- South Korea

- /

- Luxury

- /

- KOSE:A009970

Youngone Holdings Co., Ltd.'s (KRX:009970) Share Price Boosted 25% But Its Business Prospects Need A Lift Too

Youngone Holdings Co., Ltd. (KRX:009970) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 40% in the last year.

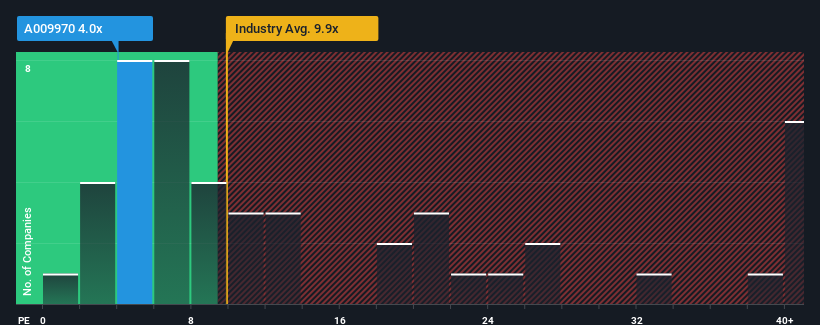

Although its price has surged higher, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Youngone Holdings as a highly attractive investment with its 4x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, Youngone Holdings' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Youngone Holdings

Is There Any Growth For Youngone Holdings?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Youngone Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. Even so, admirably EPS has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Youngone Holdings is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Youngone Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Youngone Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Youngone Holdings with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Youngone Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009970

Youngone Holdings

Manufactures and sells apparel, footwear, gear, sportswear, and jackets in South Korea and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives