- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A277070

With EPS Growth And More, Lindeman Asia Investment (KOSDAQ:277070) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Lindeman Asia Investment (KOSDAQ:277070). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Lindeman Asia Investment

How Fast Is Lindeman Asia Investment Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that Lindeman Asia Investment's EPS have grown from ₩298 to ₩341 over twelve months. I doubt many would complain about that 15% gain.

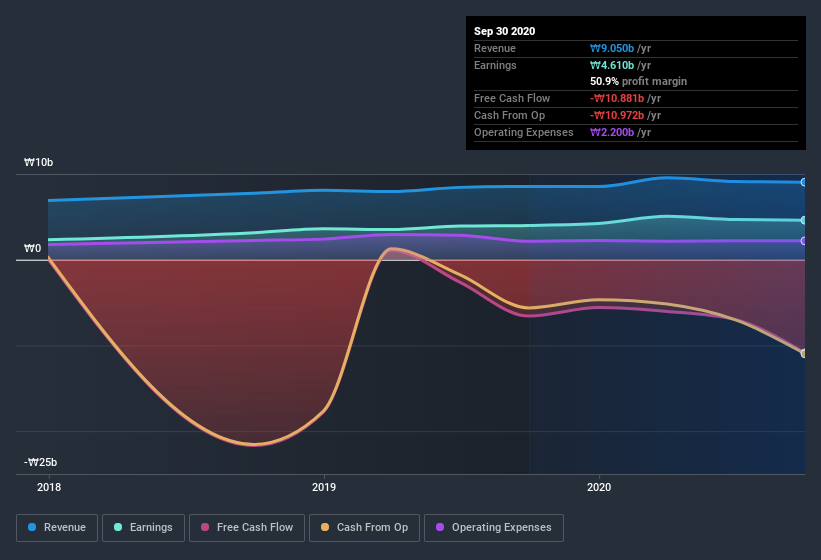

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Lindeman Asia Investment's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Lindeman Asia Investment's EBIT margins were flat over the last year, revenue grew by a solid 6.0% to ₩9.0b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Lindeman Asia Investment is no giant, with a market capitalization of ₩75b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Lindeman Asia Investment Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Lindeman Asia Investment insiders own a meaningful share of the business. Indeed, with a collective holding of 74%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₩55b invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Lindeman Asia Investment Deserve A Spot On Your Watchlist?

One important encouraging feature of Lindeman Asia Investment is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Lindeman Asia Investment you should be aware of, and 1 of them is a bit concerning.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Lindeman Asia Investment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Lindeman Asia Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A277070

Lindeman Asia Investment

Lindeman Asia Investment Co., Ltd. is a venture capital and private equity firm specializing in small and medium sized venture companies, equity, mezzanine, 1st, 2nd and 3rd round, mature stage and growth stage, growth capital investments.

Adequate balance sheet slight.