In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to fluctuations across key indices, with small-cap stocks feeling the impact of broader economic sentiment and policy shifts. As investors navigate these turbulent waters, identifying stocks with strong fundamentals becomes crucial; such companies often demonstrate resilience through sound financial health and strategic positioning in their respective markets.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Dongwon Industries (KOSE:A006040)

Simply Wall St Value Rating: ★★★★★☆

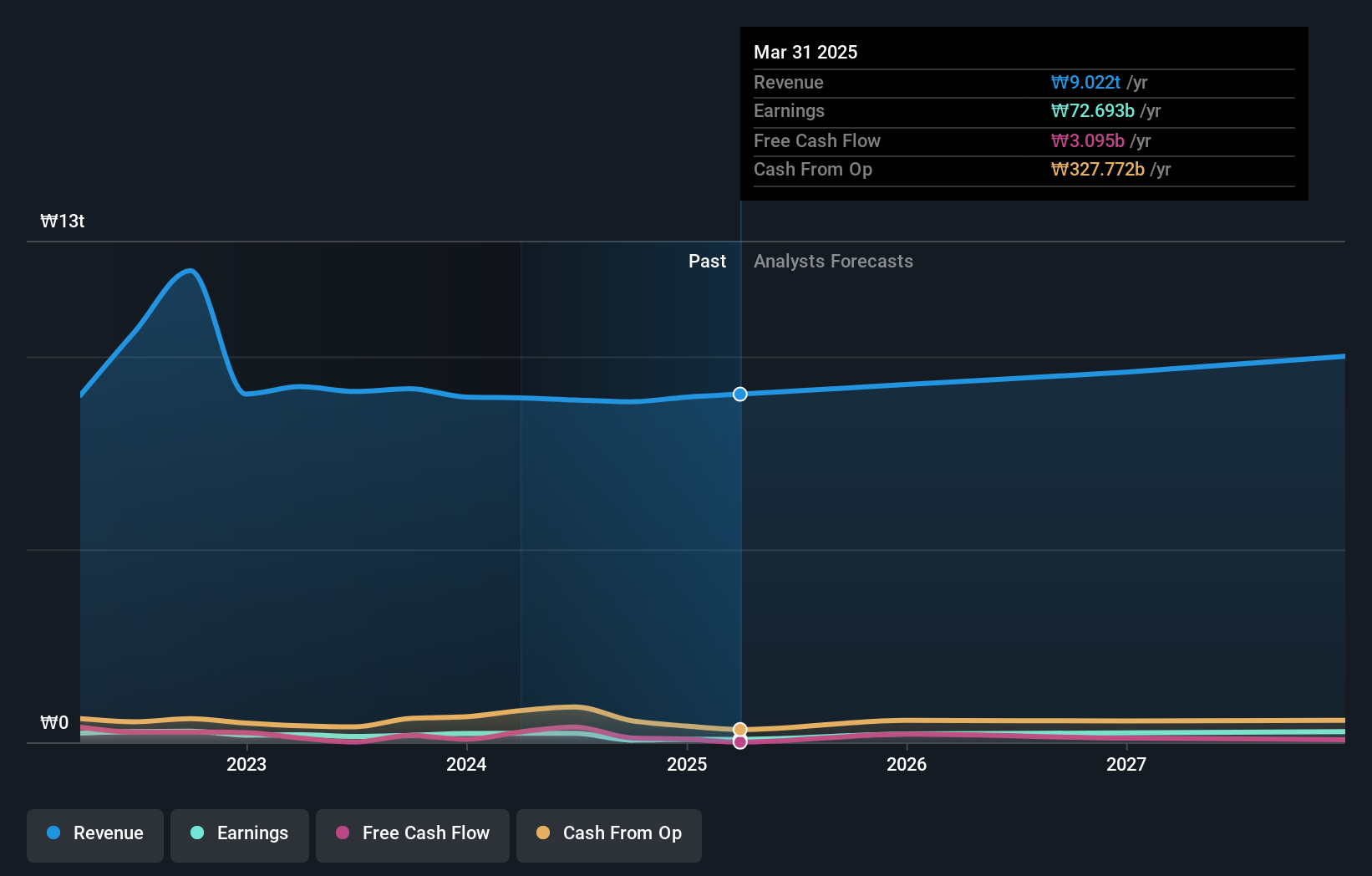

Overview: Dongwon Industries Co., Ltd. operates in the marine and fisheries, distribution, and logistics sectors both in South Korea and internationally, with a market capitalization of ₩1.20 trillion.

Operations: Dongwon Industries generates significant revenue from its Food Processing and Distribution Sector, amounting to ₩6.49 billion, followed by the Logistics Business at ₩1.41 billion. The company's net profit margin reflects its financial efficiency across these sectors.

Dongwon Industries, a notable player in the food sector, has demonstrated impressive earnings growth of 51.7% over the past year, outpacing the industry's 18.6%. This performance is bolstered by its strategic debt management, with a reduction in its debt to equity ratio from 119.5% to 75.8% over five years. Despite a high net debt to equity ratio of 52.9%, interest payments are well covered by EBIT at a multiple of 5.1x, indicating strong financial health. Recently added to the S&P Global BMI Index, Dongwon trades at an attractive valuation—22.6% below estimated fair value—suggesting potential for investors seeking undervalued opportunities in dynamic markets.

- Unlock comprehensive insights into our analysis of Dongwon Industries stock in this health report.

Examine Dongwon Industries' past performance report to understand how it has performed in the past.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

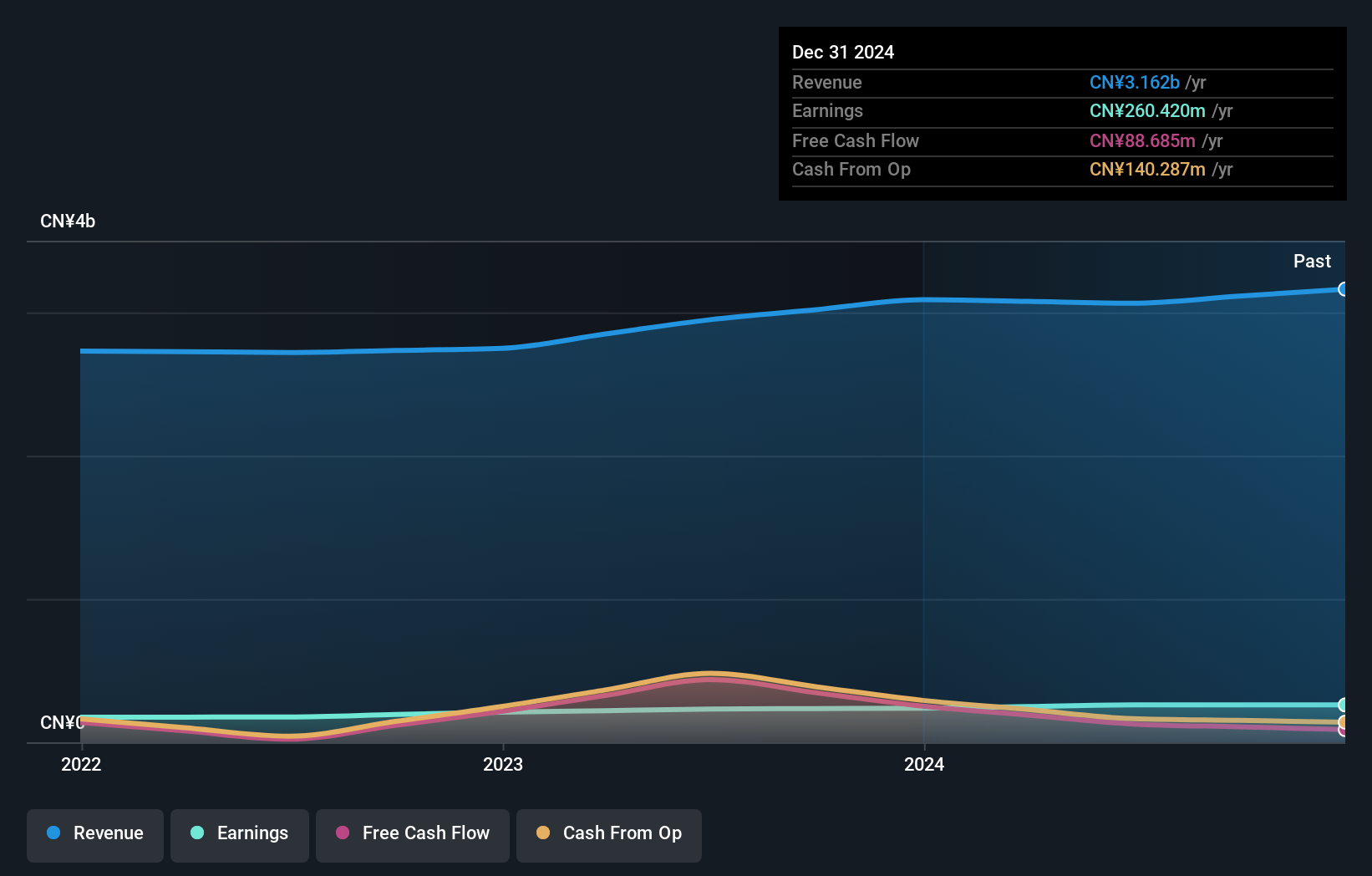

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of HK$2.89 billion.

Operations: IVD Medical Holding generates revenue primarily from its distribution business, which accounts for CN¥2.86 billion, followed by after-sales services at CN¥196.47 million. The self-branded products business contributes a smaller portion of CN¥9.05 million to the total revenue stream.

IVD Medical Holding, a small player in the healthcare sector, showcases robust financial health with earnings growth of 12.3% last year, outpacing the industry average. The company reported net income of CNY 125.29 million for the first half of 2024, up from CNY 103.01 million previously, while basic earnings per share improved to CNY 0.0927 from CNY 0.0762. Despite a debt-to-equity ratio increase to 23.3% over five years, it holds more cash than total debt and maintains a favorable price-to-earnings ratio at 10.3x compared to the industry average of 13.1x, suggesting potential value for investors even amid recent auditor changes and share price volatility.

- Delve into the full analysis health report here for a deeper understanding of IVD Medical Holding.

Explore historical data to track IVD Medical Holding's performance over time in our Past section.

Formosa Oilseed Processing (TWSE:1225)

Simply Wall St Value Rating: ★★★★☆☆

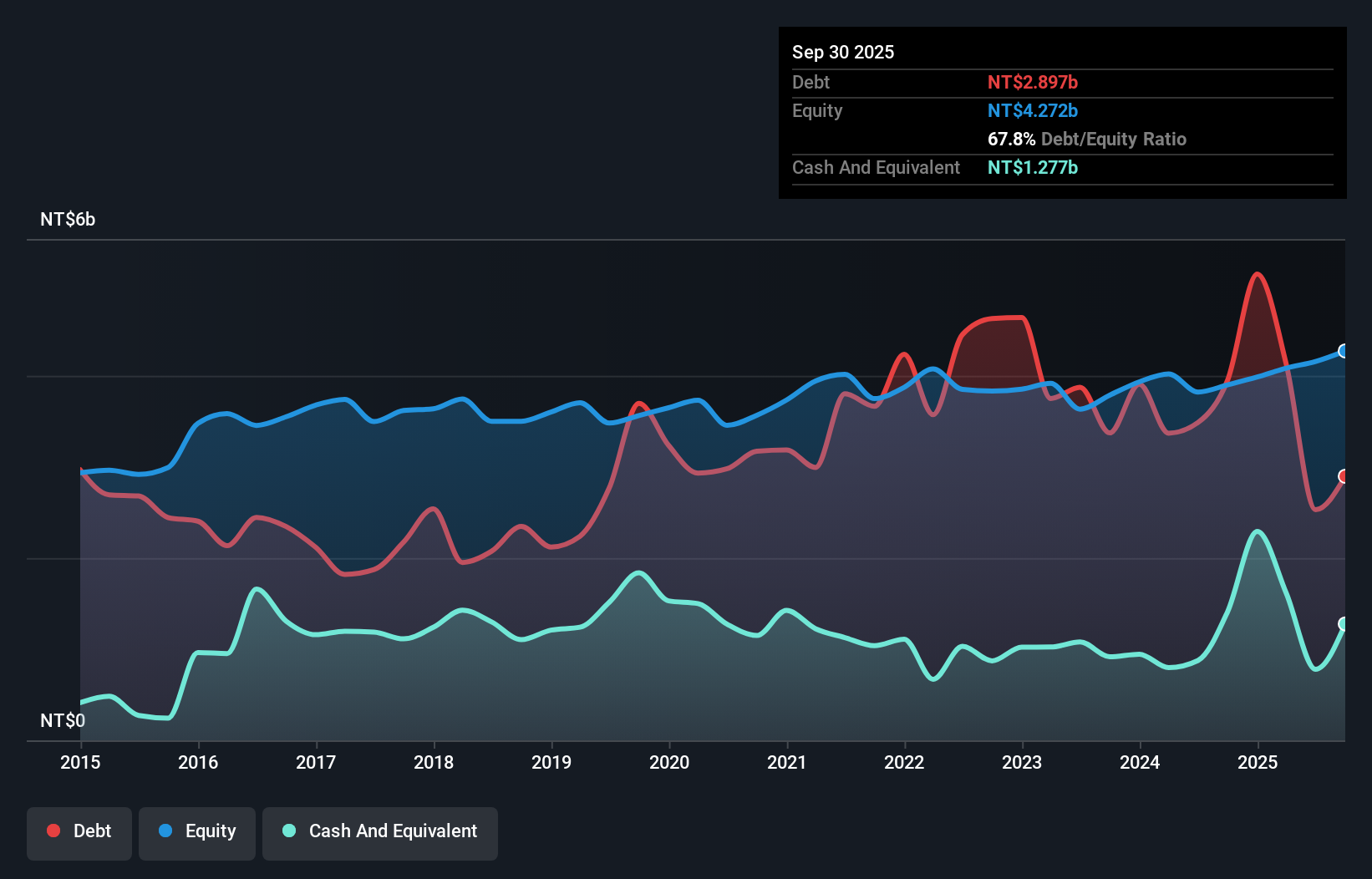

Overview: Formosa Oilseed Processing Co., Ltd. is a Taiwanese company engaged in the production and sale of oil and feed products, with a market capitalization of NT$19.17 billion.

Operations: Formosa Oilseed Processing generates revenue primarily from its oil and feed product sales. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and market conditions.

Formosa Oilseed Processing, a smaller player in the industry, has shown mixed results recently. Despite a 55.9% earnings growth over the past year, which outpaced the food industry's 14.3%, its third-quarter sales dropped to TWD 3.18 billion from TWD 3.65 billion last year, and net income fell to TWD 68.8 million from TWD 129.56 million. The company's net debt to equity ratio remains high at 65.1%, but interest payments are well covered with an EBIT coverage of 8 times interest repayments, indicating financial resilience despite recent volatility in share price and changes in leadership roles within the company’s board structure.

- Click here to discover the nuances of Formosa Oilseed Processing with our detailed analytical health report.

Learn about Formosa Oilseed Processing's historical performance.

Key Takeaways

- Unlock our comprehensive list of 4640 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Formosa Oilseed Processing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1225

Formosa Oilseed Processing

Produces and sells oil and feed products in Taiwan.

Proven track record with adequate balance sheet and pays a dividend.