- South Korea

- /

- Machinery

- /

- KOSE:A454910

Here's Why We're Not Too Worried About Doosan Robotics' (KRX:454910) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Doosan Robotics (KRX:454910) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Does Doosan Robotics Have A Long Cash Runway?

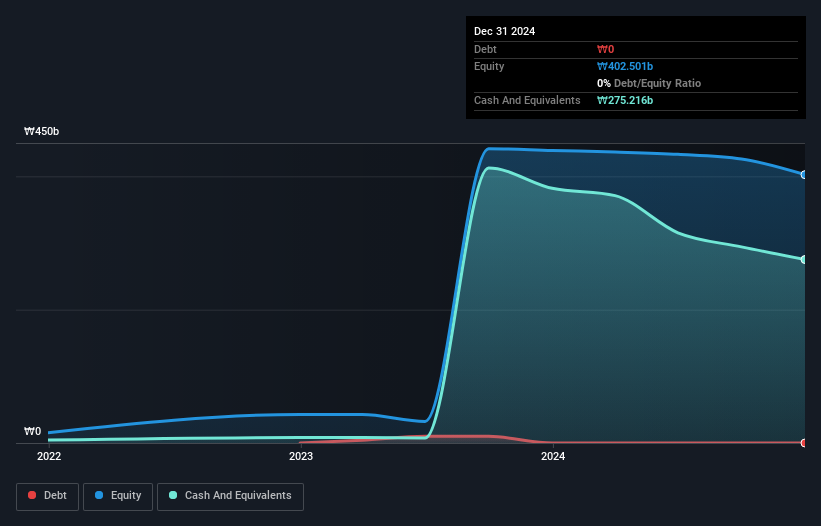

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2024, Doosan Robotics had ₩275b in cash, and was debt-free. Looking at the last year, the company burnt through ₩52b. So it had a cash runway of about 5.3 years from December 2024. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. The image below shows how its cash balance has been changing over the last few years.

See our latest analysis for Doosan Robotics

How Well Is Doosan Robotics Growing?

At first glance it's a bit worrying to see that Doosan Robotics actually boosted its cash burn by 43%, year on year. And we must say we find it concerning that operating revenue dropped 12% over the same period. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years .

How Hard Would It Be For Doosan Robotics To Raise More Cash For Growth?

Even though it seems like Doosan Robotics is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Doosan Robotics' cash burn of ₩52b is about 1.7% of its ₩3.0t market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Doosan Robotics' Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Doosan Robotics is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. We think it's very important to consider the cash burn for loss making companies, but other considerations such as the amount the CEO is paid can also enhance your understanding of the business. You can click here to see what Doosan Robotics' CEO gets paid each year .

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A454910

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion