In the midst of global market fluctuations driven by policy uncertainties and economic shifts, many investors are turning their attention to dividend stocks as a potential source of steady income. With interest rates showing little sign of rapid decline and inflationary pressures persisting, selecting stocks that offer consistent dividends can be a strategic way to navigate these challenging conditions while potentially benefiting from long-term growth opportunities.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.84% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ORION Holdings Corp. is engaged in the manufacturing and sale of confectioneries across South Korea, China, and international markets, with a market cap of approximately ₩961.90 billion.

Operations: ORION Holdings Corp.'s revenue primarily comes from its Confectionery segment, generating ₩3.72 trillion, with additional contributions from its Video segment at ₩107.12 million and Landlord segment at ₩38.70 million.

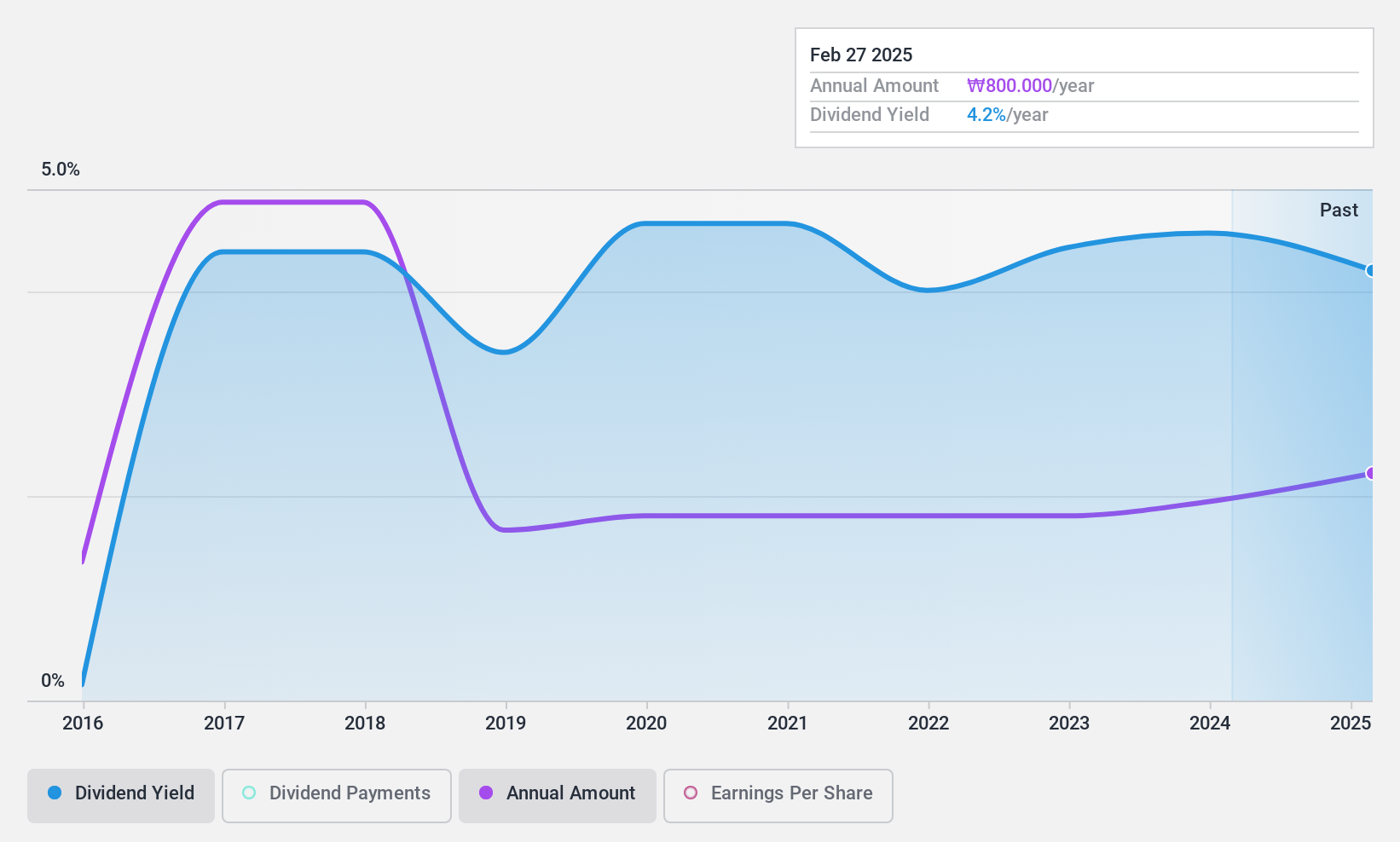

Dividend Yield: 4.6%

ORION Holdings offers a dividend yield of 4.58%, placing it in the top 25% of dividend payers in the KR market. Its dividends are well-covered by both earnings and cash flows, with a payout ratio of 41.2% and a cash payout ratio of 10.7%. However, its dividend history is marked by volatility, with payments dropping over 20% annually at times, indicating an unstable track record despite consistent growth in earnings over the past five years.

- Click here to discover the nuances of ORION Holdings with our detailed analytical dividend report.

- The analysis detailed in our ORION Holdings valuation report hints at an inflated share price compared to its estimated value.

Ryoyu Systems (TSE:4685)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ryoyu Systems Co., Ltd. offers IT solutions across multiple industries in Japan, with a market cap of ¥28.36 billion.

Operations: Ryoyu Systems Co., Ltd. generates revenue primarily from its Information Service segment, amounting to ¥38.43 billion.

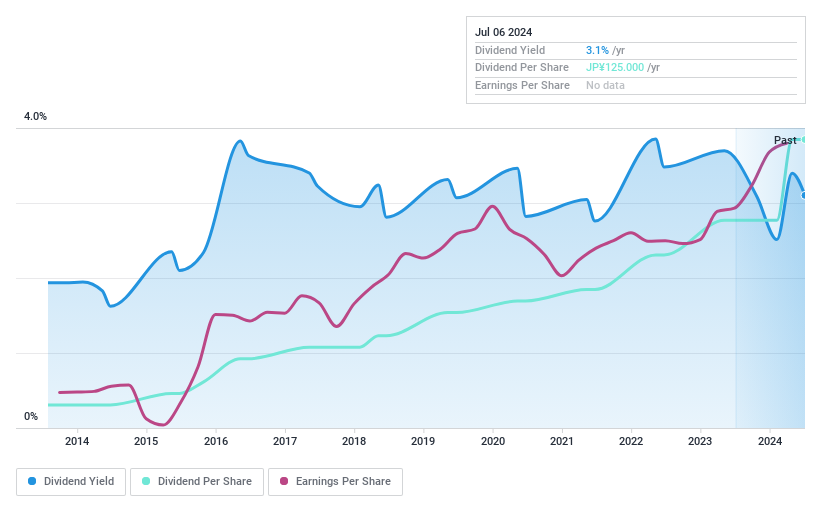

Dividend Yield: 3%

Ryoyu Systems' dividend yield of 3.01% is below the top 25% in the JP market, but its dividends are well-covered by earnings and cash flows, with payout ratios of 31.2% and 43.7%, respectively. Although dividend payments have increased over the past decade, they remain volatile with an unstable track record due to significant annual drops exceeding 20%. Earnings grew by ¥38.9 million last year, reflecting some positive financial momentum despite these challenges.

- Take a closer look at Ryoyu Systems' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Ryoyu Systems is trading behind its estimated value.

Central Automotive Products (TSE:8117)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Automotive Products Ltd. is involved in the import, export, and wholesale of automotive parts and accessories, with a market cap of ¥87.94 billion.

Operations: Central Automotive Products Ltd. generates revenue through its Automobile Disposal Business, which accounts for ¥7.93 billion, and its Automotive Parts and Accessories Sales Business, contributing ¥31.47 billion.

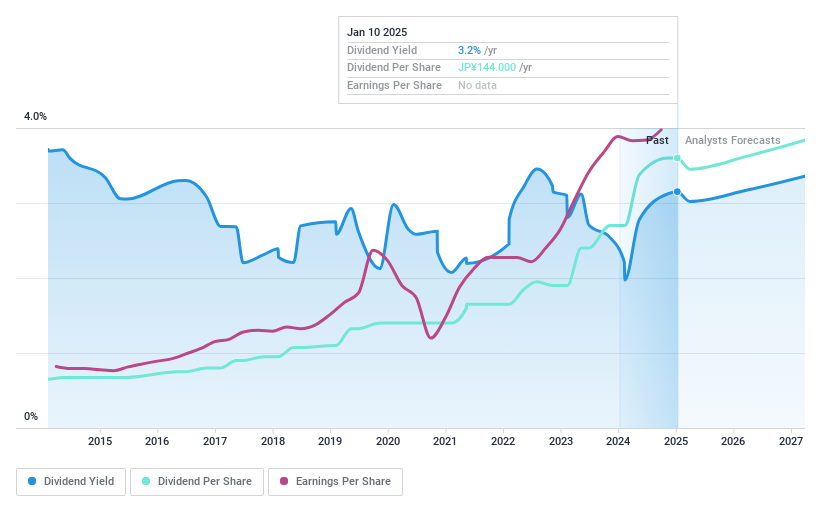

Dividend Yield: 3.1%

Central Automotive Products offers a stable dividend yield of 3.06%, which is lower than the top quartile in Japan but reliably covered by earnings and cash flows, with payout ratios of 30.1% and 43%, respectively. Over the past decade, dividends have shown consistent growth without volatility. Recently added to the S&P Global BMI Index, this inclusion may enhance its visibility among investors seeking steady income streams from well-managed dividend policies.

- Get an in-depth perspective on Central Automotive Products' performance by reading our dividend report here.

- According our valuation report, there's an indication that Central Automotive Products' share price might be on the cheaper side.

Taking Advantage

- Click through to start exploring the rest of the 1977 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4685

Ryoyu Systems

Provides information technology (IT) solutions for various industries in Japan.

Flawless balance sheet with solid track record and pays a dividend.