- South Korea

- /

- Banks

- /

- KOSE:A055550

3 KRX Dividend Stocks With Yields Up To 8.8%

Reviewed by Simply Wall St

The South Korean stock market has experienced fluctuations recently, with the KOSPI index hovering just above the 2,580-point mark amid mixed global forecasts and varying performances across major sectors. In such a volatile environment, dividend stocks can offer a degree of stability and income potential for investors seeking reliable returns.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 6.04% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.73% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.22% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.63% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.28% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.52% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.56% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.07% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.56% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.49% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of ₩6.82 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from its Non-Life Insurance Sector at ₩19.87 billion, followed by the Life Insurance Sector at ₩1.60 billion, and the Installment Finance Sector contributing ₩39.26 million.

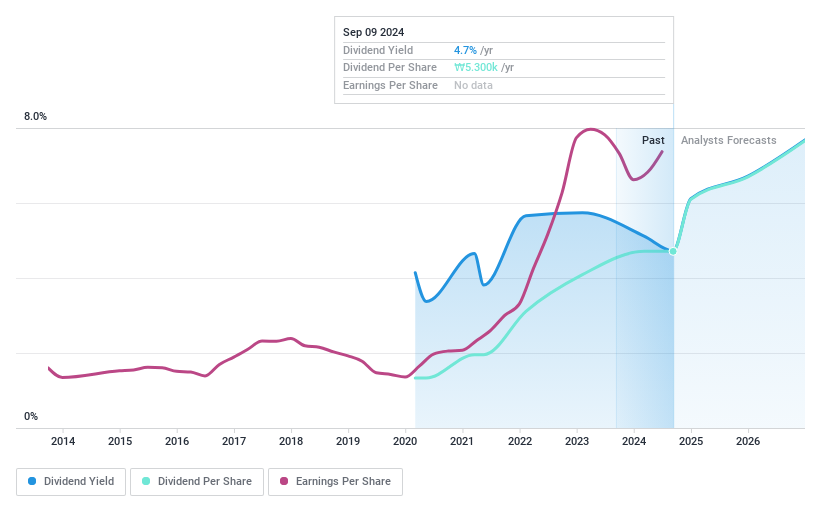

Dividend Yield: 4.7%

DB Insurance's dividend payments are well-supported by earnings and cash flows, with a low payout ratio of 16.4% and a cash payout ratio of 6.8%. Despite only paying dividends for five years, the yield is in the top 25% of Korean market payers at 4.67%. The stock trades at good value compared to peers, although its dividend track record is relatively short and considered unstable.

- Click here to discover the nuances of DB Insurance with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of DB Insurance shares in the market.

Muhak (KOSE:A033920)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Muhak Co., Ltd. manufactures and sells liquors in South Korea and has a market cap of ₩155.48 billion.

Operations: The company's revenue is primarily derived from its Liquor Division, which accounts for ₩146.33 billion, while the Other Business Division contributes ₩2.94 billion.

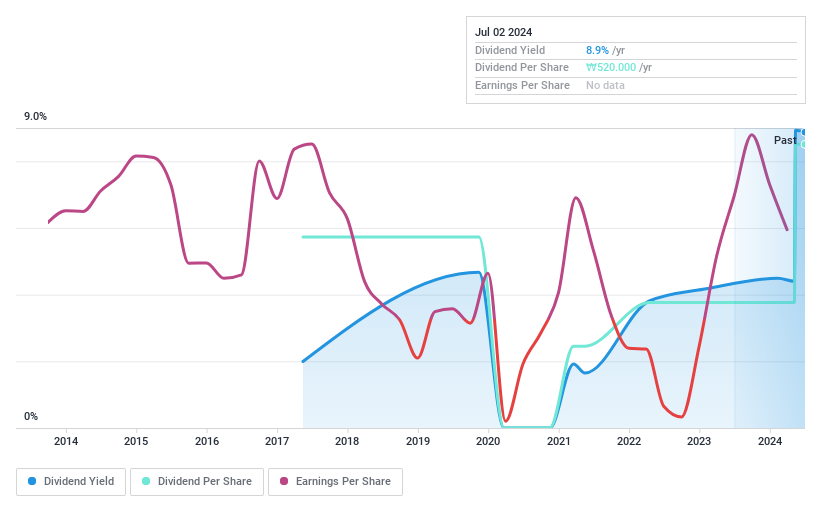

Dividend Yield: 8.9%

Muhak's dividend yield of 8.86% ranks in the top 25% of Korean market payers, supported by a low payout ratio of 27.1%, though cash flow coverage is tighter at 81.4%. Despite recent earnings growth, dividends have been unstable over seven years with notable volatility and less than a decade-long track record. The stock trades significantly below estimated fair value, but investors should weigh its inconsistent dividend history against its attractive yield and valuation.

- Click to explore a detailed breakdown of our findings in Muhak's dividend report.

- According our valuation report, there's an indication that Muhak's share price might be on the cheaper side.

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shinhan Financial Group Co., Ltd. offers a range of financial products and services both in South Korea and internationally, with a market cap of ₩29.36 trillion.

Operations: Shinhan Financial Group Co., Ltd. generates revenue from several segments, including Banking at ₩8.95 trillion, Credit Card at ₩2.07 trillion, and Securities at ₩818.57 billion.

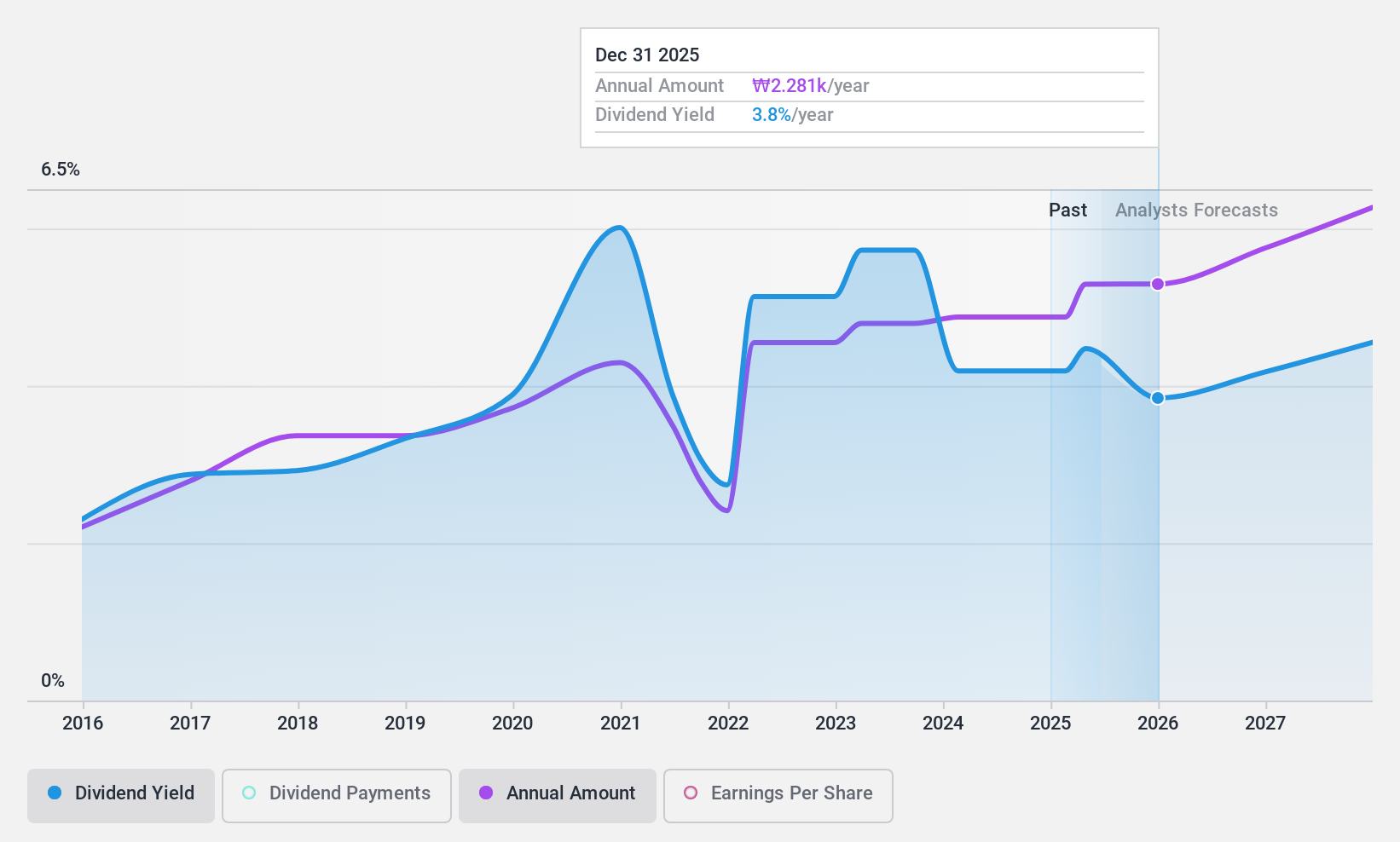

Dividend Yield: 3.6%

Shinhan Financial Group's dividend yield is slightly below the top 25% of Korean market payers, with a payout ratio of 37.9%, indicating dividends are well-covered by earnings. However, its dividend history has been volatile over the past decade, raising concerns about reliability. Recent announcements include a share buyback program worth ₩400 billion to enhance shareholder value, potentially supporting future dividend stability and growth prospects if executed effectively.

- Navigate through the intricacies of Shinhan Financial Group with our comprehensive dividend report here.

- Our valuation report here indicates Shinhan Financial Group may be undervalued.

Turning Ideas Into Actions

- Unlock more gems! Our Top KRX Dividend Stocks screener has unearthed 71 more companies for you to explore.Click here to unveil our expertly curated list of 74 Top KRX Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shinhan Financial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A055550

Shinhan Financial Group

Provides financial products and services in South Korea and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives