- South Korea

- /

- Luxury

- /

- KOSE:A000050

Further Upside For Kyungbangco.Ltd (KRX:000050) Shares Could Introduce Price Risks After 57% Bounce

The Kyungbangco.Ltd (KRX:000050) share price has done very well over the last month, posting an excellent gain of 57%. The last 30 days bring the annual gain to a very sharp 75%.

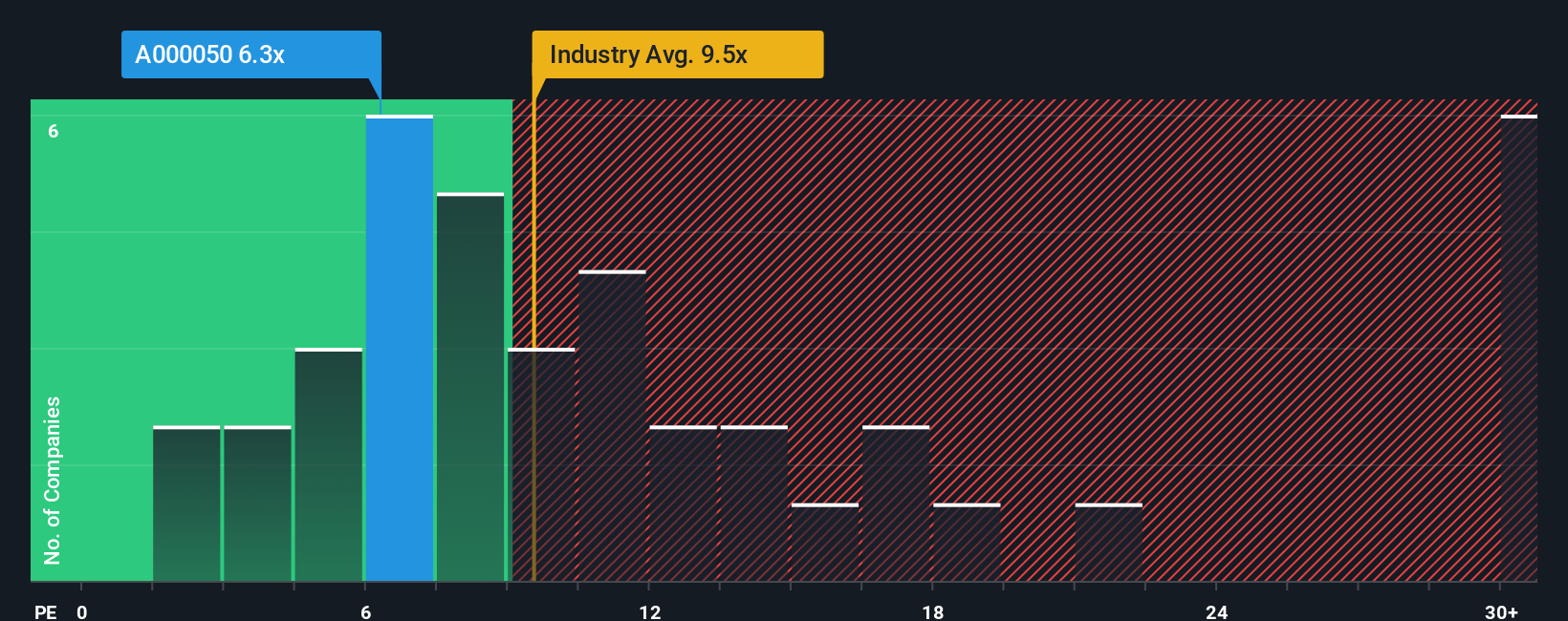

In spite of the firm bounce in price, Kyungbangco.Ltd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.3x, since almost half of all companies in Korea have P/E ratios greater than 14x and even P/E's higher than 30x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for Kyungbangco.Ltd as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Kyungbangco.Ltd

How Is Kyungbangco.Ltd's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Kyungbangco.Ltd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 473% last year. The strong recent performance means it was also able to grow EPS by 546% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Kyungbangco.Ltd is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Even after such a strong price move, Kyungbangco.Ltd's P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Kyungbangco.Ltd revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Kyungbangco.Ltd (at least 1 which is potentially serious), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Kyungbangco.Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyungbangco.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000050

Kyungbangco.Ltd

Engages in textile spinning and real estate development businesses in South Korea.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion