- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A049180

Revenues Working Against Cellumed Co.,Ltd.'s (KOSDAQ:049180) Share Price

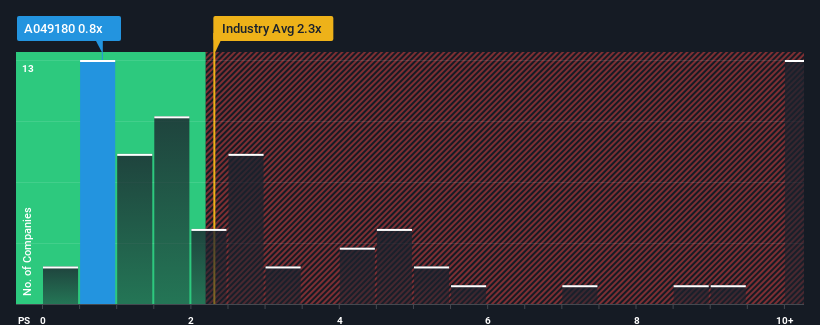

Cellumed Co.,Ltd.'s (KOSDAQ:049180) price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Medical Equipment industry in Korea, where around half of the companies have P/S ratios above 2.3x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for CellumedLtd

What Does CellumedLtd's Recent Performance Look Like?

CellumedLtd has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CellumedLtd will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For CellumedLtd?

The only time you'd be truly comfortable seeing a P/S as low as CellumedLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 38% shows it's noticeably less attractive.

In light of this, it's understandable that CellumedLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does CellumedLtd's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, CellumedLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware CellumedLtd is showing 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A049180

CellumedLtd

A biotechnology company, provides bone graft materials, medical devices, and cosmeceuticals in South Korea.

Flawless balance sheet slight.

Market Insights

Community Narratives