sheet health report.

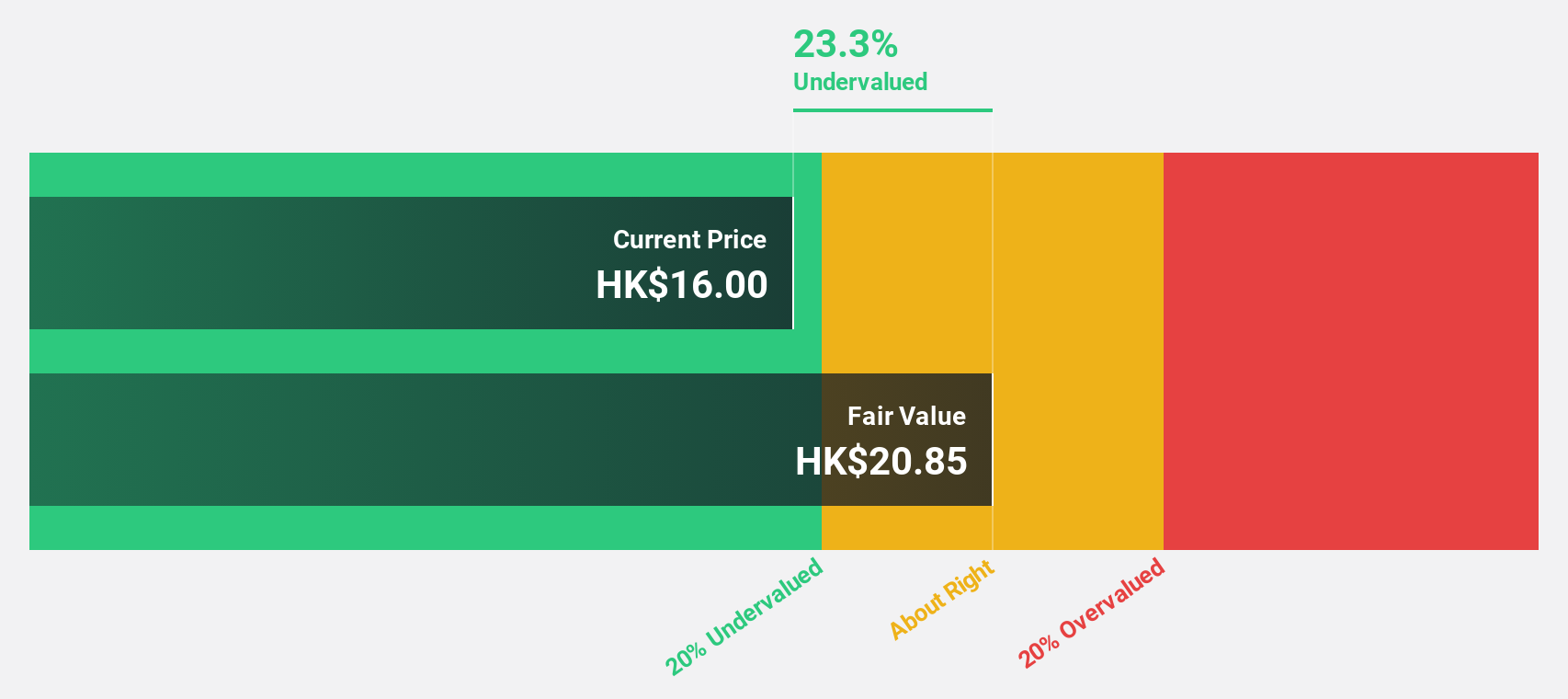

Genscript Biotech (SEHK:1548)

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services across the United States, Europe, China, Japan, other Asia Pacific regions, and internationally, with a market cap of HK$25.37 billion.

Operations: The company's revenue segments include Cell Therapy ($455.99 million), Biologics Development Services ($84.76 million), Life Science Services and Products ($432.28 million), and Industrial Synthetic Biology Products ($50.98 million).

Estimated Discount To Fair Value: 35.8%

Genscript Biotech, trading at HK$11.82, is significantly undervalued compared to its fair value estimate of HK$18.43, offering potential based on cash flows. The company's revenue is projected to grow 36.9% annually, outpacing the Hong Kong market's growth rate and indicating robust future prospects despite a forecasted low return on equity of 9.5%. Recent board changes focus on enhancing risk management in data security and geopolitical resilience, potentially strengthening operational stability.

- Our comprehensive growth report raises the possibility that Genscript Biotech is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Genscript Biotech stock in this financial health report.

Where To Now?

- Click through to start exploring the rest of the 921 Undervalued Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives