- South Korea

- /

- Commercial Services

- /

- KOSDAQ:A365340

Why We're Not Concerned Yet About SungEel HiTech Co., Ltd.'s (KOSDAQ:365340) 26% Share Price Plunge

The SungEel HiTech Co., Ltd. (KOSDAQ:365340) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

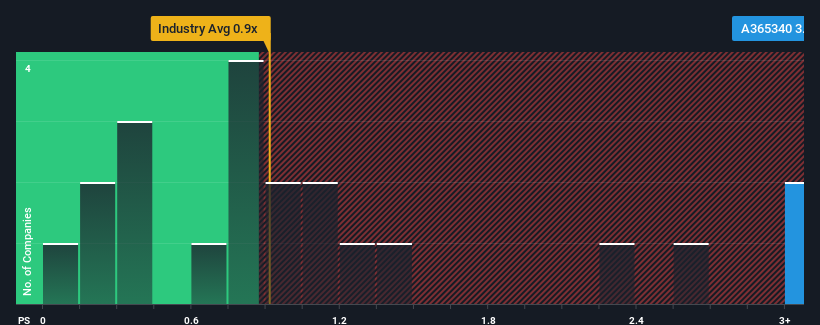

Even after such a large drop in price, when almost half of the companies in Korea's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider SungEel HiTech as a stock not worth researching with its 3.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for SungEel HiTech

How SungEel HiTech Has Been Performing

With revenue that's retreating more than the industry's average of late, SungEel HiTech has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SungEel HiTech.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, SungEel HiTech would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. As a result, revenue from three years ago have also fallen 1.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 82% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this in mind, it's not hard to understand why SungEel HiTech's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate SungEel HiTech's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into SungEel HiTech shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for SungEel HiTech that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A365340

SungEel HiTech

Operates as a secondary battery recycling company in South Korea.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives