- South Korea

- /

- Luxury

- /

- KOSDAQ:A110790

Potential Upside For Creas F&C Co.,Ltd (KOSDAQ:110790) Not Without Risk

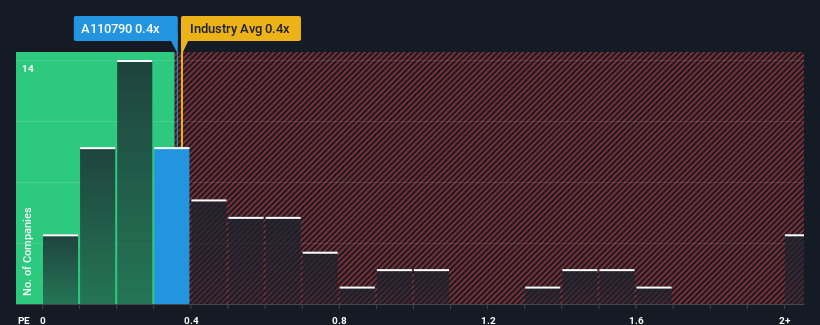

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Luxury industry in Korea, you could be forgiven for feeling indifferent about Creas F&C Co.,Ltd's (KOSDAQ:110790) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Creas F&CLtd

What Does Creas F&CLtd's P/S Mean For Shareholders?

Creas F&CLtd has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Creas F&CLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Creas F&CLtd?

In order to justify its P/S ratio, Creas F&CLtd would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 3.0% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.3% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.0%, which is noticeably less attractive.

With this information, we find it interesting that Creas F&CLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Creas F&CLtd's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Creas F&CLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Creas F&CLtd is showing 5 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A110790

Undervalued with moderate growth potential.

Market Insights

Community Narratives