- South Korea

- /

- Oil and Gas

- /

- KOSDAQ:A024060

Investors Interested In Hung -Gu Oil Ltd's (KOSDAQ:024060) Revenues

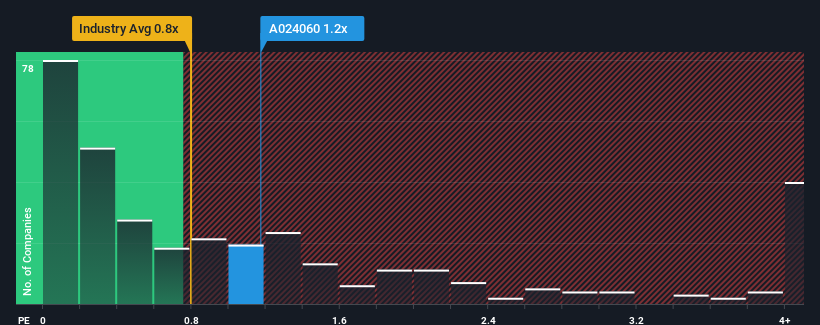

When you see that almost half of the companies in the Oil and Gas industry in Korea have price-to-sales ratios (or "P/S") below 0.3x, Hung -Gu Oil Ltd (KOSDAQ:024060) looks to be giving off some sell signals with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hung -Gu Oil

What Does Hung -Gu Oil's P/S Mean For Shareholders?

For instance, Hung -Gu Oil's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hung -Gu Oil will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Hung -Gu Oil?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hung -Gu Oil's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 0.3% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Hung -Gu Oil's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Hung -Gu Oil can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 4 warning signs for Hung -Gu Oil (2 are potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hung -Gu Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A024060

Hung -Gu Oil

Hung -Gu Oil Ltd wholesales and retails petroleum products in South Korea.

Mediocre balance sheet very low.

Market Insights

Community Narratives