- South Korea

- /

- Food

- /

- KOSE:A007310

Can Ottogi Corporation (KRX:007310) Performance Keep Up Given Its Mixed Bag Of Fundamentals?

Ottogi's (KRX:007310) stock is up by 3.1% over the past month. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement Specifically, we decided to study Ottogi's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Ottogi

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ottogi is:

7.8% = ₩111b ÷ ₩1.4t (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.08 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Ottogi's Earnings Growth And 7.8% ROE

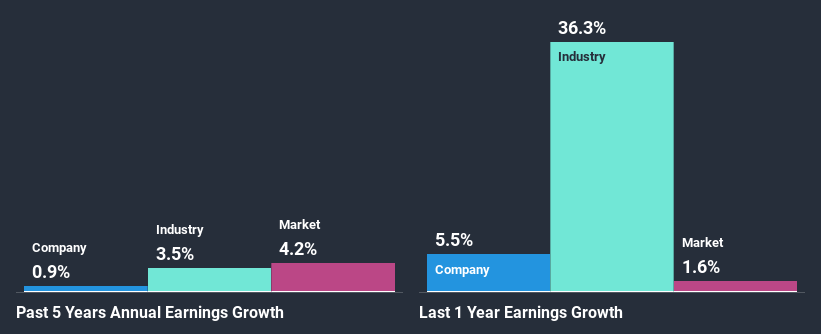

When you first look at it, Ottogi's ROE doesn't look that attractive. However, its ROE is similar to the industry average of 6.5%, so we won't completely dismiss the company. However, Ottogi has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is not particularly great to begin with. Hence, this provides some context to the flat earnings growth seen by the company.

Next, on comparing with the industry net income growth, we found that Ottogi's reported growth was lower than the industry growth of 3.5% in the same period, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Ottogi is trading on a high P/E or a low P/E, relative to its industry.

Is Ottogi Making Efficient Use Of Its Profits?

Ottogi's low three-year median payout ratio of 20% (implying that the company keeps80% of its income) should mean that the company is retaining most of its earnings to fuel its growth and this should be reflected in its growth number, but that's not the case.

Moreover, Ottogi has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 20%. Regardless, the future ROE for Ottogi is predicted to rise to 9.5% despite there being not much change expected in its payout ratio.

Summary

In total, we're a bit ambivalent about Ottogi's performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Ottogi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A007310

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026