- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A241520

Subdued Growth No Barrier To DSC Investment Inc. (KOSDAQ:241520) With Shares Advancing 27%

Those holding DSC Investment Inc. (KOSDAQ:241520) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 176% following the latest surge, making investors sit up and take notice.

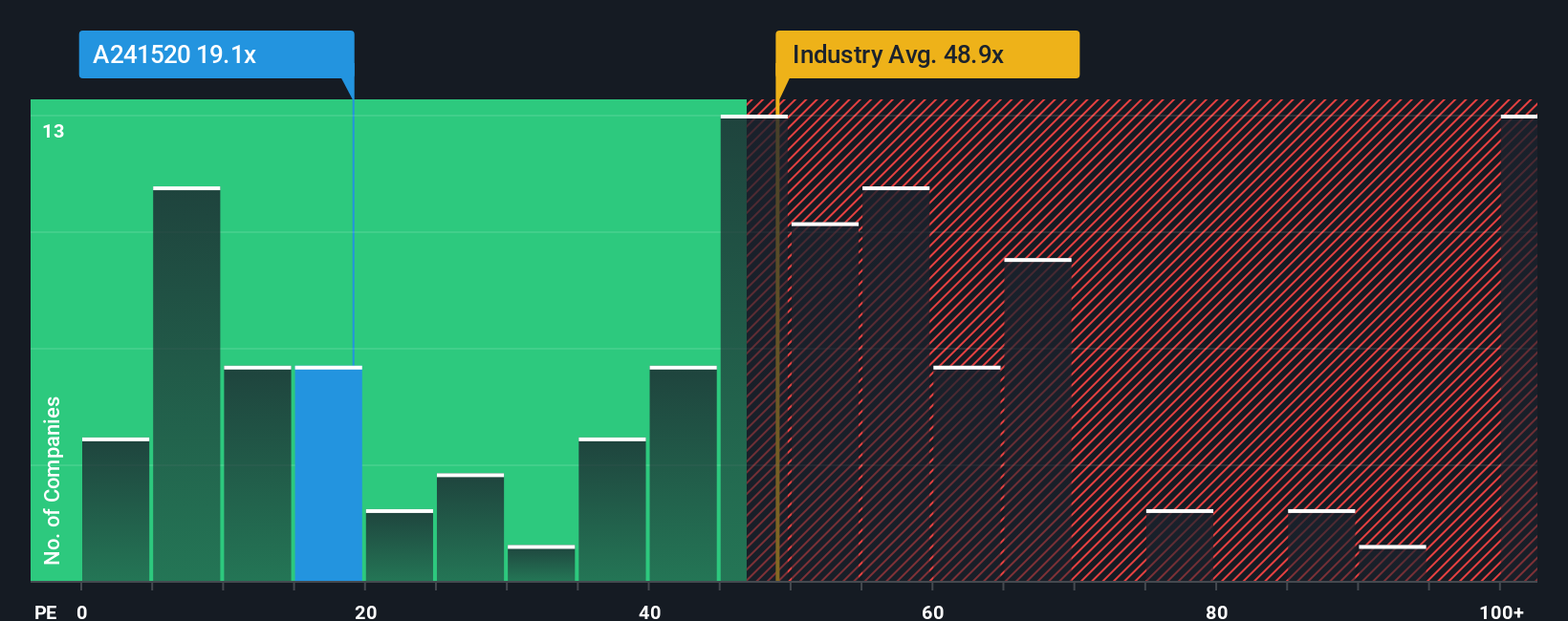

Since its price has surged higher, given around half the companies in Korea have price-to-earnings ratios (or "P/E's") below 15x, you may consider DSC Investment as a stock to potentially avoid with its 19.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

As an illustration, earnings have deteriorated at DSC Investment over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for DSC Investment

How Is DSC Investment's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as DSC Investment's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. The last three years don't look nice either as the company has shrunk EPS by 57% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's an unpleasant look.

With this information, we find it concerning that DSC Investment is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

DSC Investment shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that DSC Investment currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for DSC Investment you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A241520

DSC Investment

A venture capital firm specializing in early stage, startups, growth capital, mezzanine and secondary direct.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives