- South Korea

- /

- Luxury

- /

- KOSDAQ:A306040

Could The SJ Group Co., Ltd. (KOSDAQ:306040) Ownership Structure Tell Us Something Useful?

The big shareholder groups in SJ Group Co., Ltd. (KOSDAQ:306040) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

SJ Group is not a large company by global standards. It has a market capitalization of ₩179b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholders can tell us about SJ Group.

View our latest analysis for SJ Group

What Does The Institutional Ownership Tell Us About SJ Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

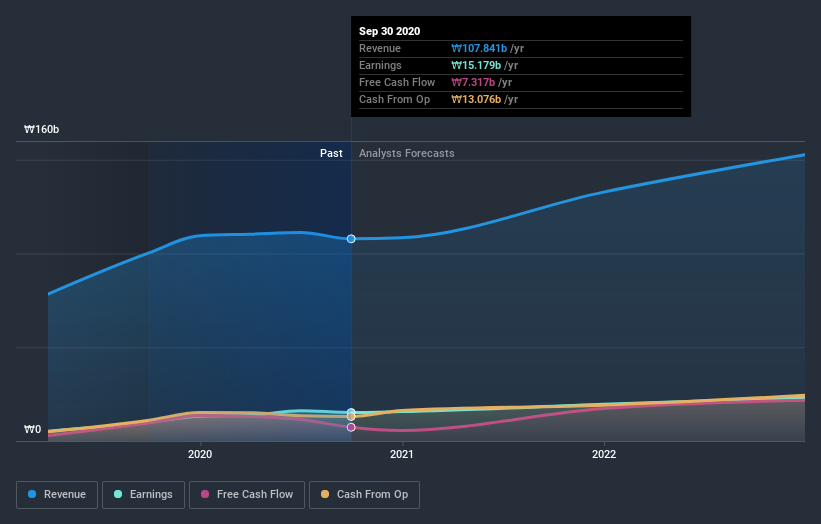

Less than 5% of SJ Group is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

We note that hedge funds don't have a meaningful investment in SJ Group. The company's largest shareholder is Juyoung Lee, with ownership of 37%. Suhyun Kim is the second largest shareholder owning 11% of common stock, and National Pension Service holds about 3.8% of the company stock.

After doing some more digging, we found that the top 3 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of SJ Group

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders own more than half of SJ Group Co., Ltd.. This gives them effective control of the company. So they have a ₩93b stake in this ₩179b business. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, with a 42% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand SJ Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for SJ Group you should know about.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading SJ Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A306040

SJ Group

Manufactures and sells backpacks, hats, children's clothing, innerwear, and women's wear.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)