- South Korea

- /

- Food

- /

- KOSE:A003230

3 Global Growth Companies With High Insider Ownership Expecting Up To 78% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performance and cautious optimism due to trade discussions and monetary policy decisions, investors are keeping a close watch on growth opportunities. In such an environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 52.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

Underneath we present a selection of stocks filtered out by our screen.

Rainbow RoboticsLtd (KOSDAQ:A277810)

Simply Wall St Growth Rating: ★★★★★★

Overview: Rainbow Robotics Co., Ltd. is a professional technological mechatronics company specializing in robotic system engineering technology, with a market cap of ₩5.42 trillion.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating ₩19.35 billion.

Insider Ownership: 23.6%

Revenue Growth Forecast: 78.8% p.a.

Rainbow Robotics Ltd. has recently turned profitable, reporting a net income of KRW 2.14 billion for 2024, up from a loss the previous year. Samsung Electronics' acquisition of a 20.29% stake positions it as the largest shareholder, potentially influencing growth strategies. The company's earnings and revenue are forecast to grow significantly faster than the market average over the next three years, with high anticipated returns on equity despite no recent insider trading activity reported.

- Click here to discover the nuances of Rainbow RoboticsLtd with our detailed analytical future growth report.

- Our valuation report here indicates Rainbow RoboticsLtd may be overvalued.

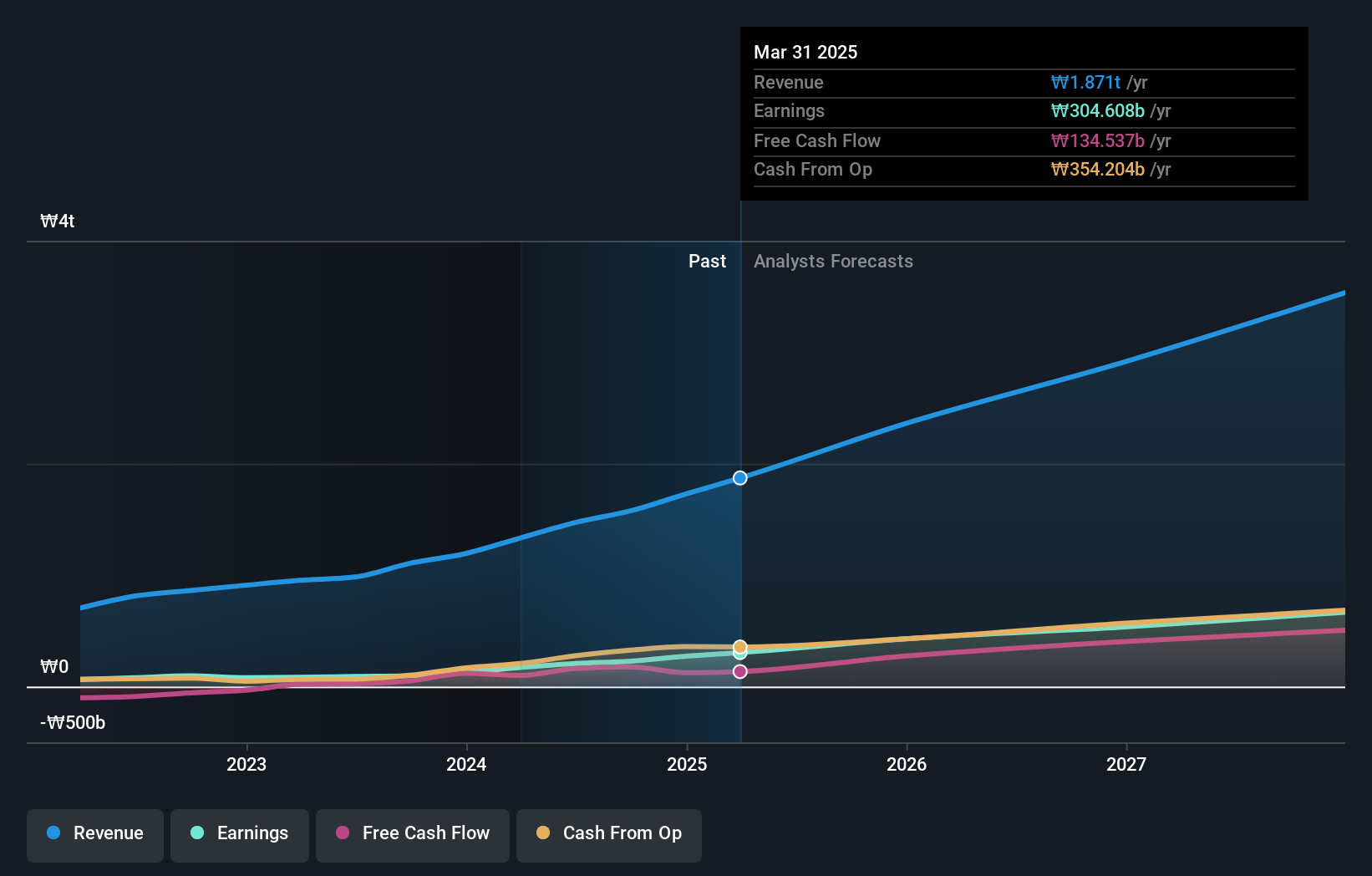

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both domestically in South Korea and internationally, with a market capitalization of ₩7.09 trillion.

Operations: Samyang Foods generates revenue through its operations in the food sector, serving both domestic and international markets.

Insider Ownership: 11.6%

Revenue Growth Forecast: 19.1% p.a.

Samyang Foods is poised for robust growth, with revenue expected to rise 19.1% annually, outpacing the Korean market's 7.4%. Its earnings are projected to grow significantly at 21.1% per year, surpassing the market average. The stock trades at a substantial discount of 36.2% below its estimated fair value, indicating potential undervaluation. Despite no recent insider trading activity, strong insider ownership aligns management interests with shareholders and supports long-term growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Samyang Foods.

- Our expertly prepared valuation report Samyang Foods implies its share price may be too high.

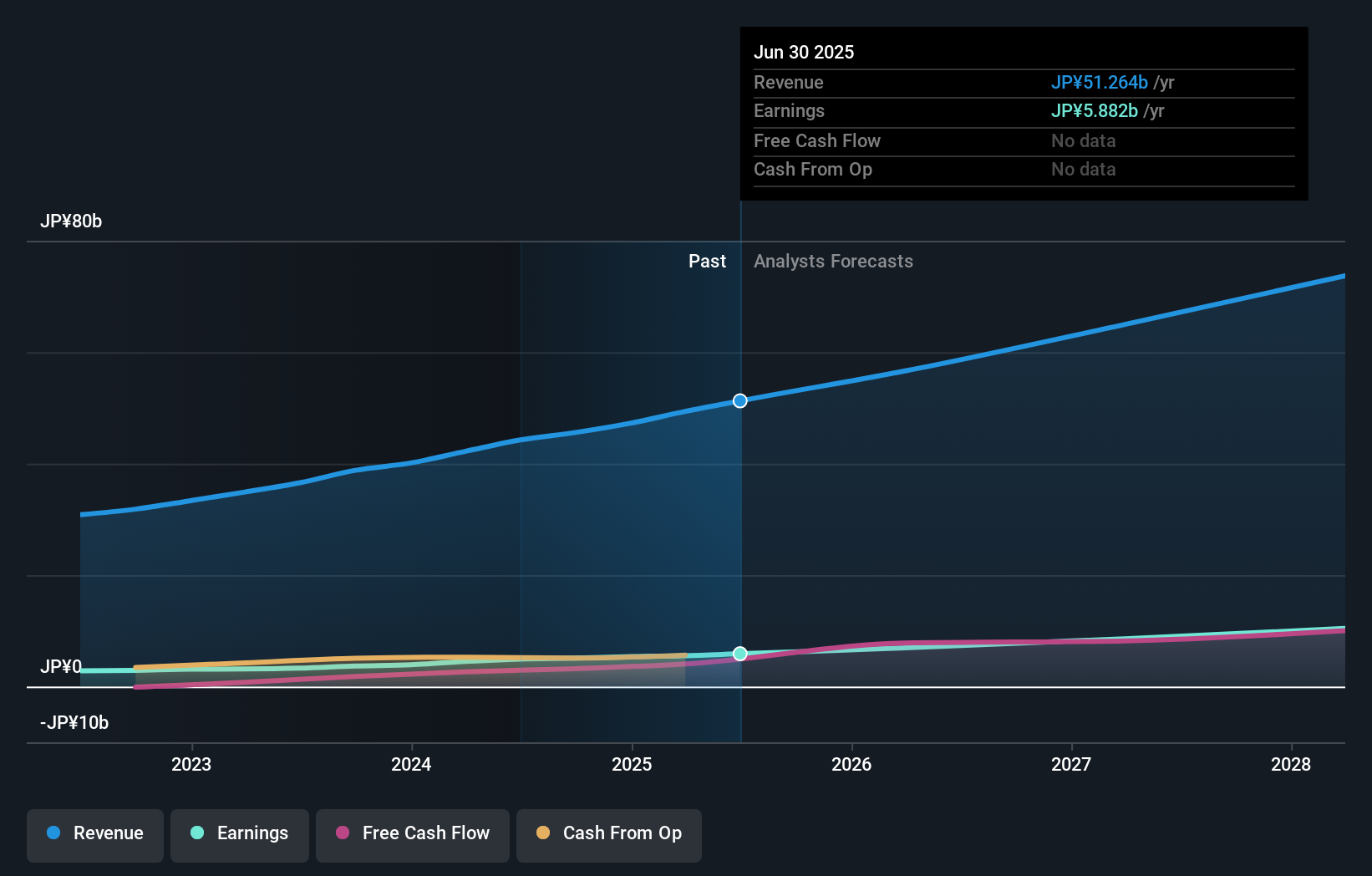

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in the repair, maintenance, and modernization of elevators and escalators in Japan, with a market cap of ¥289.88 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue primarily from its services related to the repair, maintenance, and modernization of elevators and escalators in Japan.

Insider Ownership: 21.3%

Revenue Growth Forecast: 10.9% p.a.

Japan Elevator Service Holdings is positioned for growth, with earnings projected to increase 18.5% annually, outpacing the Japanese market's 7.5%. While revenue growth is expected at 10.9% per year, it remains below significant levels but still surpasses the market average. The company's high forecasted Return on Equity of 34.3% in three years suggests efficient management practices. Recent discussions on dividend increases highlight potential shareholder value enhancement despite no recent insider trading activity noted.

- Navigate through the intricacies of Japan Elevator Service HoldingsLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Japan Elevator Service HoldingsLtd's shares may be trading at a premium.

Seize The Opportunity

- Click this link to deep-dive into the 832 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003230

Samyang Foods

Engages in the food business in South Korea and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives