- South Korea

- /

- Consumer Durables

- /

- KOSE:A009140

Some Shareholders Feeling Restless Over Kyungin Electronics Co., Ltd's (KRX:009140) P/E Ratio

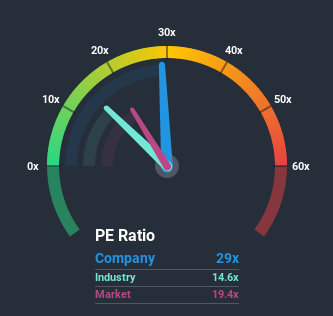

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 19x, you may consider Kyungin Electronics Co., Ltd (KRX:009140) as a stock to potentially avoid with its 29x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for Kyungin Electronics as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Kyungin Electronics

Does Growth Match The High P/E?

In order to justify its P/E ratio, Kyungin Electronics would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 449% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 43% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Kyungin Electronics' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kyungin Electronics currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Kyungin Electronics (2 are potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Kyungin Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Kyungin Electronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kyungin Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A009140

Kyungin Electronics

Manufactures and sells electronic components in South Korea.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives