- Thailand

- /

- Healthcare Services

- /

- SET:BH

Asian Dividend Stocks Offering Yields From 3% To 4.5%

Reviewed by Simply Wall St

As Asian markets navigate a complex economic landscape marked by mixed performances in major indices and ongoing challenges such as China's manufacturing contraction, investors are increasingly seeking stability through dividend-yielding stocks. In this environment, a good stock is often characterized by its ability to provide consistent income streams, making dividend stocks with yields between 3% and 4.5% particularly appealing for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.66% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.44% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.82% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.39% | ★★★★★★ |

Click here to see the full list of 1046 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

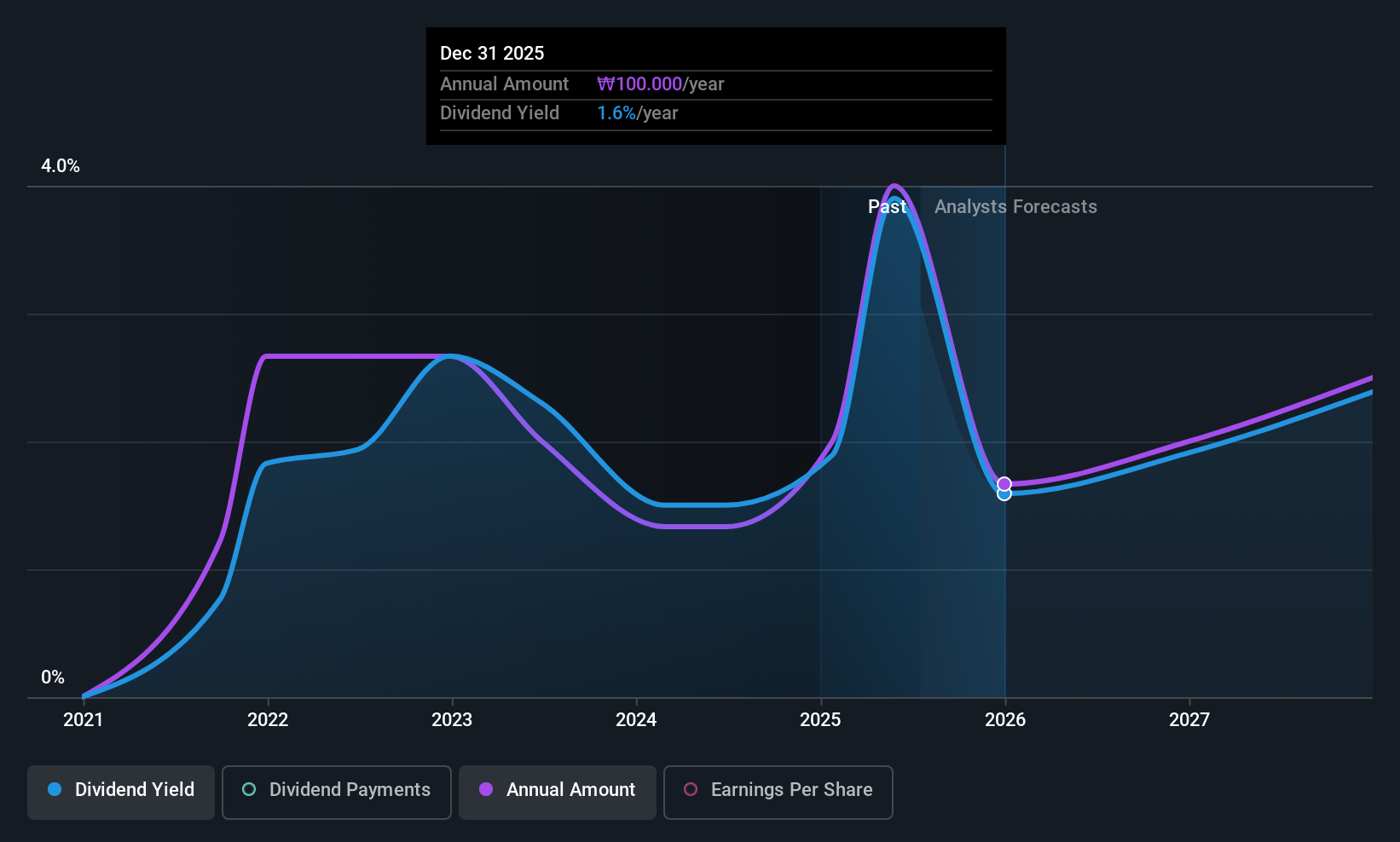

XEXYMIX (KOSDAQ:A337930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: XEXYMIX Corporation manufactures and sells athleisure clothing in South Korea, with a market cap of ₩158.18 billion.

Operations: XEXYMIX Corporation's revenue segments include Fashion at ₩281.76 billion and Advertising Agency at ₩10.86 million.

Dividend Yield: 4.5%

XEXYMIX's dividends are well covered by both earnings and cash flows, with a payout ratio of 70.2% and a cash payout ratio of 31%. Despite its top-tier dividend yield in the KR market, the company has only paid dividends for five years, with notable volatility in payments. While earnings are expected to grow significantly, the dividend track record remains unstable. The stock trades at 56.7% below estimated fair value, offering potential value despite its unreliable dividend history.

- Navigate through the intricacies of XEXYMIX with our comprehensive dividend report here.

- Our expertly prepared valuation report XEXYMIX implies its share price may be lower than expected.

China Foods (SEHK:506)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Foods Limited is an investment holding company that manufactures, distributes, markets, and sells Coca-Cola series products in the People’s Republic of China with a market cap of HK$12.50 billion.

Operations: The company's revenue primarily comes from the processing, bottling, and distribution of sparkling and still beverages, totaling CN¥22.43 billion.

Dividend Yield: 3.8%

China Foods' dividend yield is below the top quartile in Hong Kong, and its payment history has been volatile over the past decade. However, dividends are well covered by both earnings and cash flows, with a payout ratio of 49% and a cash payout ratio of 18.2%. The stock trades significantly below estimated fair value, suggesting potential undervaluation despite an unstable dividend track record. Recent board changes include Mr. SONG Liang's appointment to the ESG committee.

- Get an in-depth perspective on China Foods' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that China Foods is trading behind its estimated value.

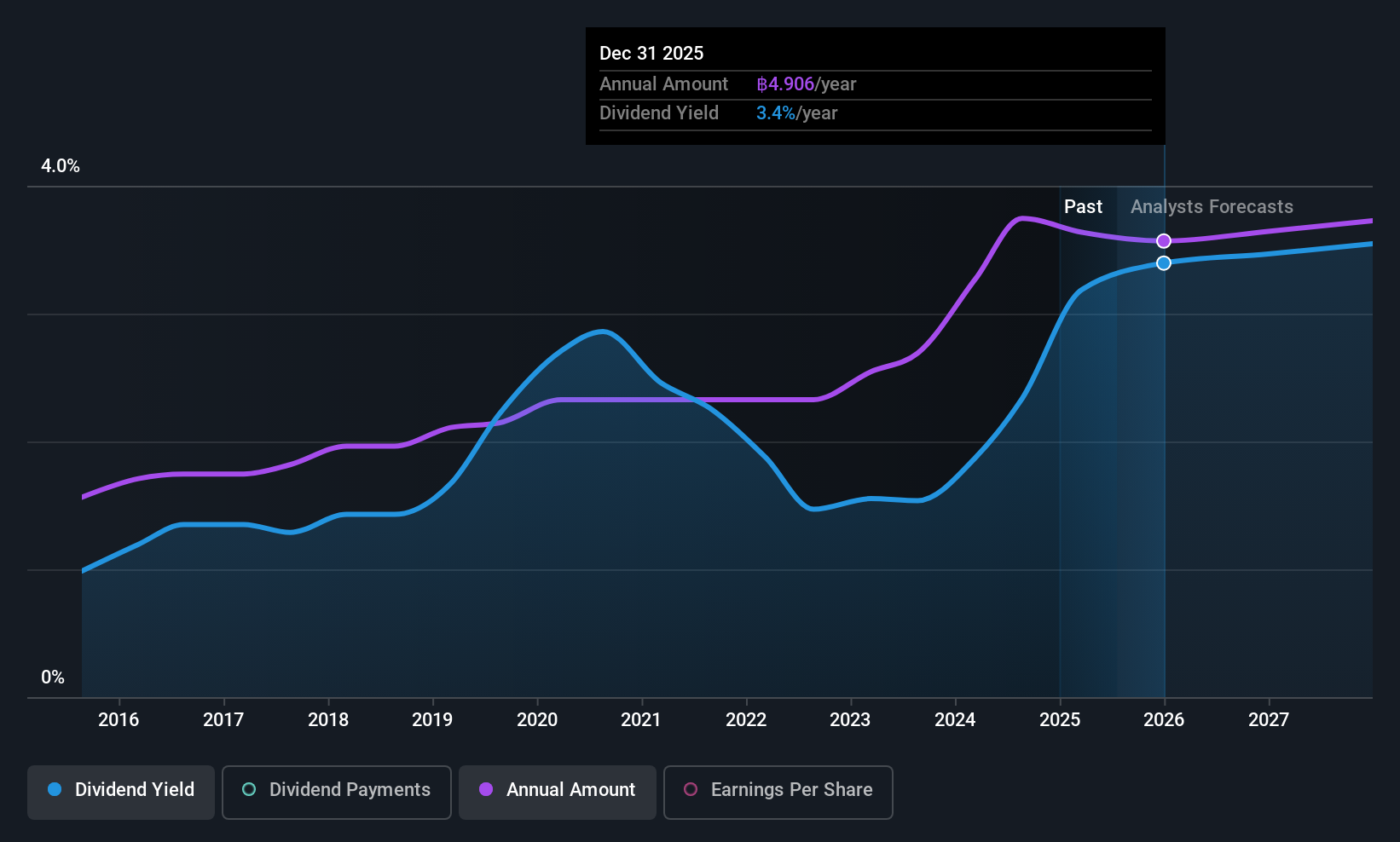

Bumrungrad Hospital (SET:BH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumrungrad Hospital Public Company Limited owns and operates hospitals in Thailand and internationally, with a market cap of THB131.57 billion.

Operations: Bumrungrad Hospital Public Company Limited generates revenue primarily from its Hospital and Health Care Center Business, amounting to THB25.41 billion.

Dividend Yield: 3%

Bumrungrad Hospital's dividends have shown stability and growth over the past decade, supported by a payout ratio of 52.8% and a cash payout ratio of 57%, indicating coverage by both earnings and cash flows. The dividend yield of 3.02% is modest compared to Thailand's top quartile, but the stock trades at a discount to its fair value. Recent earnings show steady performance with slight revenue increases, alongside board changes enhancing governance through Mr. Anon Vangvasu's appointment as an independent director.

- Dive into the specifics of Bumrungrad Hospital here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Bumrungrad Hospital is priced lower than what may be justified by its financials.

Next Steps

- Take a closer look at our Top Asian Dividend Stocks list of 1046 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bumrungrad Hospital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BH

Bumrungrad Hospital

Owns and operates hospitals in Thailand and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion