- South Korea

- /

- Food

- /

- KOSDAQ:A066360

Would Shareholders Who Purchased CherrybroLtd's (KOSDAQ:066360) Stock Three Years Be Happy With The Share price Today?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Cherrybro co.,Ltd (KOSDAQ:066360) shareholders, since the share price is down 30% in the last three years, falling well short of the market return of around 24%. There was little comfort for shareholders in the last week as the price declined a further 1.9%.

See our latest analysis for CherrybroLtd

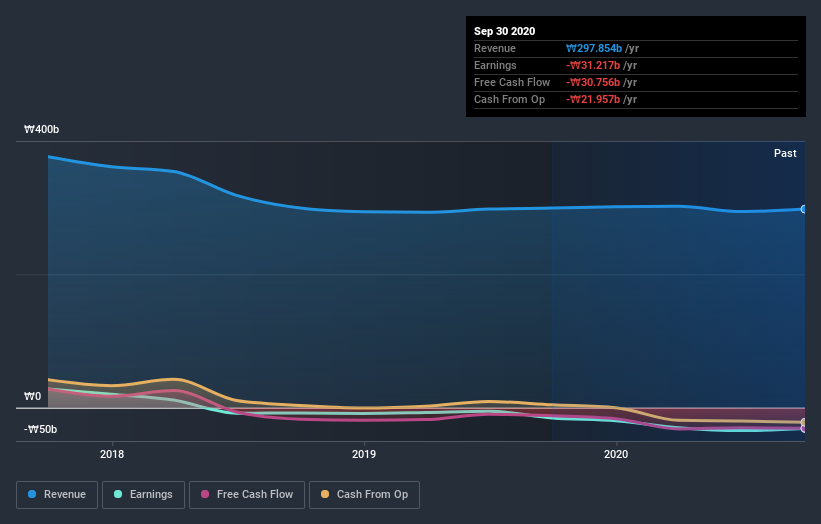

Given that CherrybroLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years CherrybroLtd saw its revenue shrink by 7.4% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 9%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling CherrybroLtd stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered CherrybroLtd's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that CherrybroLtd's TSR, which was a 26% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

The last twelve months weren't great for CherrybroLtd shares, which cost holders 16%, while the market was up about 32%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand CherrybroLtd better, we need to consider many other factors. For instance, we've identified 3 warning signs for CherrybroLtd (2 don't sit too well with us) that you should be aware of.

We will like CherrybroLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade CherrybroLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A066360

CherrybroLtd

Engages in the production and sales of chicken products in South Korea.

Good value slight.