- South Korea

- /

- Electrical

- /

- KOSE:A373220

LG Energy Solution (KOSE:A373220) Boosts Growth with Ford Alliance for Electric Vans in Europe

Reviewed by Simply Wall St

LG Energy Solution (KOSE:A373220) has recently announced a significant supply agreement with Ford Motor Company, marking a strategic move to supply 109 GWh of batteries for Ford's electric commercial vans in Europe. This partnership, which includes a shift in battery production for the Mustang Mach-E to Michigan, highlights the company's focus on enhancing business efficiency and leveraging favorable market conditions such as the IRA tax credits. As the company prepares for its upcoming Q3 2024 earnings call, readers should anticipate discussions on how these developments align with LG Energy Solution's projected strong revenue growth and its strategic positioning in the electric vehicle sector.

Take a closer look at LG Energy Solution's potential here.

Competitive Advantages That Elevate LG Energy Solution

LG Energy Solution is poised for strong revenue growth, projected at 17.2% annually, surpassing the KR market's 9.9% growth rate. This positions the company well ahead of its peers. The strategic alliance with Ford Motor Company, to supply 109 GWh of batteries for electric commercial vans, underscores its commitment to innovation and market expansion. This partnership is expected to enhance business efficiency and capitalize on favorable market conditions, including the IRA tax credits. Furthermore, the company is forecasted to become profitable within three years, with earnings projected to grow by 52.96% annually, reflecting financial health. The satisfactory debt level, with a net debt to equity ratio of 33.5%, and interest coverage of 4.9x EBIT, further solidify its financial stability.

See what the latest analyst reports say about LG Energy Solution's future prospects and potential market movements.Vulnerabilities Impacting LG Energy Solution

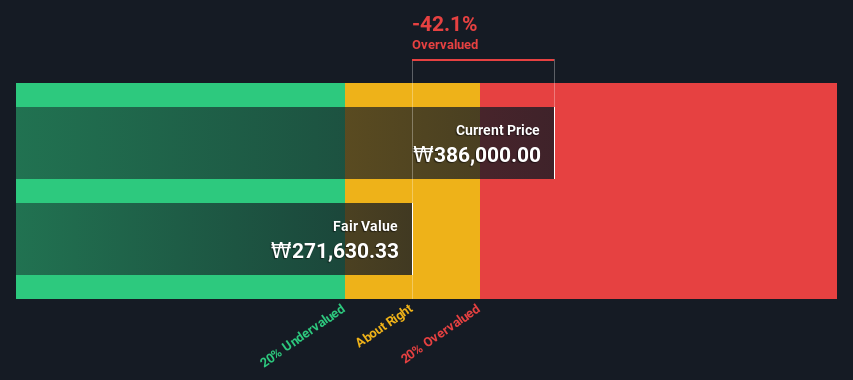

Currently, LG Energy Solution faces challenges with profitability, evidenced by a negative Return on Equity of -2.89%. Despite improvements in profit margins, the company remains unprofitable, complicating the evaluation of past earnings quality. The board's average tenure of 2.4 years suggests a lack of seasoned leadership, which may affect strategic decision-making. Additionally, the company's share price is trading above its estimated fair value, indicating potential overvaluation compared to industry peers, which could deter investors.

To gain deeper insights into LG Energy Solution's historical performance, explore our detailed analysis of past performance.Future Prospects for LG Energy Solution in the Market

The company's stable ownership, with no significant shareholder dilution, presents a solid foundation for future growth. The strategic alliance with Ford is a pivotal opportunity, potentially boosting market share and reinforcing its position in the electric vehicle sector. This partnership not only enhances product offerings but also aligns with global sustainability trends, positioning LG Energy Solution for long-term success.

Key Risks and Challenges That Could Impact LG Energy Solution's Success

Despite its strategic initiatives, LG Energy Solution faces significant threats. The high Price-To-Sales Ratio of 3.4x, compared to peers' 2.6x, suggests it is expensive, which might not meet investor expectations. Additionally, the forecasted Return on Equity of 12% in three years is relatively low, potentially impacting investor confidence. Economic headwinds and supply chain vulnerabilities, as highlighted in the latest earnings call, could further challenge growth and operational efficiency.

To dive deeper into how LG Energy Solution's valuation metrics are shaping its market position, check out our detailed analysis of LG Energy Solution's Valuation. Explore the current health of LG Energy Solution and how it reflects on its financial stability and growth potential.Conclusion

LG Energy Solution is strategically positioned for substantial revenue growth, driven by its innovative partnership with Ford and financial health, including a manageable debt profile. However, the company faces challenges such as current unprofitability and a negative Return on Equity, which could hinder investor confidence. The high Price-To-Sales Ratio and share price trading above its estimated fair value suggest that the stock may not meet investor expectations, potentially limiting its appeal. The alliance with Ford and alignment with sustainability trends offer significant opportunities for market share expansion in the electric vehicle sector, potentially leading to long-term success.

Where To Now?

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade LG Energy Solution, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About KOSE:A373220

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives