- South Korea

- /

- Food

- /

- KOSDAQ:A311390

The three-year loss for Neo Cremar (KOSDAQ:311390) shareholders likely driven by its shrinking earnings

Neo Cremar Co., Ltd. (KOSDAQ:311390) shareholders will doubtless be very grateful to see the share price up 44% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 68% in that time. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

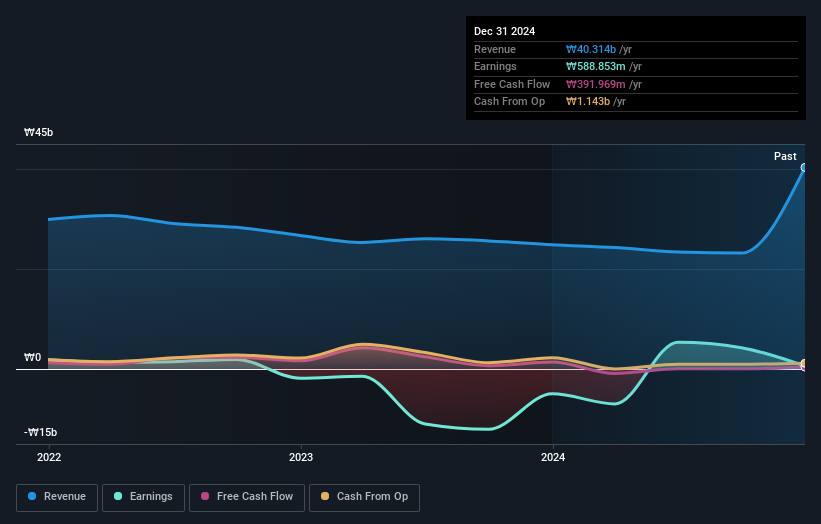

While Neo Cremar made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years Neo Cremar saw its revenue shrink by 1.1% per year. That's not what investors generally want to see. The share price decline of 19% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Neo Cremar's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Neo Cremar shareholders have received a total shareholder return of 19% over one year. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Neo Cremar that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Neo Cremar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A311390

Neo Cremar

Neo Cremar Co.,Ltd produces and sells functional food ingredients and additives in South Korea and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives