- South Korea

- /

- Luxury

- /

- KOSE:A007980

There May Be Reason For Hope In Pan-Pacific's (KRX:007980) Disappointing Earnings

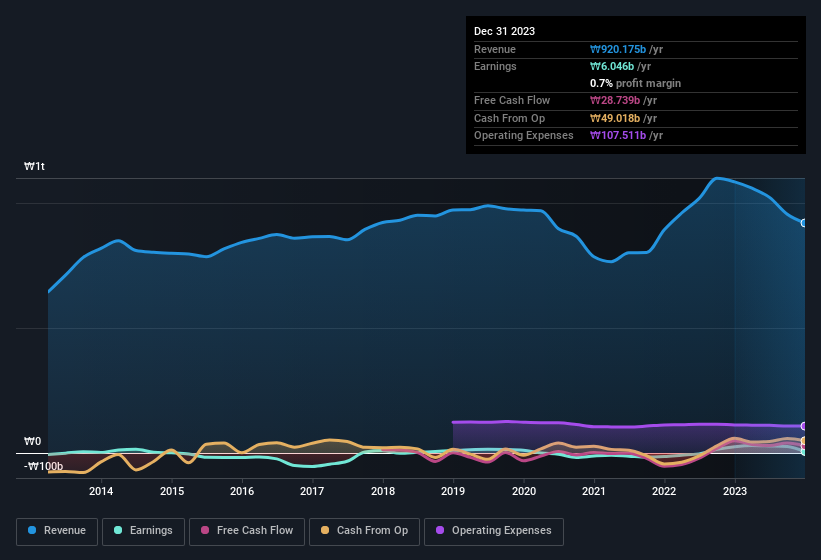

The market for Pan-Pacific Co., Ltd.'s (KRX:007980) shares didn't move much after it posted weak earnings recently. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

Check out our latest analysis for Pan-Pacific

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Pan-Pacific increased the number of shares on issue by 5.8% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Pan-Pacific's historical EPS growth by clicking on this link.

A Look At The Impact Of Pan-Pacific's Dilution On Its Earnings Per Share (EPS)

Pan-Pacific was losing money three years ago. Even looking at the last year, profit was still down 76%. Sadly, earnings per share fell further, down a full 76% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Pan-Pacific's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Pan-Pacific.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Pan-Pacific's profit suffered from unusual items, which reduced profit by ₩7.0b in the last twelve months. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Pan-Pacific to produce a higher profit next year, all else being equal.

Our Take On Pan-Pacific's Profit Performance

Pan-Pacific suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, it's hard to tell if Pan-Pacific's profits are a reasonable reflection of its underlying profitability. If you want to do dive deeper into Pan-Pacific, you'd also look into what risks it is currently facing. To help with this, we've discovered 6 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Pan-Pacific.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if TP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A007980

Solid track record and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026